How much was the taxable income assuming the taxpayer was a: a. non-resident citizen engaged in business, single b. non-resident citizen not engaged in business, married with four (4) qualified dependent children i. Progressive Tax Rates ii. Income tax due using 8% Gross Receipts Tax Rate.

How much was the taxable income assuming the taxpayer was a: a. non-resident citizen engaged in business, single b. non-resident citizen not engaged in business, married with four (4) qualified dependent children i. Progressive Tax Rates ii. Income tax due using 8% Gross Receipts Tax Rate.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 14P

Related questions

Question

pls help will rate u high for the answers

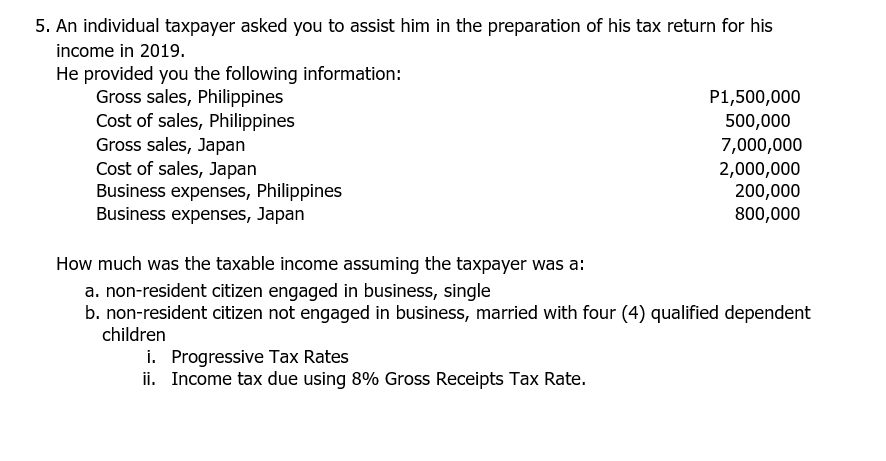

Transcribed Image Text:5. An individual taxpayer asked you to assist him in the preparation of his tax return for his

income in 2019.

He provided you the following information:

Gross sales, Philippines

Cost of sales, Philippines

Gross sales, Japan

Cost of sales, Japan

Business expenses, Philippines

Business expenses, Japan

P1,500,000

500,000

7,000,000

2,000,000

200,000

800,000

How much was the taxable income assuming the taxpayer was a:

a. non-resident citizen engaged in business, single

b. non-resident citizen not engaged in business, married with four (4) qualified dependent

children

i. Progressive Tax Rates

ii. Income tax due using 8% Gross Receipts Tax Rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT