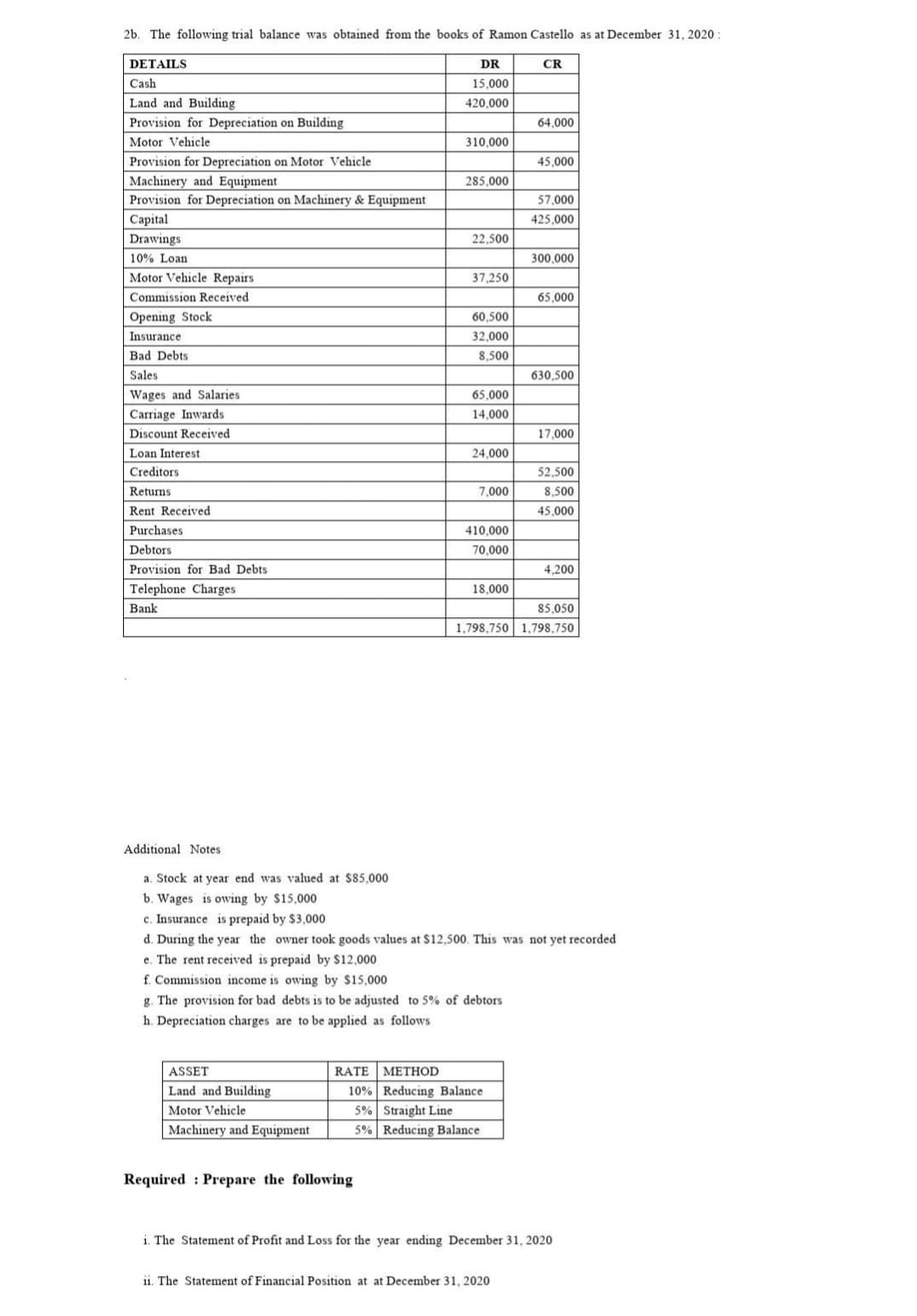

i. The Statement of Profit and Loss for the year ending December 31, 2020 ii. The Statement of Financial Position at at December 31, 2020

i. The Statement of Profit and Loss for the year ending December 31, 2020 ii. The Statement of Financial Position at at December 31, 2020

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 1PB: Consider the following situations and determine (1) which type of liability should be recognized...

Related questions

Question

Transcribed Image Text:2b. The following trial balance was obtained from the books of Ramon Castello as at December 31, 2020:

DETAILS

CR

Cash

Land and Building

Provision for Depreciation on Building

Motor Vehicle

Provision for Depreciation on Motor Vehicle

Machinery and Equipment

Provision for Depreciation on Machinery & Equipment

Capital

Drawings

10% Loan

Motor Vehicle Repairs

Commission Received.

Opening Stock

Insurance

Bad Debts

Sales

Wages and Salaries

Carriage Inwards

Discount Received

Loan Interest

Creditors

Returns

Rent Received

Purchases

Debtors

Provision for Bad Debts.

Telephone Charges

Bank

ASSET

Land and Building

Motor Vehicle

Machinery and Equipment

DR

15,000

420,000

RATE METHOD

310,000

285,000

Required Prepare the following

22,500

37,250

60,500

32,000

8,500

65,000

14,000

24,000

7,000

410,000

70,000

18,000

f. Commission income is owing by $15,000

g. The provision for bad debts is to be adjusted to 5% of debtors

h. Depreciation charges are to be applied as follows

10% Reducing Balance

5% Straight Line

5% Reducing Balance

64,000

45,000

57,000

425,000

ii. The Statement of Financial Position at at December 31, 2020

300,000

65,000

Additional Notes

a. Stock at year end was valued at $85,000

b. Wages is owing by $15,000

c. Insurance is prepaid by $3,000

d. During the year the owner took goods values at $12,500. This was not yet recorded

e. The rent received is prepaid by $12,000

630,500

17,000

85,050

1,798,750 1,798,750

52,500

8,500

45,000

4,200

i. The Statement of Profit and Loss for the year ending December 31, 2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning