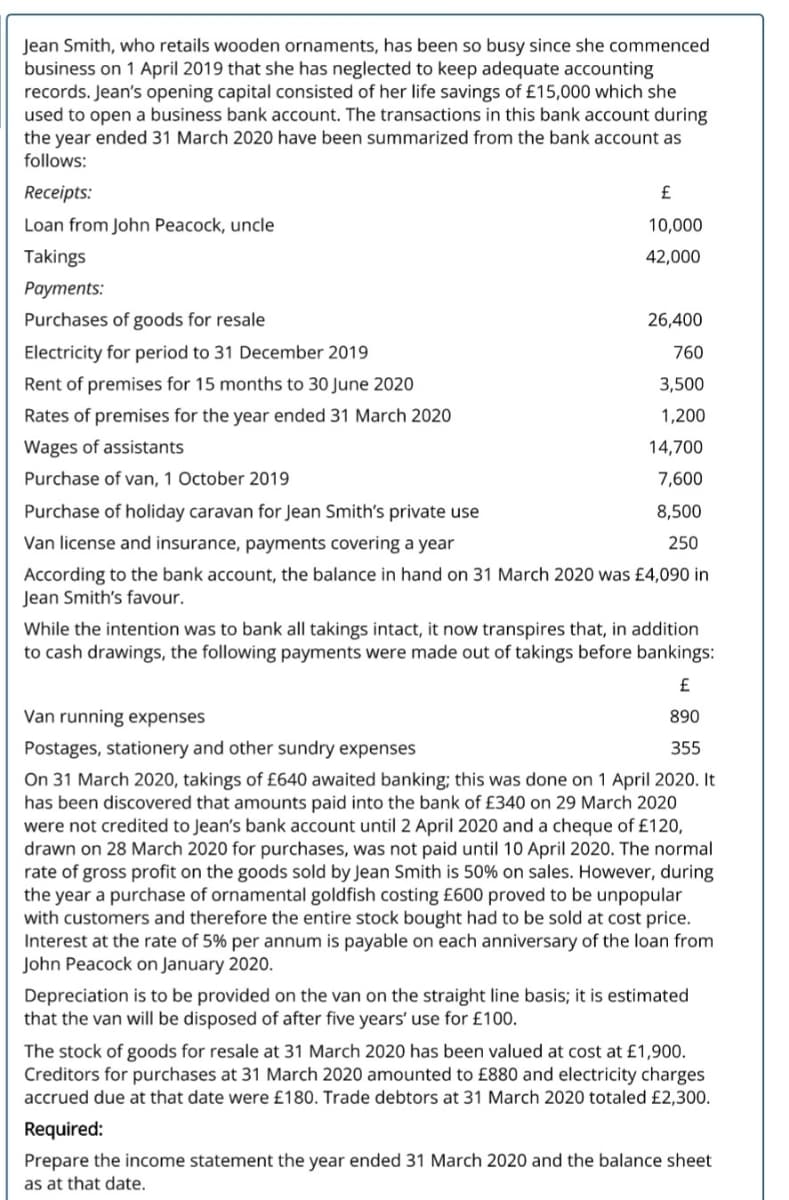

Jean Smith, who retails wooden ornaments, has been so busy since she commenced business on 1 April 2019 that she has neglected to keep adequate accounting records. Jean's opening capital consisted of her life savings of £15,000 which she used to open a business bank account. The transactions in this bank account during the year ended 31 March 2020 have been summarized from the bank account as follows: Receipts: Loan from John Peacock, uncle Takings Payments: Purchases of goods for resale Electricity for period to 31 December 2019 Rent of premises for 15 months to 30 June 2020 Rates of premises for the year ended 31 March 2020 Wages of assistants Purchase of van, 1 October 2019 Purchase of holiday caravan for Jean Smith's private use Van license and insurance, payments covering a year According to the bank account, the balance in hand on 31 March 2020 was £4,090 in Jean Smith's favour. £ 10,000 42,000 26,400 760 3,500 1,200 14,700 7,600 8,500 250 While the intention was to bank all takings intact, it now transpires that, in addition to cash drawings, the following payments were made out of takings before bankings: £ 890 Van running expenses Postages, stationery and other sundry expenses 355 On 31 March 2020, takings of £640 awaited banking; this was done on 1 April 2020. It has been discovered that amounts paid into the bank of £340 on 29 March 2020 were not credited to Jean's bank account until 2 April 2020 and a cheque of £120, drawn on 28 March 2020 for purchases, was not paid until 10 April 2020. The normal rate of gross profit on the goods sold by Jean Smith is 50% on sales. However, during the year a purchase of ornamental goldfish costing £600 proved to be unpopular with customers and therefore the entire stock bought had to be sold at cost price. Interest at the rate of 5% per annum is payable on each anniversary of the loan from John Peacock on January 2020. Depreciation is to be provided on the van on the straight line basis; it is estimated that the van will be disposed of after five years' use for £100. The stock of goods for resale at 31 March 2020 has been valued at cost at £1,900. Creditors for purchases at 31 March 2020 amounted to £880 and electricity charges accrued due at that date were £180. Trade debtors at 31 March 2020 totaled £2,300. Required: Prepare the income statement the year ended 31 March 2020 and the balance sheet as at that date.

Jean Smith, who retails wooden ornaments, has been so busy since she commenced business on 1 April 2019 that she has neglected to keep adequate accounting records. Jean's opening capital consisted of her life savings of £15,000 which she used to open a business bank account. The transactions in this bank account during the year ended 31 March 2020 have been summarized from the bank account as follows: Receipts: Loan from John Peacock, uncle Takings Payments: Purchases of goods for resale Electricity for period to 31 December 2019 Rent of premises for 15 months to 30 June 2020 Rates of premises for the year ended 31 March 2020 Wages of assistants Purchase of van, 1 October 2019 Purchase of holiday caravan for Jean Smith's private use Van license and insurance, payments covering a year According to the bank account, the balance in hand on 31 March 2020 was £4,090 in Jean Smith's favour. £ 10,000 42,000 26,400 760 3,500 1,200 14,700 7,600 8,500 250 While the intention was to bank all takings intact, it now transpires that, in addition to cash drawings, the following payments were made out of takings before bankings: £ 890 Van running expenses Postages, stationery and other sundry expenses 355 On 31 March 2020, takings of £640 awaited banking; this was done on 1 April 2020. It has been discovered that amounts paid into the bank of £340 on 29 March 2020 were not credited to Jean's bank account until 2 April 2020 and a cheque of £120, drawn on 28 March 2020 for purchases, was not paid until 10 April 2020. The normal rate of gross profit on the goods sold by Jean Smith is 50% on sales. However, during the year a purchase of ornamental goldfish costing £600 proved to be unpopular with customers and therefore the entire stock bought had to be sold at cost price. Interest at the rate of 5% per annum is payable on each anniversary of the loan from John Peacock on January 2020. Depreciation is to be provided on the van on the straight line basis; it is estimated that the van will be disposed of after five years' use for £100. The stock of goods for resale at 31 March 2020 has been valued at cost at £1,900. Creditors for purchases at 31 March 2020 amounted to £880 and electricity charges accrued due at that date were £180. Trade debtors at 31 March 2020 totaled £2,300. Required: Prepare the income statement the year ended 31 March 2020 and the balance sheet as at that date.

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 33P

Related questions

Topic Video

Question

Transcribed Image Text:Jean Smith, who retails wooden ornaments, has been so busy since she commenced

business on 1 April 2019 that she has neglected to keep adequate accounting

records. Jean's opening capital consisted of her life savings of £15,000 which she

used to open a business bank account. The transactions in this bank account during

the year ended 31 March 2020 have been summarized from the bank account as

follows:

Receipts:

£

Loan from John Peacock, uncle

10,000

Takings

42,000

Рayments:

Purchases of goods for resale

26,400

Electricity for period to 31 December 2019

760

Rent of premises for 15 months to 30 June 2020

3,500

Rates of premises for the year ended 31 March 2020

1,200

Wages of assistants

14,700

Purchase of van, 1 October 2019

7,600

Purchase of holiday caravan for Jean Smith's private use

8,500

Van license and insurance, payments covering a year

250

According to the bank account, the balance in hand on 31 March 2020 was £4,090 in

Jean Smith's favour.

While the intention was to bank all takings intact, it now transpires that, in addition

to cash drawings, the following payments were made out of takings before bankings:

£

Van running expenses

890

Postages, stationery and other sundry expenses

355

On 31 March 2020, takings of £640 awaited banking; this was done on 1 April 2020. It

has been discovered that amounts paid into the bank of £340 on 29 March 2020

were not credited to Jean's bank account until 2 April 2020 and a cheque of £120,

drawn on 28 March 2020 for purchases, was not paid until 10 April 2020. The normal

rate of gross profit on the goods sold by Jean Smith is 50% on sales. However, during

the year a purchase of ornamental goldfish costing £600 proved to be unpopular

with customers and therefore the entire stock bought had to be sold at cost price.

Interest at the rate of 5% per annum is payable on each anniversary of the loan from

John Peacock on January 2020.

Depreciation is to be provided on the van on the straight line basis; it is estimated

that the van will be disposed of after five years' use for £100.

The stock of goods for resale at 31 March 2020 has been valued at cost at £1,900.

Creditors for purchases at 31 March 2020 amounted to £880 and electricity charges

accrued due at that date were £180. Trade debtors at 31 March 2020 totaled £2,300.

Required:

Prepare the income statement the year ended 31 March 2020 and the balance sheet

as at that date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning