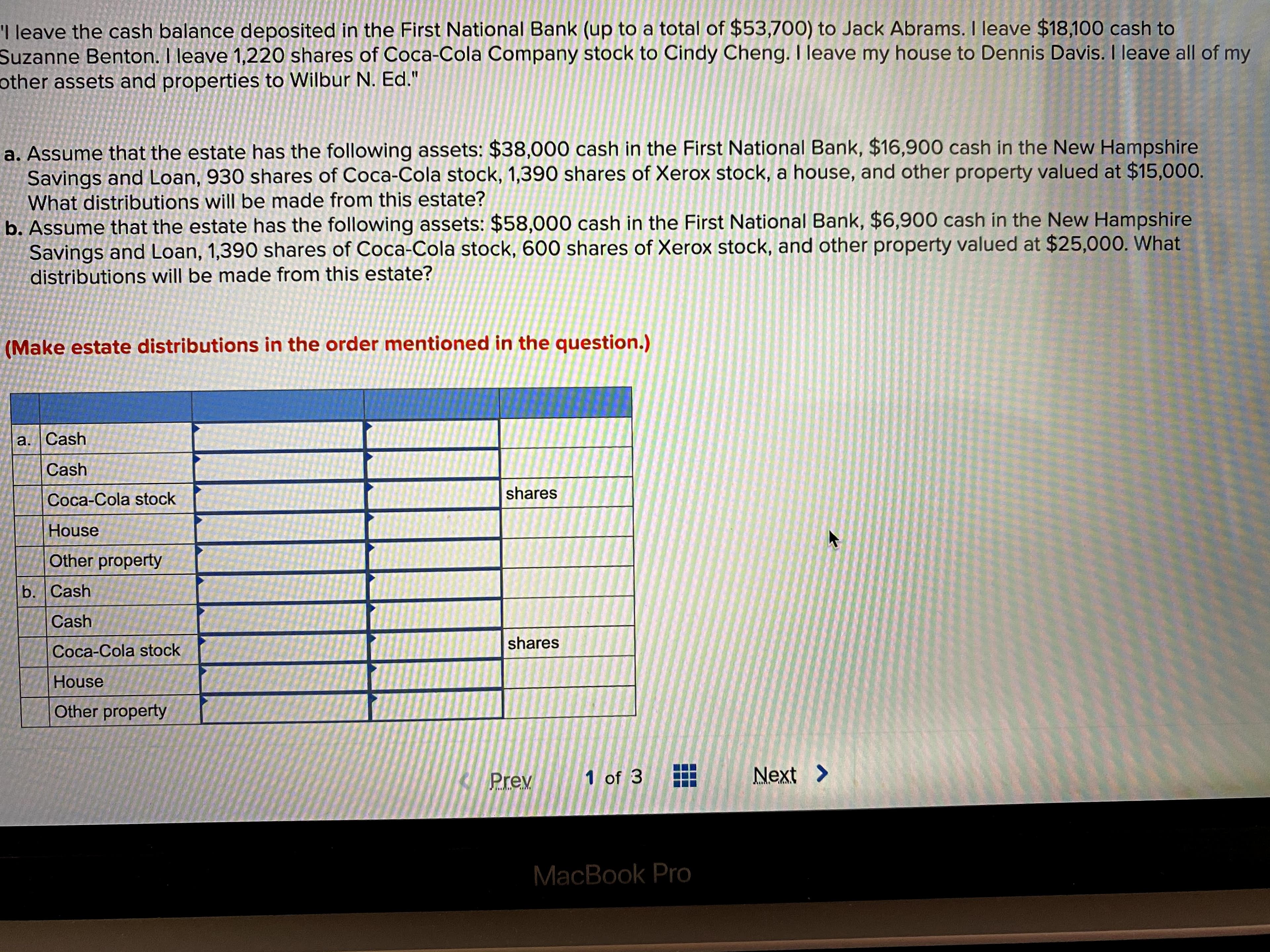

I leave the cash balance deposited in the First National Bank (up to a total of $53,700) to Jack Abrams. I leave $18,100 cash to Suzanne Benton. I leave 1,220 shares of Coca-Cola Company stock to Cindy Cheng. I leave my house to Dennis Davis. I leave all of my other assets and properties to Wilbur N. Ed." a. Assume that the estate has the following assets: $38,000 cash in the First National Bank, $16,900 cash in the New Hampshire Savings and Loan, 930 shares of Coca-Cola stock, 1,390 shares of Xerox stock, a house, and other property valued at $15,000. What distributions will be made from this estate? b. Assume that the estate has the following assets: $58,000 cash in the First National Bank, $6,900 cash in the New Hampshire Savings and Loan, 1,390 shares of Coca-Cola stock, 600 shares of Xerox stock, and other property valued at $25,00O. What distributions will be made from this estate? (Make estate distributions in the order mentioned in the question.) a. Cash Cash shares Coca-Cola stock House Other property b. Cash Cash shares Coca-Cola stock House Other property Prev 1 of 3 Next > MacBook Pro

I leave the cash balance deposited in the First National Bank (up to a total of $53,700) to Jack Abrams. I leave $18,100 cash to Suzanne Benton. I leave 1,220 shares of Coca-Cola Company stock to Cindy Cheng. I leave my house to Dennis Davis. I leave all of my other assets and properties to Wilbur N. Ed." a. Assume that the estate has the following assets: $38,000 cash in the First National Bank, $16,900 cash in the New Hampshire Savings and Loan, 930 shares of Coca-Cola stock, 1,390 shares of Xerox stock, a house, and other property valued at $15,000. What distributions will be made from this estate? b. Assume that the estate has the following assets: $58,000 cash in the First National Bank, $6,900 cash in the New Hampshire Savings and Loan, 1,390 shares of Coca-Cola stock, 600 shares of Xerox stock, and other property valued at $25,00O. What distributions will be made from this estate? (Make estate distributions in the order mentioned in the question.) a. Cash Cash shares Coca-Cola stock House Other property b. Cash Cash shares Coca-Cola stock House Other property Prev 1 of 3 Next > MacBook Pro

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 46P

Related questions

Question

Transcribed Image Text:I leave the cash balance deposited in the First National Bank (up to a total of $53,700) to Jack Abrams. I leave $18,100 cash to

Suzanne Benton. I leave 1,220 shares of Coca-Cola Company stock to Cindy Cheng. I leave my house to Dennis Davis. I leave all of my

other assets and properties to Wilbur N. Ed."

a. Assume that the estate has the following assets: $38,000 cash in the First National Bank, $16,900 cash in the New Hampshire

Savings and Loan, 930 shares of Coca-Cola stock, 1,390 shares of Xerox stock, a house, and other property valued at $15,000.

What distributions will be made from this estate?

b. Assume that the estate has the following assets: $58,000 cash in the First National Bank, $6,900 cash in the New Hampshire

Savings and Loan, 1,390 shares of Coca-Cola stock, 600 shares of Xerox stock, and other property valued at $25,00O. What

distributions will be made from this estate?

(Make estate distributions in the order mentioned in the question.)

a. Cash

Cash

shares

Coca-Cola stock

House

Other property

b. Cash

Cash

shares

Coca-Cola stock

House

Other property

Prev

1 of 3

Next >

MacBook Pro

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you