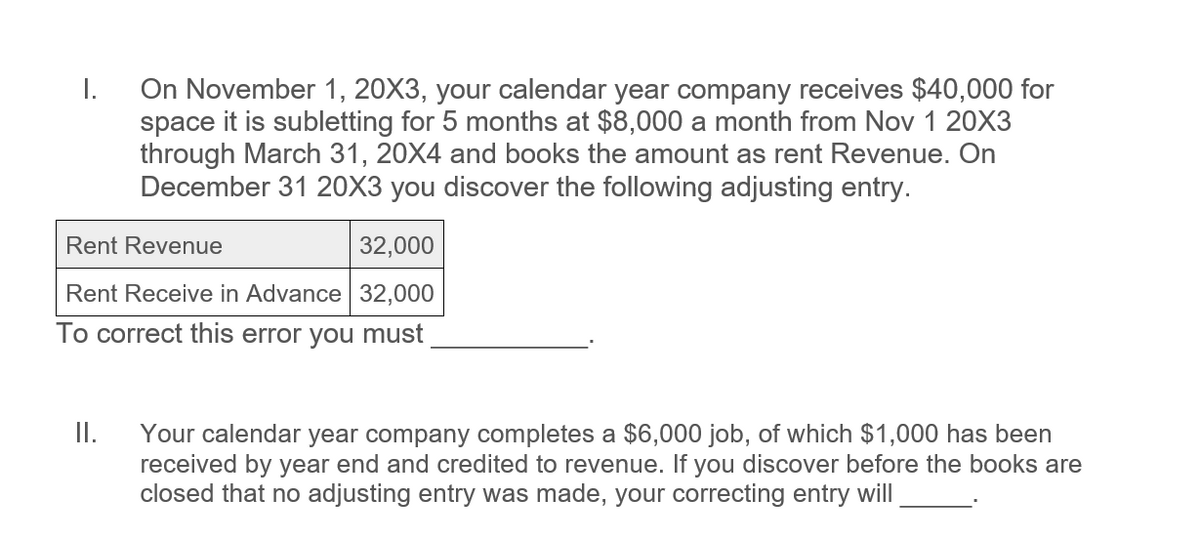

I. On November 1, 20X3, your calendar year company receives $40,000 for space it is subletting for 5 months at $8,000 a month from Nov 1 20X3 through March 31, 20X4 and books the amount as rent Revenue. On December 31 20X3 you discover the following adjusting entry. Rent Revenue 32,000 Rent Receive in Advance 32,000 To correct this error you must II. Your calendar year company completes a $6,000 job, of which $1,000 has been received by year end and credited to revenue. If you discover before the books are closed that no adjusting entry was made, your correcting entry will

I. On November 1, 20X3, your calendar year company receives $40,000 for space it is subletting for 5 months at $8,000 a month from Nov 1 20X3 through March 31, 20X4 and books the amount as rent Revenue. On December 31 20X3 you discover the following adjusting entry. Rent Revenue 32,000 Rent Receive in Advance 32,000 To correct this error you must II. Your calendar year company completes a $6,000 job, of which $1,000 has been received by year end and credited to revenue. If you discover before the books are closed that no adjusting entry was made, your correcting entry will

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter3: Review Of A Company's Accounting System

Section: Chapter Questions

Problem 5RE: Garcia Company rents out a portion of its building to Jerry Company for 1,000 per month. On August...

Related questions

Question

provide correct answer of both................

Transcribed Image Text:I.

On November 1, 20X3, your calendar year company receives $40,000 for

space it is subletting for 5 months at $8,000 a month from Nov 1 20X3

through March 31, 20X4 and books the amount as rent Revenue. On

December 31 20X3 you discover the following adjusting entry.

Rent Revenue

32,000

Rent Receive in Advance 32,000

To correct this error you must

II.

Your calendar year company completes a $6,000 job, of which $1,000 has been

received by year end and credited to revenue. If you discover before the books are

closed that no adjusting entry was made, your correcting entry will

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage