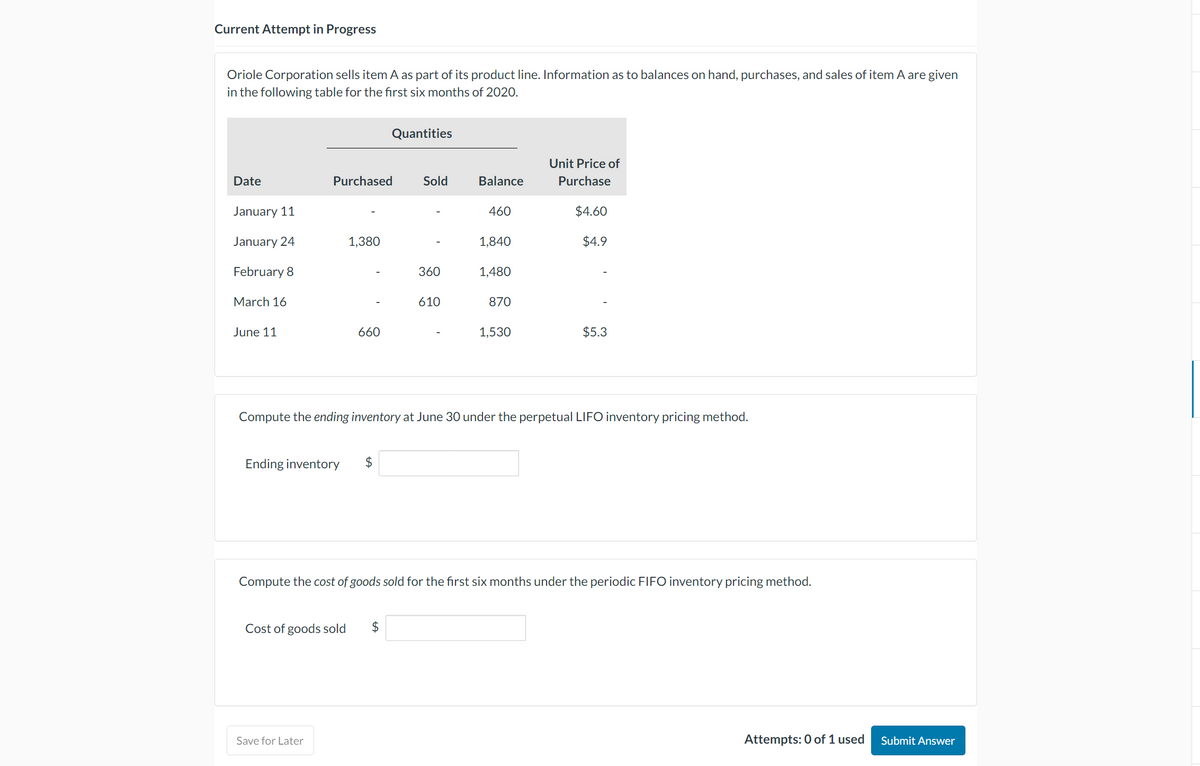

Oriole Corporation sells item A as part of its product line. Information as to balances on hand, purchases, and sales of item A are given in the following table for the first six months of 2020. Date January 11 January 24 February 8 March 16 June 11 Purchased Ending inventory 1,380 660 Cost of goods sold Quantities $ Sold $ 360 610 Balance 460 Compute the ending inventory at June 30 under the perpetual LIFO inventory pricing method. 1,840 1,480 870 1,530 Unit Price of Purchase $4.60 $4.9 $5.3 Compute the cost of goods sold for the first six months under the periodic FIFO inventory pricing method.

Oriole Corporation sells item A as part of its product line. Information as to balances on hand, purchases, and sales of item A are given in the following table for the first six months of 2020. Date January 11 January 24 February 8 March 16 June 11 Purchased Ending inventory 1,380 660 Cost of goods sold Quantities $ Sold $ 360 610 Balance 460 Compute the ending inventory at June 30 under the perpetual LIFO inventory pricing method. 1,840 1,480 870 1,530 Unit Price of Purchase $4.60 $4.9 $5.3 Compute the cost of goods sold for the first six months under the periodic FIFO inventory pricing method.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 39BE

Related questions

Topic Video

Question

Transcribed Image Text:Current Attempt in Progress

Oriole Corporation sells item A as part of its product line. Information as to balances on hand, purchases, and sales of item A are given

in the following table for the first six months of 2020.

Date

January 11

January 24

February 8

March 16

June 11

Purchased

1,380

660

Ending inventory $

Save for Later

Quantities

Cost of goods sold $

Sold

360

610

Balance

460

1,840

1,480

870

1,530

Unit Price of

Purchase

$4.60

Compute the ending inventory at June 30 under the perpetual LIFO inventory pricing method.

$4.9

$5.3

Compute the cost of goods sold for the first six months under the periodic FIFO inventory pricing method.

Attempts: 0 of 1 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning