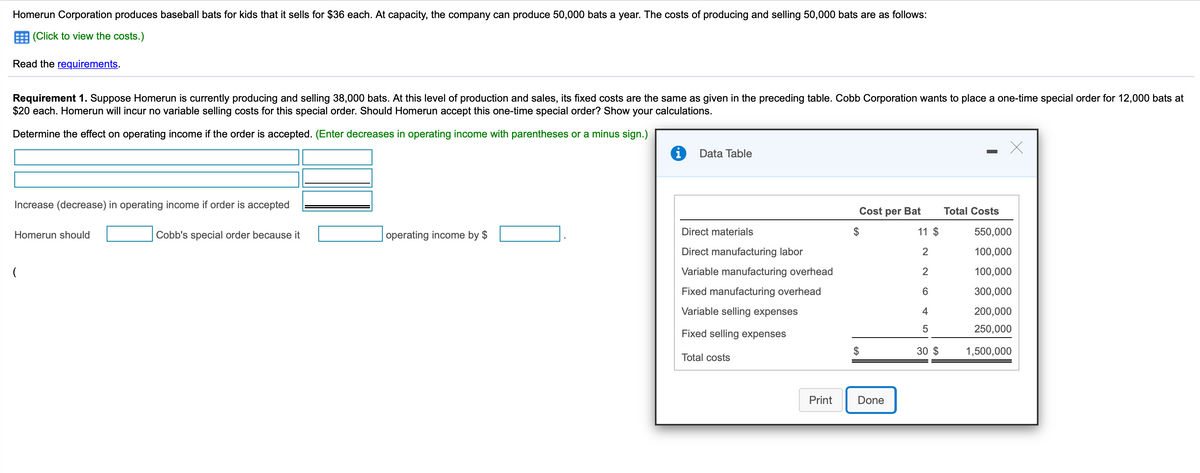

Homerun Corporation produces baseball bats for kids that it sells for $36 each. At capacity, the company can produce 50,000 bats a year. The costs of producing and selling 50,000 bats are as follows: E (Click to view the costs.) Read the requirements. Requirement 1. Suppose Homerun is currently producing and selling 38,000 bats. At this level $20 each. Homerun will incur no variable selling costs for this special order. Should Homerun accept this one-time special order? Show your calculations. production and sales, its fixed costs are the same as given in the preceding table. Cobb Corporation wants to place a one-time special order for 12,000 bats at Determine the effect on operating income if the order accepted. (Enter decreases in operating income with parentheses or a minus sign.) Data Table Increase (decrease) in operating income if order is accepted Cost per Bat Total Costs Homerun should Cobb's special order because it operating income by $ Direct materials 11 $ 550,000 Direct manufacturing labor 100,000 Variable manufacturing overhead 100,000 Fixed manufacturing overhead 300,000 Variable selling expenses 200,000 250,000 Fixed selling expenses 30 $ 1,500,000 Total costs Print Done

Homerun Corporation produces baseball bats for kids that it sells for $36 each. At capacity, the company can produce 50,000 bats a year. The costs of producing and selling 50,000 bats are as follows: E (Click to view the costs.) Read the requirements. Requirement 1. Suppose Homerun is currently producing and selling 38,000 bats. At this level $20 each. Homerun will incur no variable selling costs for this special order. Should Homerun accept this one-time special order? Show your calculations. production and sales, its fixed costs are the same as given in the preceding table. Cobb Corporation wants to place a one-time special order for 12,000 bats at Determine the effect on operating income if the order accepted. (Enter decreases in operating income with parentheses or a minus sign.) Data Table Increase (decrease) in operating income if order is accepted Cost per Bat Total Costs Homerun should Cobb's special order because it operating income by $ Direct materials 11 $ 550,000 Direct manufacturing labor 100,000 Variable manufacturing overhead 100,000 Fixed manufacturing overhead 300,000 Variable selling expenses 200,000 250,000 Fixed selling expenses 30 $ 1,500,000 Total costs Print Done

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 13P: Deuce Sporting Goods manufactures a high-end model tennis racket. The company’s forecasted income...

Related questions

Question

Transcribed Image Text:Homerun Corporation produces baseball bats for kids that it sells for $36 each. At capacity, the company can produce 50,000 bats a year. The costs of producing and selling 50,000 bats are as follows:

(Click to view the costs.)

Read the requirements.

Requirement 1. Suppose Homerun is currently producing and selling 38,000 bats. At this level of production and sales, its fixed costs are the same as given in the preceding table. Cobb Corporation wants to place a one-time special order for 12,000 bats at

$20 each. Homerun will incur no variable selling costs for this special order. Should Homerun accept this one-time special order? Show your calculations.

Determine the effect on operating income if the order is accepted. (Enter decreases in operating income with parentheses or a minus sign.)

Data Table

Increase (decrease) in operating income if order is accepted

Cost per Bat

Total Costs

Homerun should

Cobb's special order because it

operating income by $

Direct materials

11 $

550,000

Direct manufacturing labor

2

100,000

Variable manufacturing overhead

2

100,000

Fixed manufacturing overhead

6

300,000

Variable selling expenses

4

200,000

Fixed selling expenses

250,000

$

30 $

1,500,000

Total costs

Print

Done

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub