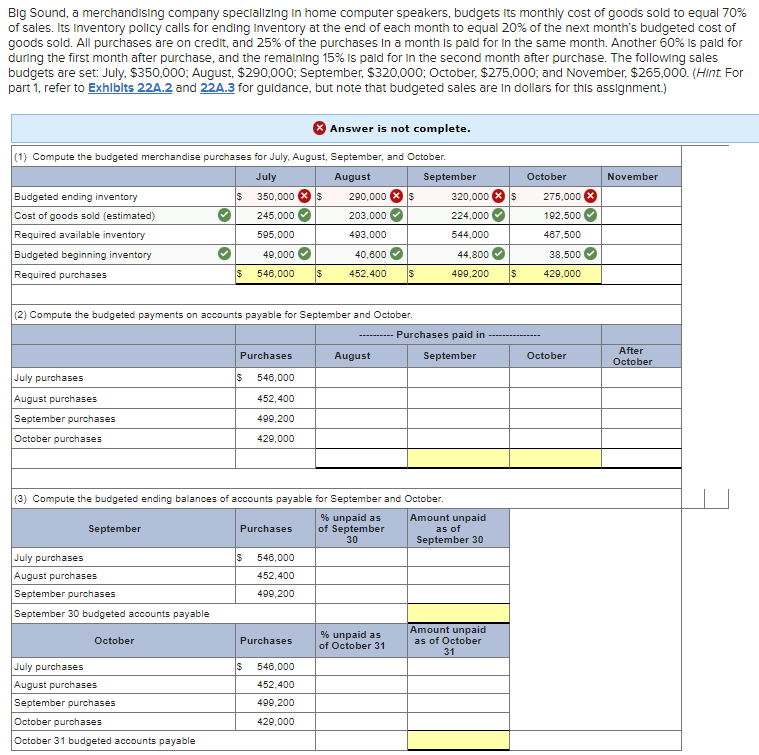

Big Sound, a merchandising company specializing in home computer speakers, budgets its monthly cost of goods sold to equal 70% of sales. Its Inventory policy calls for ending Inventory at the end of each month to equal 20% of the next month's budgeted cost of goods sold. All purchases are on credit, and 25% of the purchases in a month is paid for in the same month. Another 60% is paid for during the first month after purchase, and the remaining 15% is paid for in the second month after purchase. The following sales budgets are set: July, $350,000; August, $290,000; September, $320,000; October, $275,000; and November, $265,000. (Hint For part 1, refer to Exhibits 22A.2 and 22A.3 for guidance, but note that budgeted sales are in dollars for this assignment.) Answer is not complete. (1) Compute the budgeted merchandise purchases for July, August, September, and October. July August September Budgeted ending inventory Cost of goods sold (estimated) Required available inventory Budgeted beginning inventory Required purchases July purchases August purchases September purchases October purchases July purchases August purchases September purchases September 30 budgeted accounts payable 350,000 $ 245,000 595,000 49,000 $ 546,000 $ October $ (2) Compute the budgeted payments on accounts payable for September and October. July purchases August purchases September purchases October purchases October 31 hudgeted accounts payable Purchases $ 546,000 452,400 499,200 429,000 Purchases $ (3) Compute the budgeted ending balances of accounts payable for September and October. September Amount unpaid as of September 30 546,000 452,400 499,200 290,000 $ 203,000 493,000 Purchases 40,600 452,400 $ 546,000 452,400 499,200 429,000 August $ % unpaid as of September 30 % unpaid as of October 31 320,000 $ 224,000 544,000 44,800 499,200 Purchases paid in September Amount unpaid as of October 31 $ October 275,000 192,500 467,500 38,500 429,000 October November After October

Big Sound, a merchandising company specializing in home computer speakers, budgets its monthly cost of goods sold to equal 70% of sales. Its Inventory policy calls for ending Inventory at the end of each month to equal 20% of the next month's budgeted cost of goods sold. All purchases are on credit, and 25% of the purchases in a month is paid for in the same month. Another 60% is paid for during the first month after purchase, and the remaining 15% is paid for in the second month after purchase. The following sales budgets are set: July, $350,000; August, $290,000; September, $320,000; October, $275,000; and November, $265,000. (Hint For part 1, refer to Exhibits 22A.2 and 22A.3 for guidance, but note that budgeted sales are in dollars for this assignment.) Answer is not complete. (1) Compute the budgeted merchandise purchases for July, August, September, and October. July August September Budgeted ending inventory Cost of goods sold (estimated) Required available inventory Budgeted beginning inventory Required purchases July purchases August purchases September purchases October purchases July purchases August purchases September purchases September 30 budgeted accounts payable 350,000 $ 245,000 595,000 49,000 $ 546,000 $ October $ (2) Compute the budgeted payments on accounts payable for September and October. July purchases August purchases September purchases October purchases October 31 hudgeted accounts payable Purchases $ 546,000 452,400 499,200 429,000 Purchases $ (3) Compute the budgeted ending balances of accounts payable for September and October. September Amount unpaid as of September 30 546,000 452,400 499,200 290,000 $ 203,000 493,000 Purchases 40,600 452,400 $ 546,000 452,400 499,200 429,000 August $ % unpaid as of September 30 % unpaid as of October 31 320,000 $ 224,000 544,000 44,800 499,200 Purchases paid in September Amount unpaid as of October 31 $ October 275,000 192,500 467,500 38,500 429,000 October November After October

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 15E: Palmgren Company produces consumer products. The sales budget for four months of the year is...

Related questions

Question

Transcribed Image Text:Big Sound, a merchandising company specializing in home computer speakers, budgets its monthly cost of goods sold to equal 70%

of sales. Its Inventory policy calls for ending Inventory at the end of each month to equal 20% of the next month's budgeted cost of

goods sold. All purchases are on credit, and 25% of the purchases in a month is paid for in the same month. Another 60% is paid for

during the first month after purchase, and the remaining 15% is paid for in the second month after purchase. The following sales

budgets are set: July, $350,000; August, $290,000; September, $320,000; October, $275,000; and November, $265,000. (Hint For

part 1, refer to Exhibits 22A.2 and 22A.3 for guidance, but note that budgeted sales are in dollars for this assignment.)

Answer is not complete.

(1) Compute the budgeted merchandise purchases for July, August, September, and October.

July

August

350,000 $

245,000

595,000

49,000

$ 546,000 $

Budgeted ending inventory

Cost of goods sold (estimated)

Required available inventory

Budgeted beginning inventory

Required purchases

July purchases

August purchases

September purchases

October purchases

(2) Compute the budgeted payments on accounts payable for September and October.

September

July purchases

August purchases

September purchases

September 30 budgeted accounts payable

October

$

July purchases

August purchases

September purchases

October purchases

October 31 budgeted accounts payable

Purchases

546,000

452,400

499,200

429,000

$

Purchases

(3) Compute the budgeted ending balances of accounts payable for September and October.

% unpaid as

of September

30

$

546,000

452,400

499,200

Purchases

$

290,000

203,000

493,000

40,600

452,400

546,000

452,400

499,200

429,000

August

$

% unpaid as

of October 31

September

320,000

224,000

544,000

44,800

499,200

Purchases paid in

September

Amount unpaid

as of

September 30

Amount unpaid

as of October

31

$

October

275,000 X

192,500

467,500

38,500

429,000

October

November

After

October

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning