For the fiscal year ended June 30, 2025, calculate the following for Windsor Pharmaceutical Industries. (Round answers to 2 decimal places, e.g. 2.45.) a. Basic earnings per share. Basic earnings per share $ b. Diluted earnings per share. Diluted earnings per share $

For the fiscal year ended June 30, 2025, calculate the following for Windsor Pharmaceutical Industries. (Round answers to 2 decimal places, e.g. 2.45.) a. Basic earnings per share. Basic earnings per share $ b. Diluted earnings per share. Diluted earnings per share $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 84PSB: Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following...

Related questions

Question

100%

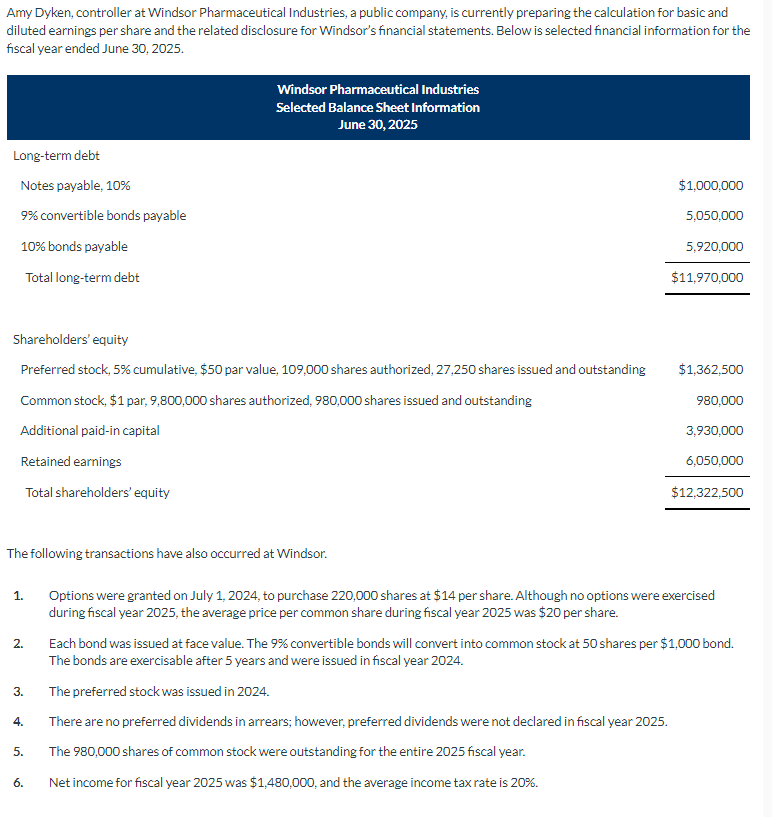

Transcribed Image Text:Amy Dyken, controller at Windsor Pharmaceutical Industries, a public company, is currently preparing the calculation for basic and

diluted earnings per share and the related disclosure for Windsor's financial statements. Below is selected financial information for the

fiscal year ended June 30, 2025.

Long-term debt

Notes payable, 10%

9% convertible bonds payable

10% bonds payable

Total long-term debt

Shareholders' equity

Preferred stock, 5% cumulative, $50 par value, 109,000 shares authorized, 27,250 shares issued and outstanding

Common stock, $1 par, 9,800,000 shares authorized, 980,000 shares issued and outstanding

Additional paid-in capital

Retained earnings

Total shareholders' equity

The following transactions have also occurred at Windsor.

1.

2.

3.

4.

Windsor Pharmaceutical Industries

Selected Balance Sheet Information

June 30, 2025

5.

6.

$1,000,000

5,050,000

5,920,000

$11,970,000

$1,362,500

980,000

3,930,000

6,050,000

$12,322,500

Options were granted on July 1, 2024, to purchase 220,000 shares at $14 per share. Although no options were exercised

during fiscal year 2025, the average price per common share during fiscal year 2025 was $20 per share.

Each bond was issued at face value. The 9% convertible bonds will convert into common stock at 50 shares per $1,000 bond.

The bonds are exercisable after 5 years and were issued in fiscal year 2024.

The preferred stock was issued in 2024.

There are no preferred dividends in arrears; however, preferred dividends were not declared in fiscal year 2025.

The 980,000 shares of common stock were outstanding for the entire 2025 fiscal year.

Net income for fiscal year 2025 was $1,480,000, and the average income tax rate is 20%.

Transcribed Image Text:For the fiscal year ended June 30, 2025, calculate the following for Windsor Pharmaceutical Industries. (Round answers to 2 decimal

places, e.g. 2.45.)

a. Basic earnings per share.

Basic earnings per share $

b. Diluted earnings per share.

Diluted earnings per share $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

how did you calculate the net income of 1480000?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning