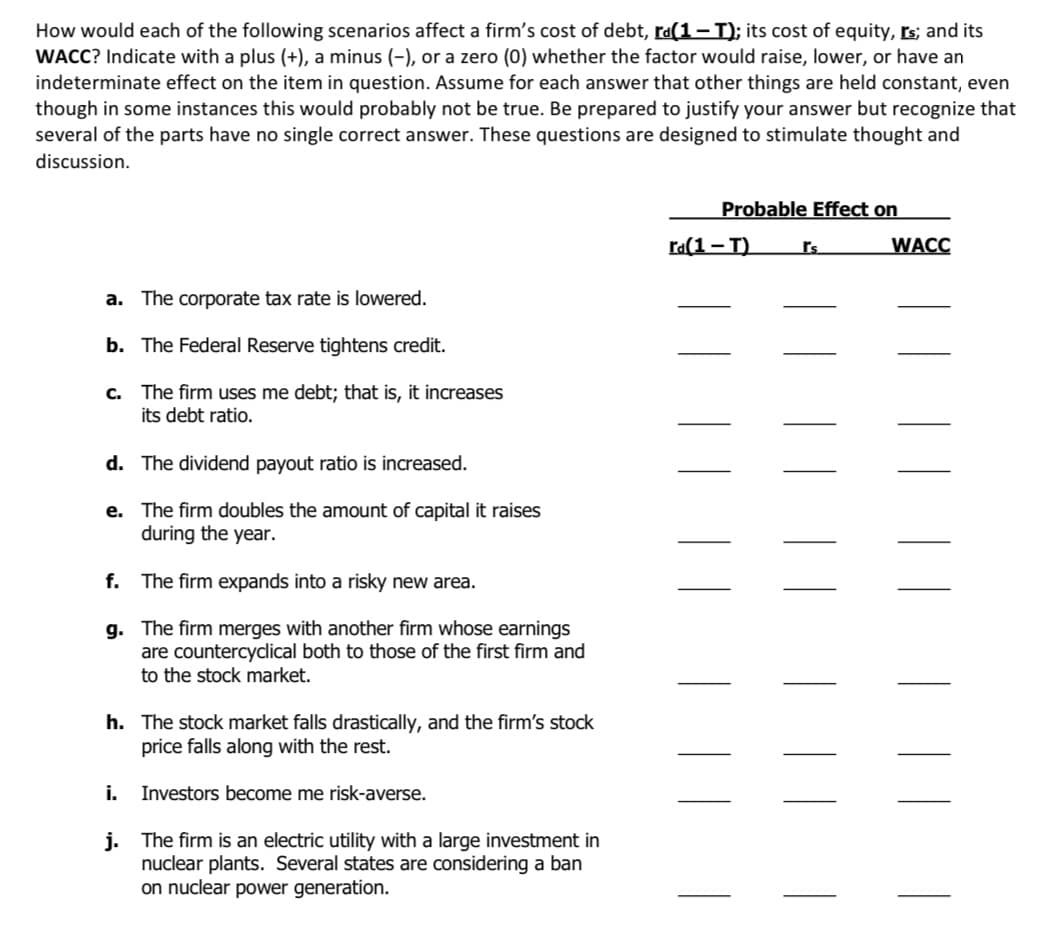

How would each of the following scenarios affect a firm's cost of debt, ra(1-T); its cost of equity, s; and its WACC? Indicate with a plus (+), a minus (-), or a zero (0) whether the factor would raise, lower, or have an indeterminate effect on the item in question. Assume for each answer that other things are held constant, even though in some instances this would probably not be true. Be prepared to justify your answer but recognize that several of the parts have no single correct answer. These questions are designed to stimulate thought and discussion. Probable Effect on ra(1-T) WACC rs a. The corporate tax rate is lowered. b. The Federal Reserve tightens credit. c. The firm uses me debt; that is, it increases its debt ratio. The dividend payout ratio is increased The firm doubles the amount of capital it raises during the year. е. The firm expands into a risky new area. f. The firm merges with another firm whose earnings g. are countercyclical both to those of the first firm and to the stock market. h. The stock market falls drastically, and the firm's stock price falls along with the rest. i. Investors become me risk-averse. j. The firm is an electric utility with a large investment in nuclear plants. Several states are considering a ban on nuclear power generation

How would each of the following scenarios affect a firm's cost of debt, ra(1-T); its cost of equity, s; and its WACC? Indicate with a plus (+), a minus (-), or a zero (0) whether the factor would raise, lower, or have an indeterminate effect on the item in question. Assume for each answer that other things are held constant, even though in some instances this would probably not be true. Be prepared to justify your answer but recognize that several of the parts have no single correct answer. These questions are designed to stimulate thought and discussion. Probable Effect on ra(1-T) WACC rs a. The corporate tax rate is lowered. b. The Federal Reserve tightens credit. c. The firm uses me debt; that is, it increases its debt ratio. The dividend payout ratio is increased The firm doubles the amount of capital it raises during the year. е. The firm expands into a risky new area. f. The firm merges with another firm whose earnings g. are countercyclical both to those of the first firm and to the stock market. h. The stock market falls drastically, and the firm's stock price falls along with the rest. i. Investors become me risk-averse. j. The firm is an electric utility with a large investment in nuclear plants. Several states are considering a ban on nuclear power generation

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 3Q

Related questions

Question

Transcribed Image Text:How would each of the following scenarios affect a firm's cost of debt, ra(1-T); its cost of equity, s; and its

WACC? Indicate with a plus (+), a minus (-), or a zero (0) whether the factor would raise, lower, or have an

indeterminate effect on the item in question. Assume for each answer that other things are held constant, even

though in some instances this would probably not be true. Be prepared to justify your answer but recognize that

several of the parts have no single correct answer. These questions are designed to stimulate thought and

discussion.

Probable Effect on

ra(1-T)

WACC

rs

a. The corporate tax rate is lowered.

b. The Federal Reserve tightens credit.

c. The firm uses me debt; that is, it increases

its debt ratio.

The dividend payout ratio is increased

The firm doubles the amount of capital it raises

during the year.

е.

The firm expands into a risky new area.

f.

The firm merges with another firm whose earnings

g.

are countercyclical both to those of the first firm and

to the stock market.

h.

The stock market falls drastically, and the firm's stock

price falls along with the rest.

i.

Investors become me risk-averse.

j.

The firm is an electric utility with a large investment in

nuclear plants. Several states are considering a ban

on nuclear power generation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning