How do I find the product cost per unit?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 2RP

Related questions

Question

How do I find the product cost per unit?

Transcribed Image Text:Required information

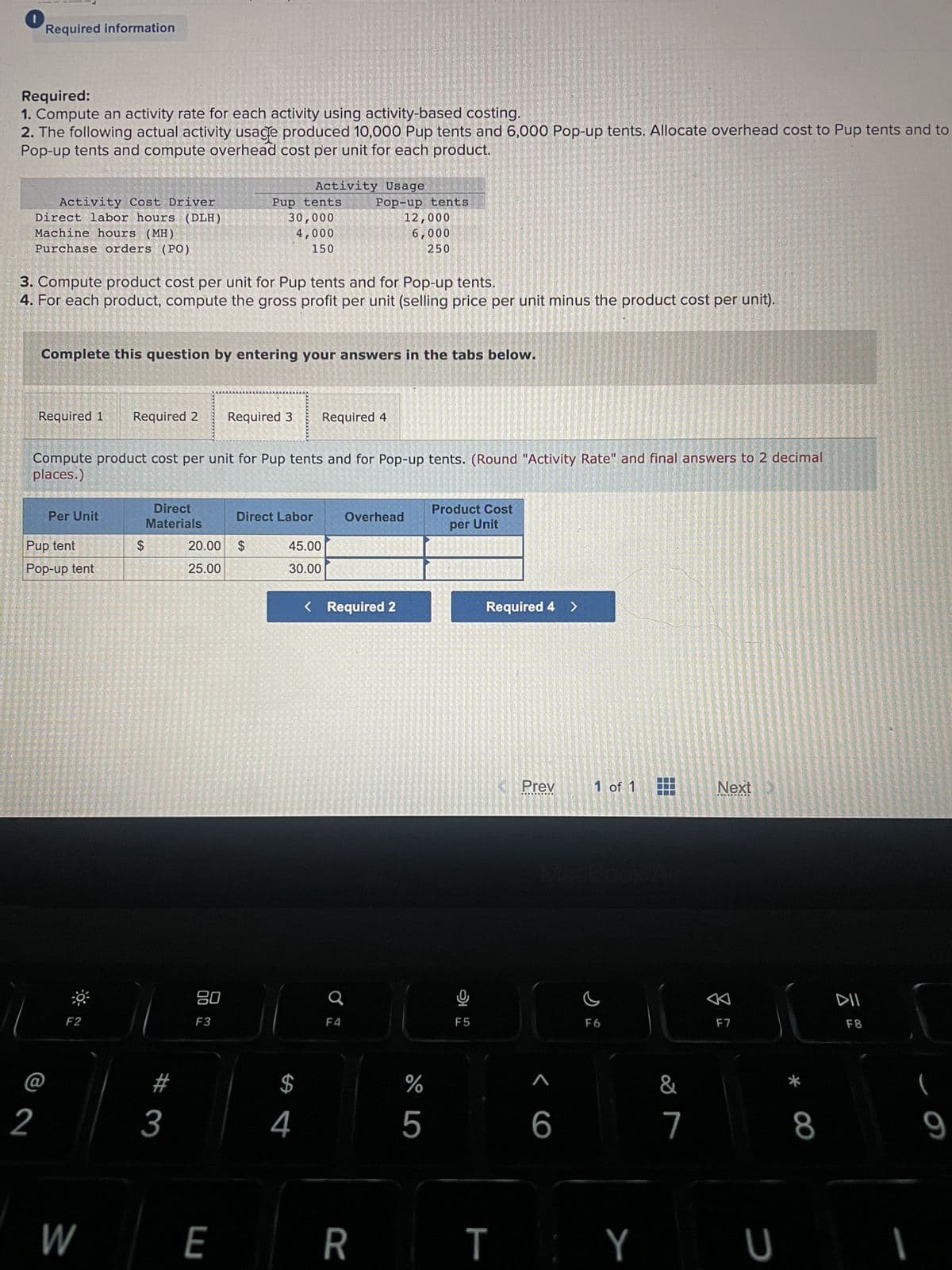

Required:

1. Compute an activity rate for each activity using activity-based costing.

2. The following actual activity usage produced 10,000 Pup tents and 6,000 Pop-up tents. Allocate overhead cost to Pup tents and to

Pop-up tents and compute overhead cost per unit for each product.

Activity Cost Driver

Direct labor hours (DLH)

Machine hours (MH)

Purchase orders (PO)

2

3. Compute product cost per unit for Pup tents and for Pop-up tents.

4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit).

Required 1

Complete this question by entering your answers in the tabs below.

Pup tent

Pop-up tent

FORMA

Per Unit

F2

Compute product cost per unit for Pup tents and for Pop-up tents. (Round "Activity Rate" and final answers to 2 decimal

places.)

W

From M

LA MESE

Required 2

191-250

$

Direct

Materials

#

3

Pup tents

30,000

4,000

150

80

F3

20.00 $

25.00

E

Activity Usage

Required 3 Required 4

Direct Labor

45.00

30.00

$

Pop-up tents

12,000

6,000

250

4

F4

Overhead

< Required 2

R

%

5

LO

Product Cost

per Unit

F5

Required 4 >

Prev

<6

1 of 1

F6

&

7

Next

A

F7

TY U

8

DII

F8

(

9

![Problem Video X

Assignment

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.johnstoncc.edu%252Fv

ces

!

2

Question 1- Ch. 17 Assignmen X

Required information

[The following information applies to the questions displayed below.]

Activity

Assembly

Tent Master produces Pup tents and Pop-up tents. The company budgets $252,000 of overhead cost and 42,000 direct

labor hours. Additional information follows.

Per Unit

Pup tent

Pop-up tent

Electricity

Materials purchasing

Total

Selling Price

$ 78

73

Activity Cost Driver

Direct labor hours (DLH)

Machine hours (MH)

Purchase orders (PO)

F2

Budgeted Cost

$ 168,000

24,000

60,000

$ 252,000

# 3

(1) PR17 3B Practice Video - Yox +

Direct Materials

80

F3

$ 20

25

Required:

1. Compute an activity rate for each activity using activity-based costing.

2. The following actual activity usage produced 10,000 Pup tents and 6,000 Pop-up tents. Allocate overhead cost to Pup tents and to

Pop-up tents and compute overhead cost per unit for each product.

Activity Usage

Pup tents

30,000

4,000

150

Required 1 Required 2 Required 3 Required 4

$

4

Activity Cost Driver

Direct labor hours (DLH)

Machine hours (MH)

Purchase orders (PO)

Complete this question by entering your answers in the tabs below.

F4

Direct Labor

$ 45

30

Pop-up tents

3. Compute product cost per unit for Pup tents and for Pop-up tents.

4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit).

12,000

6,000

250

%

5

O

Saved

F5

Prev

2

<6

Budgeted

Activity Usage

42,000

10,000

400

1 of 1

F6

&

7

Next

F7

* CO

8

DII

F8

(

9

8

FO](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fe8ec1a3c-ef25-41e0-a640-297aa0ac5121%2F5cb2282b-46be-4dff-accf-6ca75fe80a71%2F5a9aeoo_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Problem Video X

Assignment

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.johnstoncc.edu%252Fv

ces

!

2

Question 1- Ch. 17 Assignmen X

Required information

[The following information applies to the questions displayed below.]

Activity

Assembly

Tent Master produces Pup tents and Pop-up tents. The company budgets $252,000 of overhead cost and 42,000 direct

labor hours. Additional information follows.

Per Unit

Pup tent

Pop-up tent

Electricity

Materials purchasing

Total

Selling Price

$ 78

73

Activity Cost Driver

Direct labor hours (DLH)

Machine hours (MH)

Purchase orders (PO)

F2

Budgeted Cost

$ 168,000

24,000

60,000

$ 252,000

# 3

(1) PR17 3B Practice Video - Yox +

Direct Materials

80

F3

$ 20

25

Required:

1. Compute an activity rate for each activity using activity-based costing.

2. The following actual activity usage produced 10,000 Pup tents and 6,000 Pop-up tents. Allocate overhead cost to Pup tents and to

Pop-up tents and compute overhead cost per unit for each product.

Activity Usage

Pup tents

30,000

4,000

150

Required 1 Required 2 Required 3 Required 4

$

4

Activity Cost Driver

Direct labor hours (DLH)

Machine hours (MH)

Purchase orders (PO)

Complete this question by entering your answers in the tabs below.

F4

Direct Labor

$ 45

30

Pop-up tents

3. Compute product cost per unit for Pup tents and for Pop-up tents.

4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit).

12,000

6,000

250

%

5

O

Saved

F5

Prev

2

<6

Budgeted

Activity Usage

42,000

10,000

400

1 of 1

F6

&

7

Next

F7

* CO

8

DII

F8

(

9

8

FO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you