I need to find the Quality of Income, Times interest earned ratio and Cash coverage ratio for Blue Water and Prime Fish.

I need to find the Quality of Income, Times interest earned ratio and Cash coverage ratio for Blue Water and Prime Fish.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.13P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

I need to find the Quality of Income, Times interest earned ratio and Cash coverage ratio for Blue Water and Prime Fish.

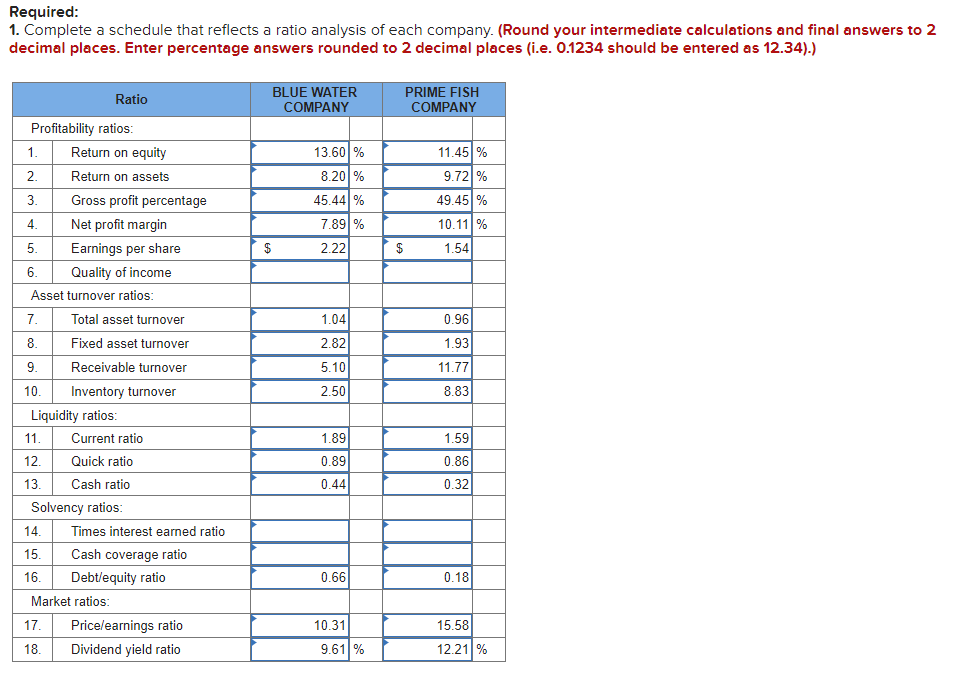

Transcribed Image Text:Required:

1. Complete a schedule that reflects a ratio analysis of each company. (Round your intermediate calculations and final answers to 2

decimal places. Enter percentage answers rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).)

BLUE WATER

PRIME FISH

COMPANY

Ratio

COMPANY

Profitability ratios:

13.60 %

8.20 %

45.44 %

11.45 %

9.72 %

49.45 %

1.

Return on equity

2.

Return on assets

3.

Gross profit percentage

4.

Net profit margin

7.89 %

10.11 %

5.

Earnings per share

$

2.22

1.54

6.

Quality of income

Asset turnover ratios:

7.

Total asset turnover

1.04

0.96

8.

Fixed asset turnover

2.82

1.93

9.

Receivable turnover

5.10

11.77

10.

Inventory turnover

2.50

8.83

Liquidity ratios:

11.

Current ratio

1.89

1.59

12.

Quick ratio

0.89

0.86

13.

Cash ratio

0.44

0.32

Solvency ratios:

14.

Times interest earned ratio

15.

Cash coverage ratio

16.

Debt/equity ratio

0.66

0.18

Market ratios:

17.

Pricelearnings ratio

10.31

15.58

18.

Dividend yield ratio

9.61 %

12.21 %

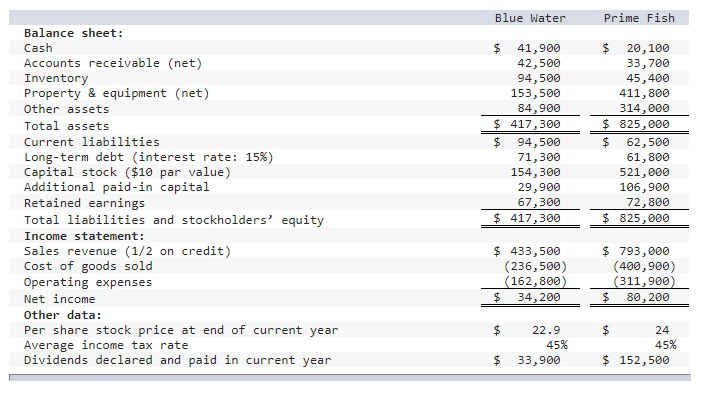

Transcribed Image Text:Blue Water

Prime Fish

Balance sheet:

$ 41,900

42,500

94,500

153,500

84,900

$ 417,300

Cash

$ 20,100

Accounts receivable (net)

Inventory

Property & equipment (net)

33,700

45,400

411,800

314,000

$ 825,000

Other assets

Total assets

94,500

71,300

154,300

29,900

67,300

$ 417,300

Current liabilities

$

Long-term debt (interest rate: 15%)

Capital stock ($10 par value)

Additional paid-in capital

Retained earnings

62,500

61,800

521,000

106,900

72,800

$ 825,000

Total liabilities and stockholders' equity

Income statement:

Sales revenue (1/2 on credit)

Cost of goods sold

Operating expenses

$ 433,500

(236,500)

(162,800)

$4

$ 793,000

(400,900)

(311,900)

$4

Net income

34,200

80, 200

Other data:

Per share stock price at end of current year

Average income tax rate

Dividends declared and paid in current year

22.9

24

45%

45%

33,900

$ 152,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning