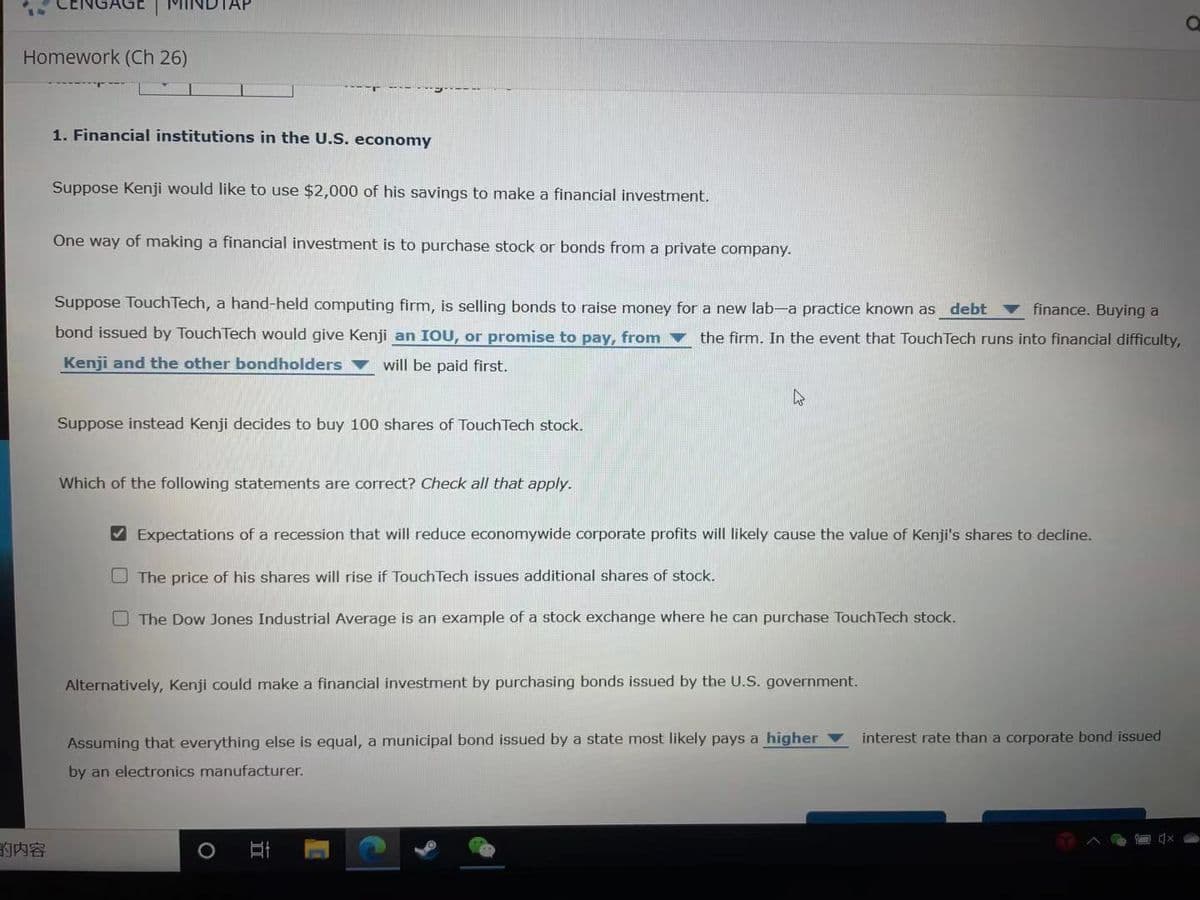

Homework (Ch 26) 1. Financial institutions in the U.S. economy Suppose Kenji would like to use $2,000 of his savings to make a financial investment. One way of making a financial investment is to purchase stock or bonds from a private company. Suppose Touch Tech, a hand-held computing firm, is selling bonds to raise money for a new lab-a practice known as debt finance. Buying a bond issued by TouchTech would give Kenji an IOU, or promise to pay, from ▼ the firm. In the event that TouchTech runs into financial difficulty, Kenji and the other bondholders v will be paid first. Suppose instead Kenji decides to buy 100 shares of Touch Tech stock. Which of the following statements are correct? Check all that apply. V Expectations of a recession that will reduce economywide corporate profits will likely cause the value of Kenji's shares to decline. O The price of his shares will rise if Touch Tech issues additional shares of stock. O The Dow Jones Industrial Average is an example of a stock exchange where he can purchase TouchTech stock. Alternatively, Kenji could make a financial investment by purchasing bonds issued by the U.S. government. Assuming that everything else is equal, a municipal bond issued by a state most likely pays a higher interest rate than a corporate bond issued by an electronics manufacturer.

Homework (Ch 26) 1. Financial institutions in the U.S. economy Suppose Kenji would like to use $2,000 of his savings to make a financial investment. One way of making a financial investment is to purchase stock or bonds from a private company. Suppose Touch Tech, a hand-held computing firm, is selling bonds to raise money for a new lab-a practice known as debt finance. Buying a bond issued by TouchTech would give Kenji an IOU, or promise to pay, from ▼ the firm. In the event that TouchTech runs into financial difficulty, Kenji and the other bondholders v will be paid first. Suppose instead Kenji decides to buy 100 shares of Touch Tech stock. Which of the following statements are correct? Check all that apply. V Expectations of a recession that will reduce economywide corporate profits will likely cause the value of Kenji's shares to decline. O The price of his shares will rise if Touch Tech issues additional shares of stock. O The Dow Jones Industrial Average is an example of a stock exchange where he can purchase TouchTech stock. Alternatively, Kenji could make a financial investment by purchasing bonds issued by the U.S. government. Assuming that everything else is equal, a municipal bond issued by a state most likely pays a higher interest rate than a corporate bond issued by an electronics manufacturer.

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter18: Savings,investment And The Financial System

Section: Chapter Questions

Problem 1CQQ

Related questions

Question

Transcribed Image Text:Homework (Ch 26)

1. Financial institutions in the U.S. economy

Suppose Kenji would like to use $2,000 of his savings to make a financial investment.

One way of making a financial investment is to purchase stock or bonds from a private company.

Suppose TouchTech, a hand-held computing firm, is selling bonds to raise money for a new lab-a practice known as debt

v finance. Buying a

bond issued by Touch Tech would give Kenji an IOU, or promise to pay, from v the firm. In the event that Touch Tech runs into financial difficulty,

Kenji and the other bondholders ▼ will be paid first.

Suppose instead Kenji decides to buy 100 shares of Touch Tech stock.

Which of the following statements are correct? Check all that apply.

V Expectations of a recession that will reduce economywide corporate profits will likely cause the value of Kenji's shares to decline.

O The price of his shares will rise if Touch Tech issues additional shares of stock.

O The Dow Jones Industrial Average is an example of a stock exchange where he can purchase TouchTech stock.

Alternatively, Kenji could make a financial investment by purchasing bonds issued by the U.S. government.

Assuming that everything else is equal, a municipal bond issued by a state most likely pays a higher v

interest rate than a corporate bond issued

by an electronics manufacturer.

的内容

Expert Solution

Step 1

Company k would like to use $2000 of his saving to make a financial investment by purchase stock or bonds from a private company.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning