is the source of the demand for loanable funds. As the interest rate falls, the quantity of loanable funds demanded Suppose the interest rate is 2.5%. Based on the previous graph, the quantity of loanable funds supplied is than the quantity of loans demanded, resulting in a of loanable funds. This would encourage lenders to the interest rates they charge, thereby ▼ the quantity of loanable funds supplied and the quantity of loanable funds demanded, moving the market toward the equilibrium interest rate of

is the source of the demand for loanable funds. As the interest rate falls, the quantity of loanable funds demanded Suppose the interest rate is 2.5%. Based on the previous graph, the quantity of loanable funds supplied is than the quantity of loans demanded, resulting in a of loanable funds. This would encourage lenders to the interest rates they charge, thereby ▼ the quantity of loanable funds supplied and the quantity of loanable funds demanded, moving the market toward the equilibrium interest rate of

Chapter21: Financial Markets, Saving, And Investment

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:is the source of the demand for loanable funds. As the interest rate falls, the quantity of loanable funds demanded

Suppose the interest rate is 2.5%. Based on the previous graph, the quantity of loanable funds supplied is

than the quantity of loans

demanded, resulting in a

of loanable funds. This would encourage lenders to

the interest rates they charge, thereby

▼ the quantity of loanable funds supplied and

the quantity of loanable funds demanded, moving the market toward

the equilibrium interest rate of

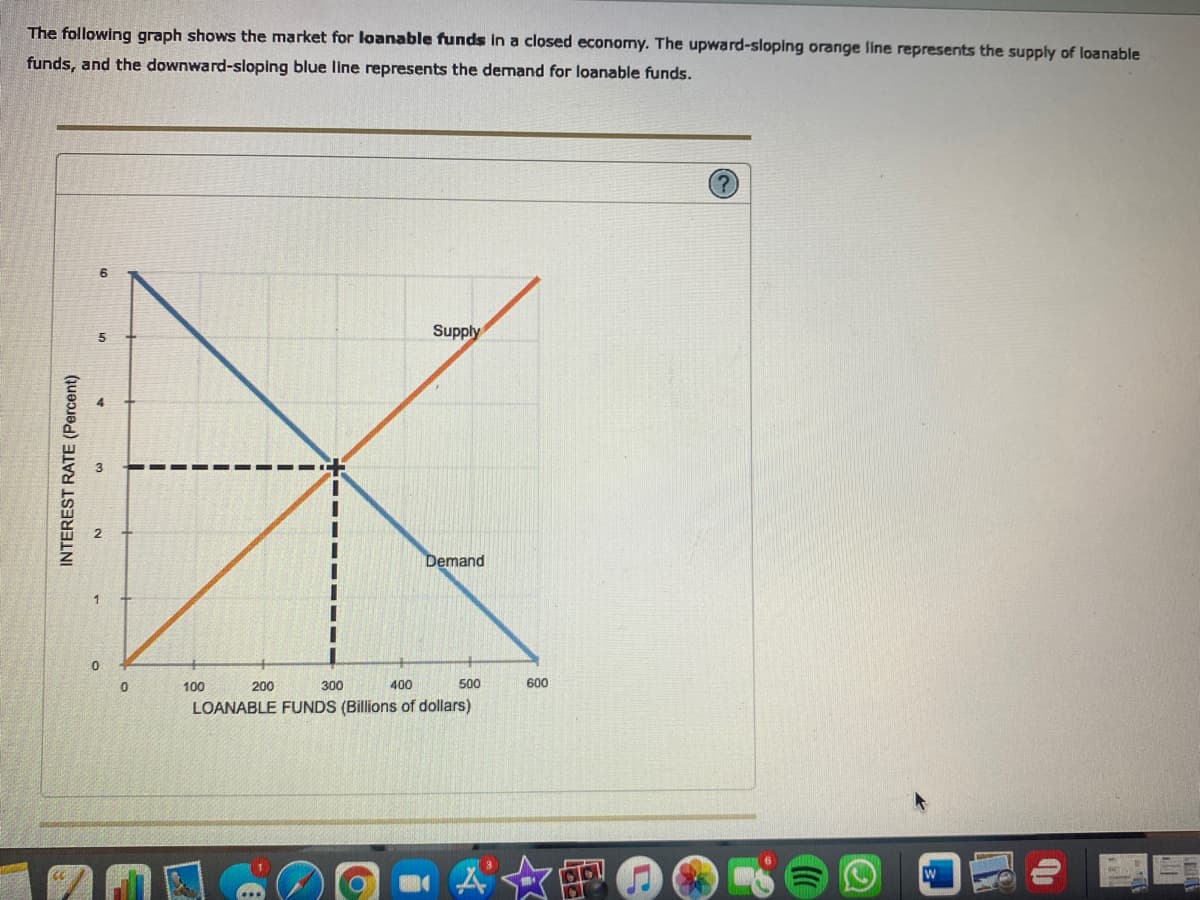

Transcribed Image Text:The following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable

funds, and the downward-sloping blue line represents the demand for loanable funds.

Supply

Demand

100

200

300

400

500

600

LOANABLE FUNDS (Billions of dollars)

INTEREST RATE (Percent)

Expert Solution

Step 1

The graph shows market for loanable funds. Equilibrium in the loanable funds market is reached at the intersection of demand and supply curves.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax