How much of Melissa's material (after making the correction) is attributable to direct material and how much to overhead? How is the direct material cost assigned to individual jobs, and how is the overhead cost allocated?

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

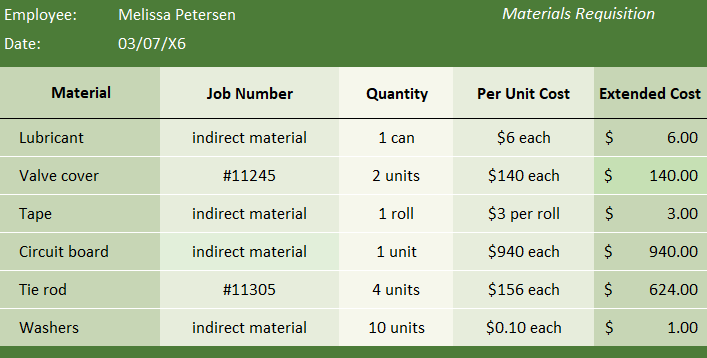

Melissa Petersen is a quality control specialist employed by Fenway Racing. Fenway Racing manufactures custom race cars to exact specifications of drivers. Melissa's job is to perform final testing of each car's engine and make final performance related adjustments. Some adjustments involve simple recalibration and consume only indirect materials like lubricants, tape, washers, and screws. Occasionally, a major adjustment is needed, and requires an expensive direct material component. Below is Melissa's materials requisition form for March 7, 20X6:

b.) How much of Melissa's material (after making the correction) is attributable to direct material and how much to

Trending now

This is a popular solution!

Step by step

Solved in 2 steps