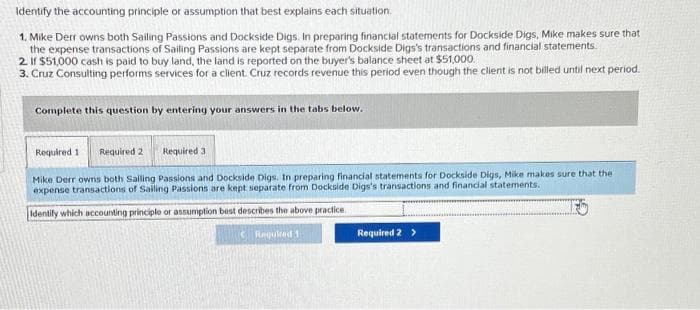

Identify the accounting principle or assumption that best explains each situation. 1. Mike Derr owns both Sailing Passions and Dockside Digs. In preparing financial statements for Dockside Digs, Mike makes sure that the expense transactions of Sailing Passions are kept separate from Dockside Digs's transactions and financial statements. 2. If $51,000 cash is paid to buy land, the land is reported on the buyer's balance sheet at $51,000. 3. Cruz Consulting performs services for a client. Cruz records revenue this period even though the client is not billed until next period. Complete this question by entering your answers in the tabs below. Required 3 Mike Derr owns both Sailing Passions and Dockside Digs. In preparing financial statements for Dockside Digs, Mike makes sure that the i expense transactions of Sailing Passions are kept separate from Dockside Digs's transactions and financial statements. Identify which accounting principle or assumption best describes the above practice Required 1 Required 1 Required 2 Required 2 >

Identify the accounting principle or assumption that best explains each situation. 1. Mike Derr owns both Sailing Passions and Dockside Digs. In preparing financial statements for Dockside Digs, Mike makes sure that the expense transactions of Sailing Passions are kept separate from Dockside Digs's transactions and financial statements. 2. If $51,000 cash is paid to buy land, the land is reported on the buyer's balance sheet at $51,000. 3. Cruz Consulting performs services for a client. Cruz records revenue this period even though the client is not billed until next period. Complete this question by entering your answers in the tabs below. Required 3 Mike Derr owns both Sailing Passions and Dockside Digs. In preparing financial statements for Dockside Digs, Mike makes sure that the i expense transactions of Sailing Passions are kept separate from Dockside Digs's transactions and financial statements. Identify which accounting principle or assumption best describes the above practice Required 1 Required 1 Required 2 Required 2 >

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 1PA: For each of the following situations write the principle, assumption, or concept that justifies or...

Related questions

Question

Hh1.

Account

Transcribed Image Text:Identify the accounting principle or assumption that best explains each situation.

1. Mike Derr owns both Sailing Passions and Dockside Digs. In preparing financial statements for Dockside Digs, Mike makes sure that

the expense transactions of Sailing Passions are kept separate from Dockside Digs's transactions and financial statements.

2. If $51,000 cash is paid to buy land, the land is reported on the buyer's balance sheet at $51,000.

3. Cruz Consulting performs services for a client. Cruz records revenue this period even though the client is not billed until next period.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Required 3

Mike Derr owns both Sailing Passions and Dockside Digs. In preparing financial statements for Dockside Digs, Mike makes sure that the

expense transactions of Sailing Passions are kept separate from Dockside Digs's transactions and financial statements.

Identify which accounting principle or assumption best describes the above practice

Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub