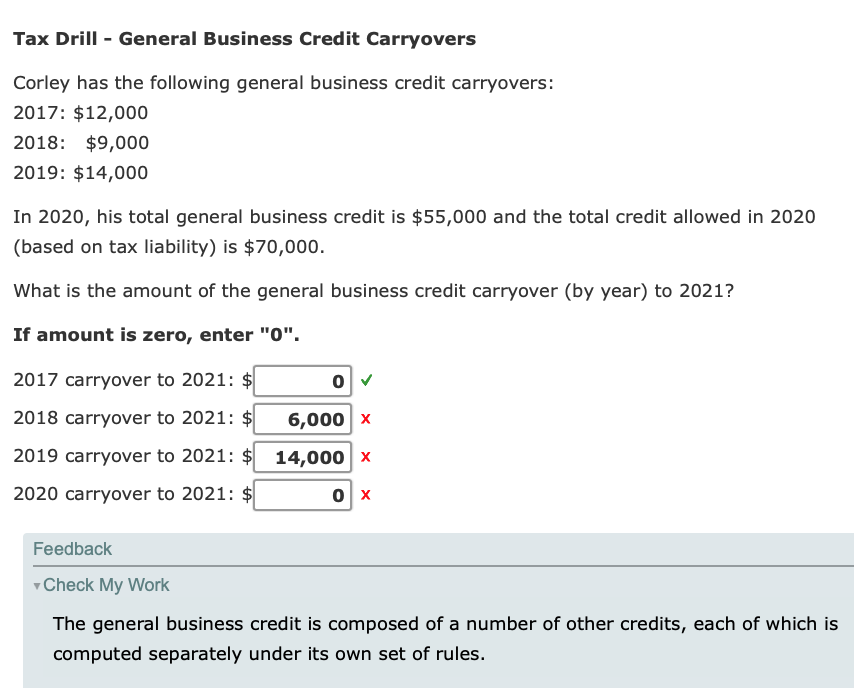

Corley has the following general business credit carryovers: 2017: $12,000 2018: $9,000 2019: $14,000 In 2020, his total general business credit is $55,000 and the total credit allowed in 2020 (based on tax liability) is $70,000. What is the amount of the general business credit carryover (by year) to 2021?

Corley has the following general business credit carryovers: 2017: $12,000 2018: $9,000 2019: $14,000 In 2020, his total general business credit is $55,000 and the total credit allowed in 2020 (based on tax liability) is $70,000. What is the amount of the general business credit carryover (by year) to 2021?

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 25P

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

Transcribed Image Text:Tax Drill - General Business Credit Carryovers

Corley has the following general business credit carryovers:

2017: $12,000

2018: $9,000

2019: $14,000

In 2020, his total general business credit is $55,000 and the total credit allowed in 2020

(based on tax liability) is $70,000.

What is the amount of the general business credit carryover (by year) to 2021?

If amount is zero, enter "0".

2017 carryover to 2021: $

2018 carryover to 2021: $

6,000 x

2019 carryover to 2021: $

14,000 x

2020 carryover to 2021: $

Feedback

Check My Work

The general business credit is composed of a number of other credits, each of which is

computed separately under its own set of rules.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning