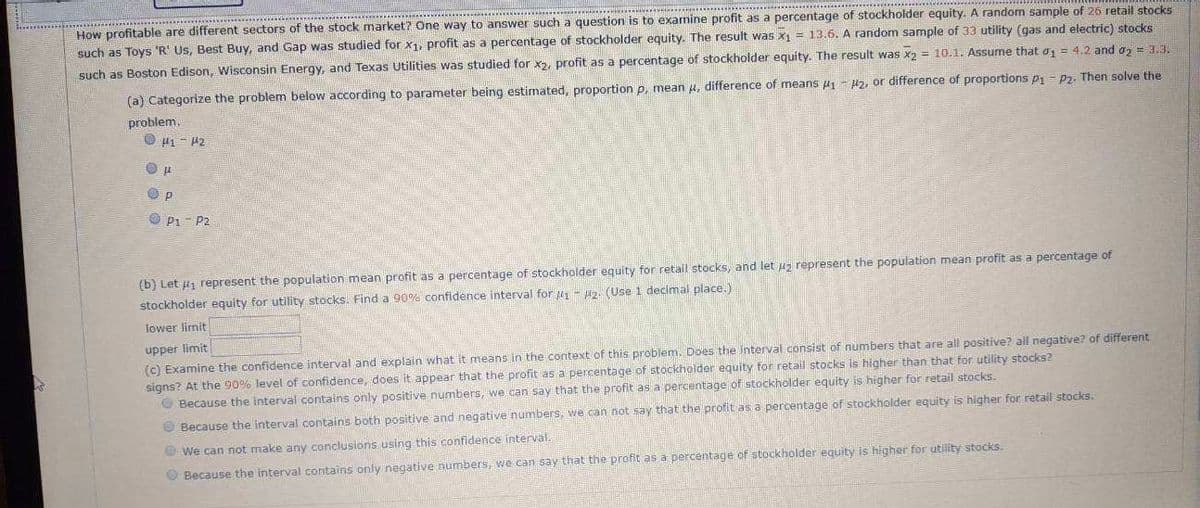

How profitable are different sectors of the stock market? One way to answer such a question is to examine profit as a percentage of stockholder equity. A random sample of 26 retail stocks such as Toys 'R Us, Best Buy, and Gap was studied for x1, profit as a percentage of stockholder equity. The result was x1 = 13.6. A random sample of 33 utility (gas and electric) stocks such as Boston Edison, Wisconsin Energy, and Texas Utilities was studied for x2, profit as a percentage of stockholder equíty. The result was x2 = 10.1. Assume that oz = 4.2 and az = 3.3. (a) Categorize the problem below according to parameter being estimated, proportion p, mean u, difference of means 41 H2, or difference of proportions p - P2. Then solve the problem. O u1 - 42 O P1 - P2 (b) Let 1 represent the population mean profit as a percentage of stockholder equity for retail stocks, and let uz répresent the population mean profit as a percentage of stockholder equity for utility stocks. Find a 90% confidence interval for - H2. (Use 1 decimal place.) lower limit upper limit (c) Examine the confidence interval and explain what it means in the context of this problem. Does the interval consist of numbers that are all positive? all negative? of different signs? At the 90% level of confidence, does it appear that the profit as a percentage of stockholder equity for retail stocks is higher than that for utility stocks? O Because the interval contains only positive numbers, we can say that the profit as a percentage of stockholder equity is higher for retail stocks. O Because the interval contains both positive and negative numbers, we can not say that the profit as a percentage of stockholder equity is higher for retail stocks. O We can not make any conclusions using this confidence interval. O Because the interval contains only negative numbers, we can say that the profit as a percentage of stockholder equity is higher for utility stocks.

How profitable are different sectors of the stock market? One way to answer such a question is to examine profit as a percentage of stockholder equity. A random sample of 26 retail stocks such as Toys 'R Us, Best Buy, and Gap was studied for x1, profit as a percentage of stockholder equity. The result was x1 = 13.6. A random sample of 33 utility (gas and electric) stocks such as Boston Edison, Wisconsin Energy, and Texas Utilities was studied for x2, profit as a percentage of stockholder equíty. The result was x2 = 10.1. Assume that oz = 4.2 and az = 3.3. (a) Categorize the problem below according to parameter being estimated, proportion p, mean u, difference of means 41 H2, or difference of proportions p - P2. Then solve the problem. O u1 - 42 O P1 - P2 (b) Let 1 represent the population mean profit as a percentage of stockholder equity for retail stocks, and let uz répresent the population mean profit as a percentage of stockholder equity for utility stocks. Find a 90% confidence interval for - H2. (Use 1 decimal place.) lower limit upper limit (c) Examine the confidence interval and explain what it means in the context of this problem. Does the interval consist of numbers that are all positive? all negative? of different signs? At the 90% level of confidence, does it appear that the profit as a percentage of stockholder equity for retail stocks is higher than that for utility stocks? O Because the interval contains only positive numbers, we can say that the profit as a percentage of stockholder equity is higher for retail stocks. O Because the interval contains both positive and negative numbers, we can not say that the profit as a percentage of stockholder equity is higher for retail stocks. O We can not make any conclusions using this confidence interval. O Because the interval contains only negative numbers, we can say that the profit as a percentage of stockholder equity is higher for utility stocks.

Functions and Change: A Modeling Approach to College Algebra (MindTap Course List)

6th Edition

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Bruce Crauder, Benny Evans, Alan Noell

Chapter5: A Survey Of Other Common Functions

Section5.3: Modeling Data With Power Functions

Problem 6E: Urban Travel Times Population of cities and driving times are related, as shown in the accompanying...

Related questions

Question

Transcribed Image Text:How profitable are different sectors of the stock market? One way to answer such a question is to examine profit as a percentage of stockholder equity. A random sample of 26 retail stocks

such as Toys 'R' Us, Best Buy, and Gap was studied for x1, profit as a percentage of stockholder equity. The result was x1 = 13.6. A random sample of 33 utility (gas and electric) stocks

such as Boston Edison, Wisconsin Energy, and Texas Utilities was studied for x, profit as a percentage of stockholder equity. The result was x2 = 10.1. Assume that a = 4.2 and a, = 3.3.

(a) Categorize the problem below according to parameter being estimated, proportion p, mean 4, difference of means 41 - H2, or difference of proportions Pi - P2. Then solve the

problem.

O u1 - 42

O P1 - P2

(b) Let 41 represent the population mean profit as a percentage of stockholder equity for retail stocks, and let uz represent the population mean profit as a percentage of

stockholder equity for utility stocks. Find a 90% confidence interval for a - H2. (Use 1 decimal place.)

lower limit

upper limit

(c) Examine the confidence interval and explain what it means in the context of this problem. Does the interval consist of numbers that are all positive? all negative? of different

signs? At the 90% level of confidence, does it appear that the profit as a percentage of stockhelder equity for retail stocks is higher than that for utility stocks?

O Because the interval contains only positive numbers, we can say that the profit as a percentage of stockholder equity is higher for retail stocks.

O Because the interval contains both positive and negative numbers, we can not say that the profit as a percentage of stockholder equity is higher for retail stocks.

O We can not make any conclusions using this confidence interval.

O Because the interval contains only negative numbers, we can say that the profit as a percentage of stockholder equity is higher for utility stocks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill