Hyrkas Corporation's most recent balance sheet and income statement appear below: Balance Sheet December 31, Year 2 and Year 1 (in thousands of dollars) Year 2 Year 1 Assets Current assets: Cash $ 190 $ 270 Accounts receivable, net 300 320 Inventory 270 240 Prepaid expenses 20 20 Total current assets 780 850 Plant and equipment, net 1,000 1,060 Total assets $ 1,780 $ 1,910 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 240 $ 270 Accrued liabilities 50 50 Notes payable, short term 40 40 Total current liabilities 330 360 Bonds payable 230 360 Total liabilities 560 720 Stockholders’ equity: Common stock, $2 par value 200 200 Additional paid-in capital 330 330 Retained earnings 690 660 Total stockholders’ equity 1,220 1,190 Total liabilities & stockholders’ equity $ 1,780 $ 1,910 Income Statement For the Year Ended December 31, Year 2 (in thousands of dollars) Sales (all on account) $ 1,340 Cost of goods sold 840 Gross margin 500 Selling and administrative expense 415 Net operating income 85 Interest expense 20 Net income before taxes 65 Income taxes (30%) 20 Net income $ 45 Dividends on common stock during Year 2 totaled $15 thousand. The market price of common stock at the end of Year 2 was $16.30 per share. Required: Compute the following for Year 2: d. Dividend payout ratio. (Do not round intermediate calculations. Round your "Percentage" answer to 1 decimal place.) e. Dividend yield ratio. (Round your "Percentage" answer to 2 decimal places.) f. Return on total assets. (Do not round intermediate calculations. Round your "Percentage" answer to 2 decimal places.) g. Return on equity. (Round your "Percentage" answer to 2 decimal places.) h. Book value per share. (Round your answer to 2 decimal places.) i. Working capital. (Input your answer in thousands of dollars.) j. Current ratio. (Round your answer to 2 decimal places.) k. Acid-test (quick) ratio. (Round your answer to 2 decimal places.) l. Accounts receivable turnover. (Round your answer to 2 decimal

Hyrkas Corporation's most recent balance sheet and income statement appear below:

| Balance Sheet | ||

| December 31, Year 2 and Year 1 | ||

| (in thousands of dollars) | ||

| Year 2 | Year 1 | |

|---|---|---|

| Assets | ||

| Current assets: | ||

| Cash | $ 190 | $ 270 |

| Accounts receivable, net | 300 | 320 |

| Inventory | 270 | 240 |

| Prepaid expenses | 20 | 20 |

| Total current assets | 780 | 850 |

| Plant and equipment, net | 1,000 | 1,060 |

| Total assets | $ 1,780 | $ 1,910 |

| Liabilities and |

||

| Current liabilities: | ||

| Accounts payable | $ 240 | $ 270 |

| Accrued liabilities | 50 | 50 |

| Notes payable, short term | 40 | 40 |

| Total current liabilities | 330 | 360 |

| Bonds payable | 230 | 360 |

| Total liabilities | 560 | 720 |

| Stockholders’ equity: | ||

| Common stock, $2 par value | 200 | 200 |

| Additional paid-in capital | 330 | 330 |

| 690 | 660 | |

| Total stockholders’ equity | 1,220 | 1,190 |

| Total liabilities & stockholders’ equity | $ 1,780 | $ 1,910 |

| Income Statement | |

| For the Year Ended December 31, Year 2 | |

| (in thousands of dollars) | |

| Sales (all on account) | $ 1,340 |

|---|---|

| Cost of goods sold | 840 |

| Gross margin | 500 |

| Selling and administrative expense | 415 |

| Net operating income | 85 |

| Interest expense | 20 |

| Net income before taxes | 65 |

| Income taxes (30%) | 20 |

| Net income | $ 45 |

Dividends on common stock during Year 2 totaled $15 thousand. The market price of common stock at the end of Year 2 was $16.30 per share.

Required:

Compute the following for Year 2:

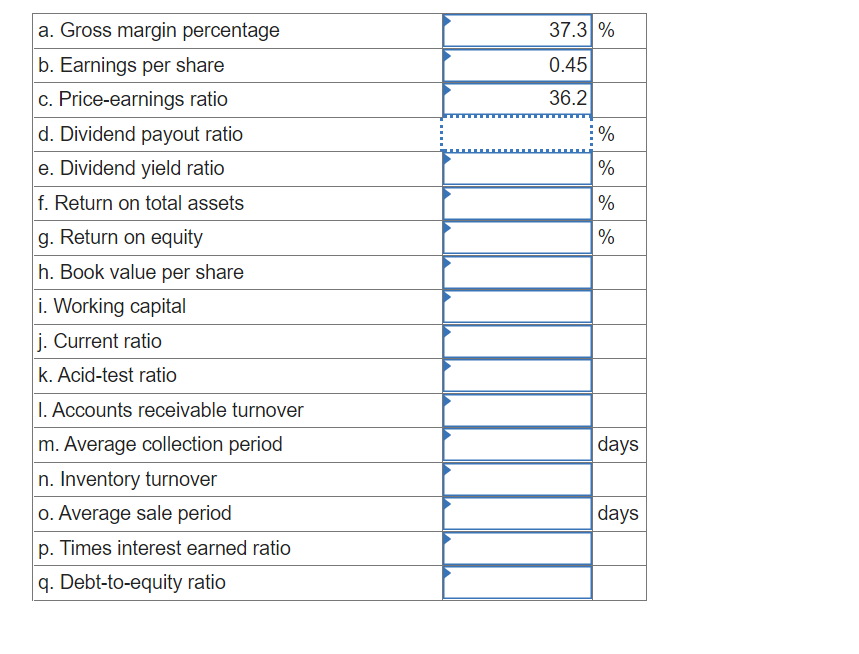

d. Dividend payout ratio. (Do not round intermediate calculations. Round your "Percentage" answer to 1 decimal place.)

e. Dividend yield ratio. (Round your "Percentage" answer to 2 decimal places.)

f. Return on total assets. (Do not round intermediate calculations. Round your "Percentage" answer to 2 decimal places.)

g. Return on equity. (Round your "Percentage" answer to 2 decimal places.)

h. Book value per share. (Round your answer to 2 decimal places.)

i.

j.

k. Acid-test (quick) ratio. (Round your answer to 2 decimal places.)

l. Accounts receivable turnover. (Round your answer to 2 decimal places.)

m. Average collection period. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 1 decimal place.)

n. Inventory turnover. (Round your answer to 2 decimal places.)

o. Average sale period. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 1 decimal place.)

p. Times interest earned ratio. (Round your answer to 2 decimal places.)

q. Debt-to-equity ratio. (Round your answer to 2 decimal places.)

Step by step

Solved in 2 steps