a. The preceding paragraph describes five accounting events: (1) a sales transaction, (2) the first purchase of Inventory. (3) a second purchase of Inventory, (4) the recognition of cost of goods sold expense, and (5) the payment of Income tax expense. Show the amounts of each event in horizontal statements models, assuming first a FIFO and then a LIFO cost flow. b. Compute net Income using FIFO. c. Compute net Income using LIFO. e. Which method, FIFO or LIFO, produced the larger amount of assets on the balance sheet?

a. The preceding paragraph describes five accounting events: (1) a sales transaction, (2) the first purchase of Inventory. (3) a second purchase of Inventory, (4) the recognition of cost of goods sold expense, and (5) the payment of Income tax expense. Show the amounts of each event in horizontal statements models, assuming first a FIFO and then a LIFO cost flow. b. Compute net Income using FIFO. c. Compute net Income using LIFO. e. Which method, FIFO or LIFO, produced the larger amount of assets on the balance sheet?

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter7: Inventory Cost Flow Assumptions (fifolifo)

Section: Chapter Questions

Problem 1R: Del Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500...

Related questions

Question

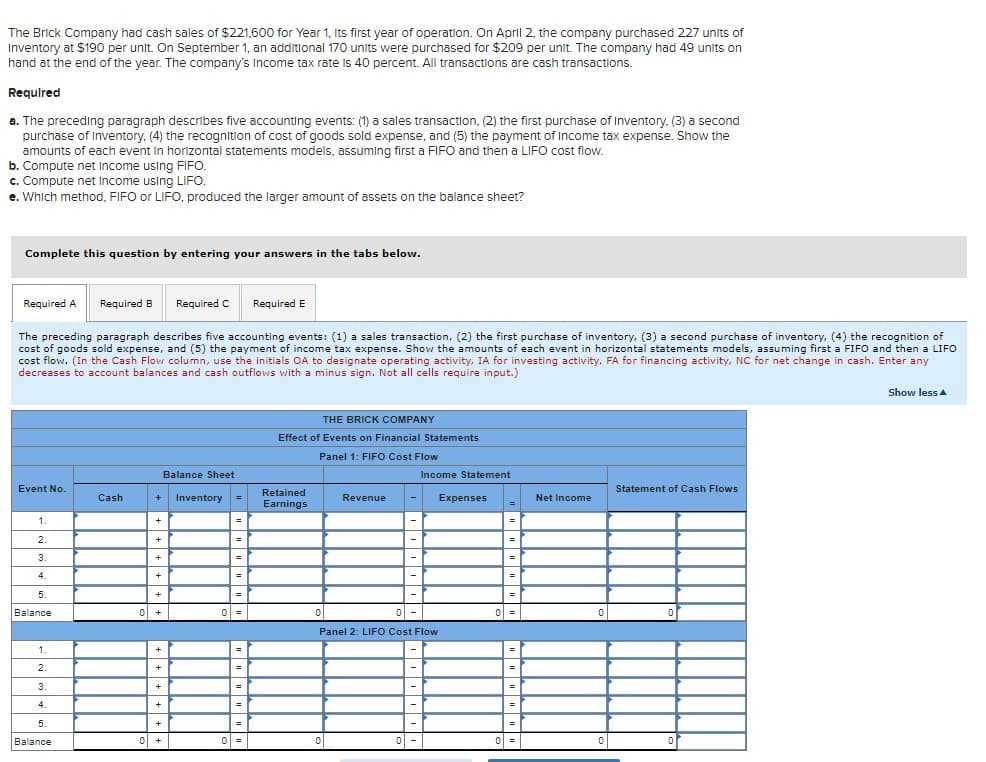

Transcribed Image Text:The Brick Company had cash sales of $221,600 for Year 1, Its first year of operation. On April 2, the company purchased 227 units of

Inventory at $190 per unit. On September 1, an additlonal 170 units were purchased for $209 per unit. The company had 49 units on

hand at the end of the year. The company's Income tax rate Is 40 percent. All transactions are cash transactlons.

Requlred

a. The preceding paragraph describes five accounting events: (1) a sales transaction, (2) the first purchase of Inventory, (3) a second

purchase of Inventory, (4) the recognition of cost of goods sold expense, and (5) the payment of Income tax expense. Show the

amounts of each event In horizontal statements models, assuming first a FIFO and then a LIFO cost flow.

b. Compute net Income using FIFO.

c. Compute net Income using LIFO.

e. Which method, FIFO or LIFO, produced the larger amount of assets on the balance sheet?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Required E

The preceding paragraph describes five accounting events: (1) a sales transaction, (2) the first purchase of inventory, (3) a second purchase of inventory, (4) the recognition of

cost of goods sold expense, and (5) the payment of income tax expense. Show the amounts of each event in horizontal statements models, assuming first a FIFO and then a LIFO

cost flow. (In the Cash Flow column, use the initials OA to designate operating activity, IA for investing activity, FA for financing activity, NC for net change in cash. Enter any

decreases to account balances and cash outflows with a minus sign. Not all cells require input.)

Show less A

THE BRICK COMPANY

Effect of Events on Financial Statements

Panel 1: FIF0 Cost Flow

Balance Sheet

Income Statement

Event No.

Statement of Cash Flows

Retained

Cash

Inventory

Revenue

Expenses

Net Income

+

-

Earnings

1.

2.

+

3.

+

=

4.

+

=

5.

+

Balance

ol +

이=

Panel 2: LIFO Cost Flow

1.

=

+

2.

+

3.

+

%3!

4.

+

=

5.

=

Balance

이=

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

how did you get the -68419 and -61272 in the fifo

Solution

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning