How do you get the $41,200 from the 70% of 85000 units shown in answer 2 solution

Chapter5: Process Costing

Section: Chapter Questions

Problem 3EA: Given the following information, determine the equivalent units of ending work in process for...

Related questions

Question

How do you get the $41,200 from the 70% of 85000 units shown in answer 2 solution

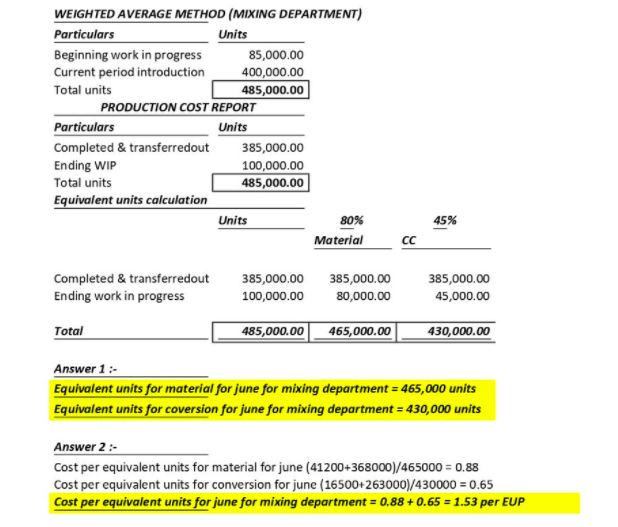

Transcribed Image Text:WEIGHTED AVERAGE METHOD (MIXING DEPARTMENT)

Units

Particulars

Beginning work in progress

Current period introduction

85,000.00

400,000.00

485,000.00

Total units

PRODUCTION COST REPORT

Particulars

Completed & transferredout

Units

385,000.00

100,000.00

485,000.00

Ending WIP

Total units

Equivalent units calculation

Units

80%

45%

Material

Completed & transferredout

Ending work in progress

385,000.00

385,000.00

385,000.00

100,000.00

80,000.00

45,000.00

Total

485,000.00

465,000.00

430,000.00

Answer 1:-

Equivalent units for material for june for mixing department = 465,000 units

Equivalent units for coversion for june for mixing department = 430,000 units

Answer 2:-

Cost per equivalent units for material for june (41200+368000)/465000 = 0.88

Cost per equivalent units for conversion for june (16500+263000)/430000 = 0.65

Cost per equivalent units for june for mixing department = 0.88 + 0.65 = 1.53 per EUP

%3D

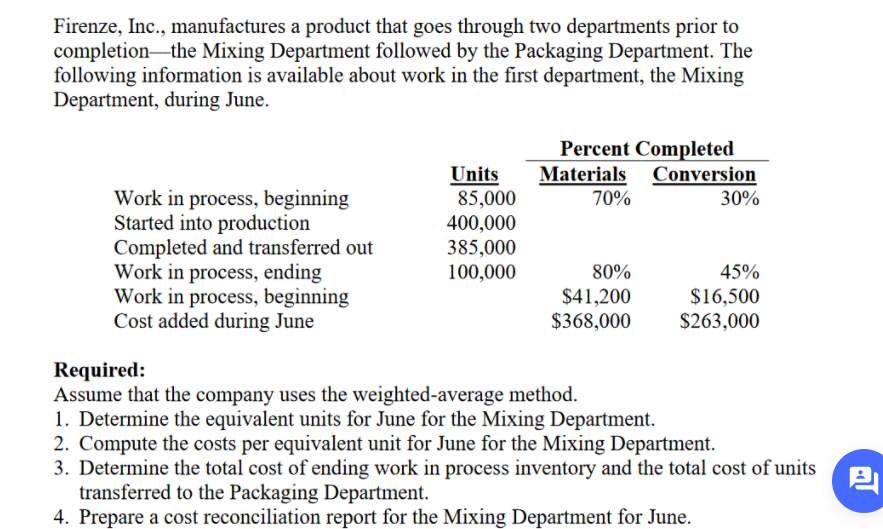

Transcribed Image Text:Firenze, Inc., manufactures a product that goes through two departments prior to

completion-the Mixing Department followed by the Packaging Department. The

following information is available about work in the first department, the Mixing

Department, during June.

Percent Completed

Materials Conversion

70%

Work in process, beginning

Started into production

Completed and transferred out

Work in process, ending

Work in process, beginning

Cost added during June

Units

85,000

400,000

385,000

100,000

30%

80%

$41,200

$368,000

45%

$16,500

$263,000

Required:

Assume that the company uses the weighted-average method.

1. Determine the equivalent units for June for the Mixing Department.

2. Compute the costs per equivalent unit for June for the Mixing Department.

3. Determine the total cost of ending work in process inventory and the total cost of units

transferred to the Packaging Department.

4. Prepare a cost reconciliation report for the Mixing Department for June.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,