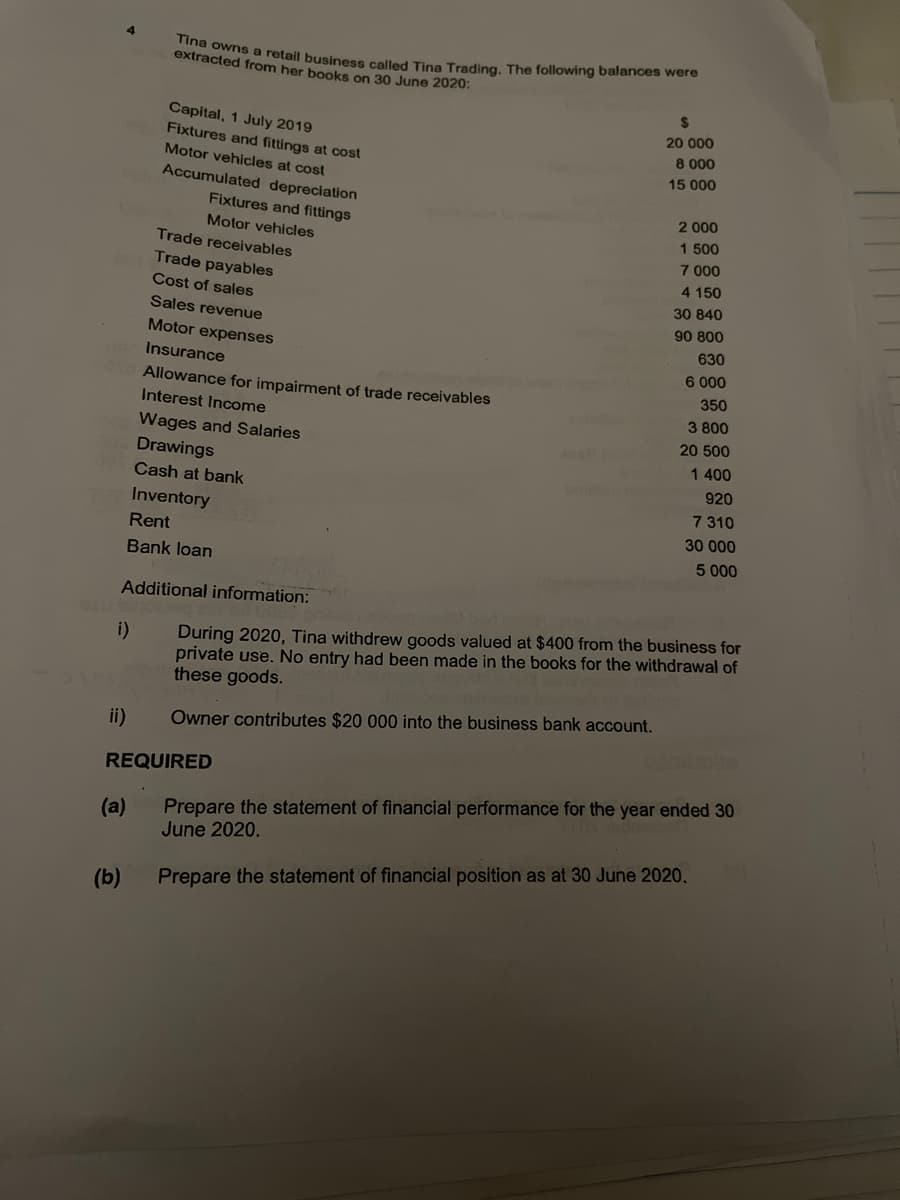

i) ii) Tina owns a retail business called Tina Trading. The following balances were extracted from her books on 30 June 2020: (a) Capital, 1 July 2019 Fixtures and fittings at cost Motor vehicles at cost Accumulated depreciation (b) Fixtures and fittings Motor vehicles Additional information: Trade receivables Trade payables Cost of sales Sales revenue Motor expenses Insurance Allowance for impairment of trade receivables Interest Income Wages and Salaries Drawings Cash at bank Inventory Rent Bank loan REQUIRED pho solution $ 20 000 8 000 15 000 2 000 1 500 7 000 4 150 30 840 90 800 630 6 000 350 3 800 20 500 1 400 920 7 310 30 000 5 000 During 2020, Tina withdrew goods valued at $400 from the business for private use. No entry had been made in the books for the withdrawal of these goods. Owner contributes $20 000 into the business bank account. CESTUDER Prepare the statement of financial performance for the year ended 30 June 2020. Prepare the statement of financial position as at 30 June 2020.

i) ii) Tina owns a retail business called Tina Trading. The following balances were extracted from her books on 30 June 2020: (a) Capital, 1 July 2019 Fixtures and fittings at cost Motor vehicles at cost Accumulated depreciation (b) Fixtures and fittings Motor vehicles Additional information: Trade receivables Trade payables Cost of sales Sales revenue Motor expenses Insurance Allowance for impairment of trade receivables Interest Income Wages and Salaries Drawings Cash at bank Inventory Rent Bank loan REQUIRED pho solution $ 20 000 8 000 15 000 2 000 1 500 7 000 4 150 30 840 90 800 630 6 000 350 3 800 20 500 1 400 920 7 310 30 000 5 000 During 2020, Tina withdrew goods valued at $400 from the business for private use. No entry had been made in the books for the withdrawal of these goods. Owner contributes $20 000 into the business bank account. CESTUDER Prepare the statement of financial performance for the year ended 30 June 2020. Prepare the statement of financial position as at 30 June 2020.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 2MCQ: In December 2019, Swanstrom Inc. receives a cash payment of $3,500 for services performed in...

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

Transcribed Image Text:4

i)

ii)

Tina owns a retail business called Tina Trading. The following balances were

extracted from her books on 30 June 2020:

(a)

(b)

Capital, 1 July 2019

Fixtures and fittings at cost

Motor vehicles at cost

Accumulated depreciation

Fixtures and fittings

Motor vehicles

Additional information:

Trade receivables

Trade payables

Cost of sales

Sales revenue

Motor expenses

Insurance

Allowance for impairment of trade receivables

Interest Income

Wages and Salaries

Drawings

Cash at bank

Inventory

Rent

Bank loan

REQUIRED

ans

$

20 000

8 000

15 000

2 000

1 500

7 000

4 150

30 840

90 800

630

6 000

350

3 800

20 500

1 400

920

7 310

30 000

5 000

During 2020, Tina withdrew goods valued at $400 from the business for

private use. No entry had been made in the books for the withdrawal of

these goods.

Owner contributes $20 000 into the business bank account.

Prepare the statement of financial performance for the year ended 30

June 2020.

Prepare the statement of financial position as at 30 June 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT