i v2.cengagenow.com * CengageNoWv2 | Online teaching and learning resource from Cengage Learning Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $251,200. The equipment was expected to have a useful life of three years, or 4,800 operating hours, and a residual value of $20,800. The equipment was used for 1,920 hours during Year 1, 1,488 hours in Year 2, and 1,392 hours in Year 3. Required: 1. Determine the amount of depreciation expense for the three years ending December 31, Year 1, Year 2, Year 3, by (a) the straight-line method, (b) the units-of- activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the three years by each method. Note: For all methods, round the answer for each year to the nearest whole dollar. Depreciation Expense Units-of-Activity Method Double-Declining-Balance Method Year Straight-Line Method Year 1 $4 Year 2 $4 Year 3 $4 Total 2. What method yields the highest depreciation expense for Year 1? 3. What method yields the most depreciation over the three-year life of the equipment? Previous Submit Test for Gradin Email Instructor All work saved.

i v2.cengagenow.com * CengageNoWv2 | Online teaching and learning resource from Cengage Learning Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $251,200. The equipment was expected to have a useful life of three years, or 4,800 operating hours, and a residual value of $20,800. The equipment was used for 1,920 hours during Year 1, 1,488 hours in Year 2, and 1,392 hours in Year 3. Required: 1. Determine the amount of depreciation expense for the three years ending December 31, Year 1, Year 2, Year 3, by (a) the straight-line method, (b) the units-of- activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the three years by each method. Note: For all methods, round the answer for each year to the nearest whole dollar. Depreciation Expense Units-of-Activity Method Double-Declining-Balance Method Year Straight-Line Method Year 1 $4 Year 2 $4 Year 3 $4 Total 2. What method yields the highest depreciation expense for Year 1? 3. What method yields the most depreciation over the three-year life of the equipment? Previous Submit Test for Gradin Email Instructor All work saved.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.4E

Related questions

Question

Please help me see if my answer is right.

Transcribed Image Text:i v2.cengagenow.com

* CengageNoWv2 | Online teaching and learning resource from Cengage Learning

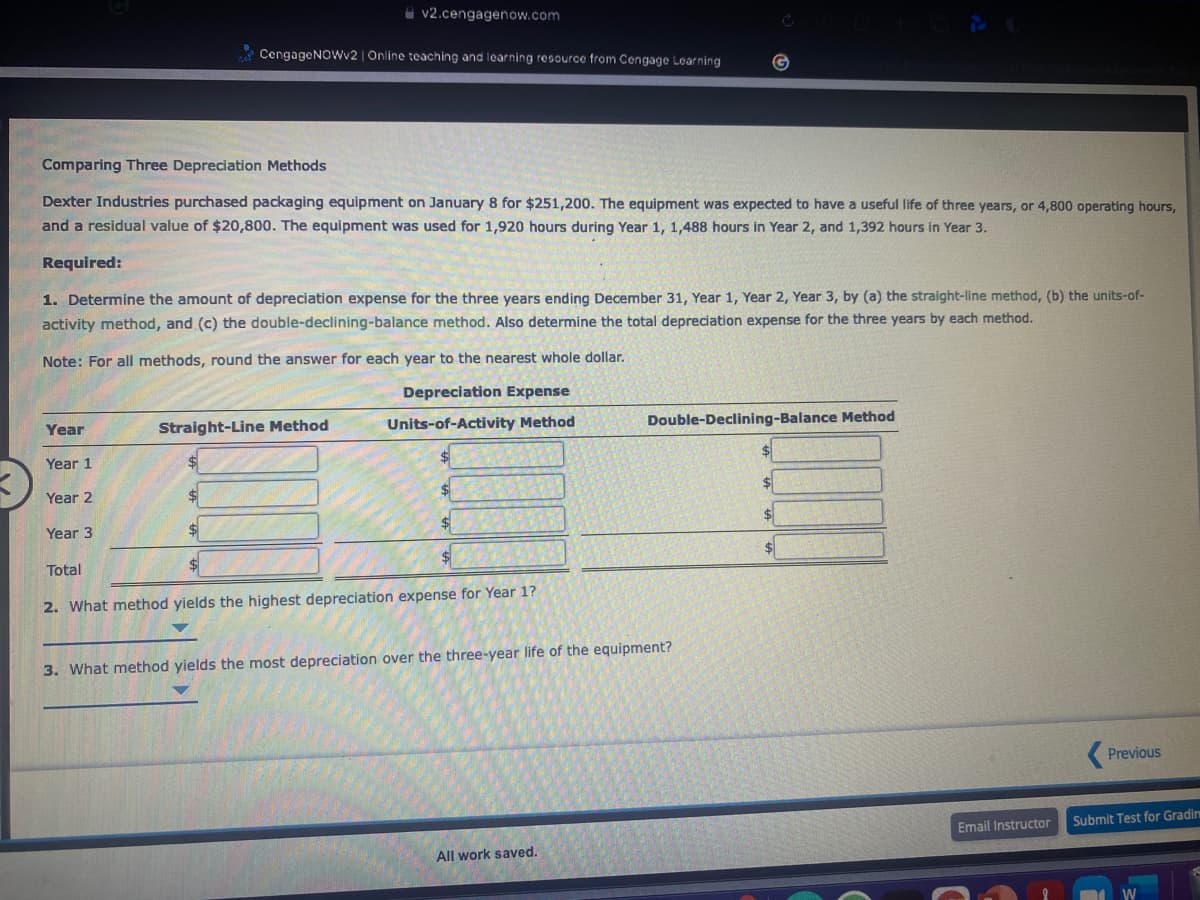

Comparing Three Depreciation Methods

Dexter Industries purchased packaging equipment on January 8 for $251,200. The equipment was expected to have a useful life of three years, or 4,800 operating hours,

and a residual value of $20,800. The equipment was used for 1,920 hours during Year 1, 1,488 hours in Year 2, and 1,392 hours in Year 3.

Required:

1. Determine the amount of depreciation expense for the three years ending December 31, Year 1, Year 2, Year 3, by (a) the straight-line method, (b) the units-of-

activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the three years by each method.

Note: For all methods, round the answer for each year to the nearest whole dollar.

Depreciation Expense

Units-of-Activity Method

Double-Declining-Balance Method

Year

Straight-Line Method

Year 1

%24

Year 2

$4

Year 3

$4

Total

2. What method yields the highest depreciation expense for Year 1?

3. What method yields the most depreciation over the three-year life of the equipment?

Previous

Submit Test for Gradin

Email Instructor

All work saved.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning