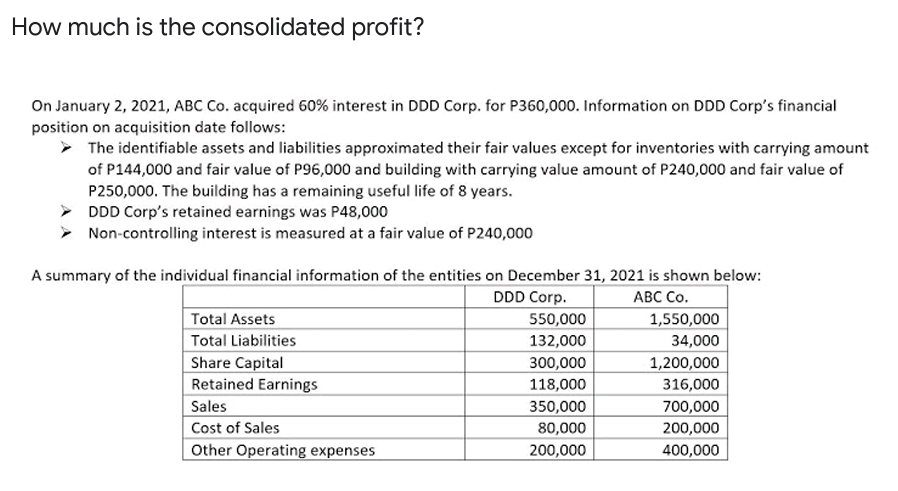

How much is the consolidated profit? On January 2, 2021, ABC Co. acquired 60% interest in DDD Corp. for P360,000. Information on DDD Corp's financial position on acquisition date follows: > The identifiable assets and liabilities approximated their fair values except for inventories with carrying amount of P144,000 and fair value of P96,000 and building with carrying value amount of P240,000 and fair value of P250,000. The building has a remaining useful life of 8 years. > DDD Corp's retained earnings was P48,000 > Non-controlling interest is measured at a fair value of P240,000 A summary of the individual financial information of the entities on December 31, 2021 is shown below: DDD Corp. ABC Co. Total Assets 550,000 1,550,000 Total Liabilities 132,000 34,000 Share Capital 300,000 1,200,000 Retained Earnings 118,000 316,000 Sales 350,000 700,000 Cost of Sales 80,000 200,000 Other Operating expenses 200,000 400,000

How much is the consolidated profit? On January 2, 2021, ABC Co. acquired 60% interest in DDD Corp. for P360,000. Information on DDD Corp's financial position on acquisition date follows: > The identifiable assets and liabilities approximated their fair values except for inventories with carrying amount of P144,000 and fair value of P96,000 and building with carrying value amount of P240,000 and fair value of P250,000. The building has a remaining useful life of 8 years. > DDD Corp's retained earnings was P48,000 > Non-controlling interest is measured at a fair value of P240,000 A summary of the individual financial information of the entities on December 31, 2021 is shown below: DDD Corp. ABC Co. Total Assets 550,000 1,550,000 Total Liabilities 132,000 34,000 Share Capital 300,000 1,200,000 Retained Earnings 118,000 316,000 Sales 350,000 700,000 Cost of Sales 80,000 200,000 Other Operating expenses 200,000 400,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 30E

Related questions

Question

100%

Transcribed Image Text:How much is the consolidated profit?

On January 2, 2021, ABC Co. acquired 60% interest in DDD Corp. for P360,000. Information on DDD Corp's financial

position on acquisition date follows:

> The identifiable assets and liabilities approximated their fair values except for inventories with carrying amount

of P144,000 and fair value of P96,000 and building with carrying value amount of P240,000 and fair value of

P250,000. The building has a remaining useful life of 8 years.

> DDD Corp's retained earnings was P48,000

> Non-controlling interest is measured at a fair value of P240,000

A summary of the individual financial information of the entities on December 31, 2021 is shown below:

DDD Corp.

550,000

АВС Со.

Total Assets

1,550,000

Total Liabilities

132,000

34,000

Share Capital

Retained Earnings

300,000

1,200,000

118,000

316,000

Sales

Cost of Sales

350,000

700,000

80,000

200,000

Other Operating expenses

200,000

400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning