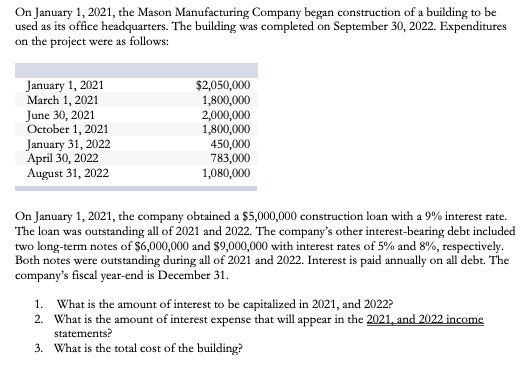

On January 1, 2021, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 March 1, 2021 June 30, 2021 October 1, 2021 January 31, 2022 April 30, 2022 August 31, 2022 $2,050,000 1,800,000 2,000,000 1,800,000 450,000 783,000 1,080,000 On January 1, 2021, the company obtained a $5,000,000 construction loan with a 9% interest rate. The loan was outstanding all of 2021 and 2022. The company's other interest-bearing debt included two long-term notes of $6,000,000 and $9,000,000 with interest rates of 5% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company's fiscal year-end is December 31. 1. What is the amount of interest to be capitalized in 2021, and 2022? 2. What is the amount of interest expense that will appear in the 2021, and 2022 income statements? 3. What is the total cost of the building?

On January 1, 2021, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 March 1, 2021 June 30, 2021 October 1, 2021 January 31, 2022 April 30, 2022 August 31, 2022 $2,050,000 1,800,000 2,000,000 1,800,000 450,000 783,000 1,080,000 On January 1, 2021, the company obtained a $5,000,000 construction loan with a 9% interest rate. The loan was outstanding all of 2021 and 2022. The company's other interest-bearing debt included two long-term notes of $6,000,000 and $9,000,000 with interest rates of 5% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company's fiscal year-end is December 31. 1. What is the amount of interest to be capitalized in 2021, and 2022? 2. What is the amount of interest expense that will appear in the 2021, and 2022 income statements? 3. What is the total cost of the building?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter5: Business Deductions

Section: Chapter Questions

Problem 29P

Related questions

Question

What are the answers to the three questions listed?

Transcribed Image Text:On January 1, 2021, the Mason Manufacturing Company began construction of a building to be

used as its office headquarters. The building was completed on September 30, 2022. Expenditures

on the project were as follows:

January 1, 2021

March 1, 2021

June 30, 2021

October 1, 2021

January 31, 2022

April 30, 2022

August 31, 2022

$2,050,000

1,800,000

2,000,000

1,800,000

450,000

783,000

1,080,000

On January 1, 2021, the company obtained a $5,000,000 construction loan with a 9% interest rate.

The loan was outstanding all of 2021 and 2022. The company's other interest-bearing debt included

two long-term notes of $6,000,000 and $9,000,000 with interest rates of 5% and 8%, respectively.

Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The

company's fiscal year-end is December 31.

1. What is the amount of interest to be capitalized in 2021, and 2022?

2. What is the amount of interest expense that will appear in the 2021, and 2022 income

statements?

3. What is the total cost of the building?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

how did you get these numbers ?

| Year 2022: Weighted-Average accumulated expenditure | |||

| Date | Amount | Capitalization period | Weighted Average Accumulated Expenditures |

| 1-Jan-22 | $8,100,000 | 9/9 | $8,100,000 |

| 31-Jan-22 | $450,000 | 8/9 | $400,000 |

| 30-Apr-22 | $783,000 | 5/9 | $435,000 |

| 31-Aug-22 | $1,080,000 | 1/9 | $120,000 |

| Total | $10,413,000 | $9,055,000 |

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning