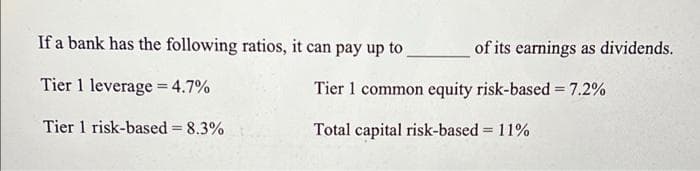

If a bank has the following ratios, it can pay up to of its earnings as dividends. Tier 1 leverage = 4.7% Tier 1 common equity risk-based 7.2% %3D Tier 1 risk-based 8.3% Total capital risk-based 11% %3! %3D

Q: On January 1, 2025, Ariana Corporation issued its 8%, 5-year convertible debt instrument with a face...

A: The correct answer is for the above question is given in the following steps for your reference.

Q: Jade, Kale, And Lilo are in the process of liquidating their partnership. The balance sheet and the ...

A: Liquidation of Partnership For liquidating the partnership it settle the all expenses and dues which...

Q: When costing loss is Rs. 5,600, administrative overhead under-absorbed being Rs. 600, the loss as pe...

A: It is pertinent to note that under or over absorption of fixed overheads leads to differences in pro...

Q: A serious exposure for an organization that is connnected with the revenue cycle is the loss of asse...

A: In this question we asked about a serious exposure for an organization that is connnected with the r...

Q: On 1 January 2021, Tymba plc has a building with a carrying value of £500,000 which was purchased on...

A: As per IAS 16, Property, Plant and Equipment Amount that can be transferred from revaluation surplu...

Q: Allen Air Lines must liquidate some equipment that is being replaced. The equipment originally cost ...

A: The after-tax salvage value of the asset is calculated by deducting the tax rate on the difference i...

Q: Accrued salaries of P 20,000 was overlooked at the end of 2021. What would be the adjusting entry if...

A: Accrued salaries are salaries which are due for payment but not yet paid. If company has missed to r...

Q: Aggrava Limited is currently preparing budgets for September to December. Its estimated sales figure...

A: Inventory budget is the estimation of inventory to be required in the business in a particular perio...

Q: A company that usually sells satellite TV equipment for $50 and two years of satellite TV service fo...

A: Revenue refers to the total amount of money received through the sale of items or services related t...

Q: Fred is considering three job offers in advertising. A full-time position as a coordinator that pay...

A: The after tax income of an individual is calculated by deducting the paid taxes from the income for ...

Q: What is the effect of omission of prepaid expense in retained earnings at the end of year 2? Group ...

A: Prepaid expenses are those expenses which are related with future period of time but paid in advance...

Q: An investment Sheila is considering is a new work truck. Her old Chevy is expected to last another t...

A: Answer:- Followings are the pros of switching trucks:- 1. New truck provide more production and ef...

Q: Business that are exempt from output VAT but entitle to input VAT are A. Vat Exempt Persons B. Vat...

A: Value Added Tax is a novel form of levying tax on goods and services. It is paid to the credit of go...

Q: Depreciation of equipment during 2021 was overstated by P 16,000. What would be the adjusting entry ...

A: An adjusting journal entry is a journal entry made in a company's general ledger at the end of an ac...

Q: Which of the following is not a characteristic of non-counterbalancing error? a. If not detected, t...

A: The errors which are not automatically corrected in the following accounting period is known as Non-...

Q: Find Total Capital: Tier 1 capital = 350 Subordinated unsecured debt, 15-year remaining maturity = 9...

A: Bank needs to maintain various ratios and tier 2 capital is the 2nd layer of capital which needs to ...

Q: The articles of incorporation were received, authorizing Reverse Corporation to issue 100,000 shares...

A: Ordinary shares refer to the equity share capital of the company. If the company issues its ordinary...

Q: Discuss the importance of reflective approach to learning in the accounting & finance discipline, de...

A: Performance Evaluation: Performance evaluation is characterized as a formal and useful system to qua...

Q: 3. Net income for 2021 Select ) 4. Retained Earnings as of December 31, 2019 ( Select] Retained Farp...

A: Net income is transferred to retained earning account every year. Hence last year income adjustment ...

Q: 2. Two employees have earned taxable pay of $ 2,700 and $ 2,400 Both are within limits and 3.4% Henc...

A: SUTA TAX is referred to as the State unemployment tax, payable by the employer on behalf of the empl...

Q: What are some pros and cons of the CERES CSR reporting framework i.e. the measure tools, reporting s...

A: CERES CSR defines the corporate social responsibility of companies and their resultant action toward...

Q: The cheque which is issued to creditor but is not presented for payment is called? Omitted cheque Un...

A: Sometimes a cheque is issued to a creditor but the creditor takes some time to present it to the ban...

Q: please help! 31. Buddle paper company produces specality papers. During August, the company produced...

A: Solution.. Actual output = 50,000 units Standard hours per unit = 12 minutes = 12/60 hours = 0....

Q: On dissolution of a firm, the Balance Sheet revealed that total creditors' 50,000, Total Capital 48,...

A: Solution.. Capital = ₹48,000 Creditors = ₹50,000 Cash = ₹3,000 Loss on realisation = ?

Q: The payment of supplier's account is debited to accounts receivable. What is the effect of the error...

A: Ans. The error while passing journal entries leads to overstated or understate of profits.

Q: I woud like to know what is the formula for accumulated deficit and cash and cash equivalents (the p...

A: In this question we write formula for accumulated deficit and cash and cash equivalents.

Q: PROBLEM 1: The following events and transactions relate to the shareholder's equity accounts of the ...

A: Legal capital refers to the total number of shares of all categories issued by the company at par va...

Q: Current Attempt in Progress Cullumber Corporation reports the following January 1, 2020 balances for...

A: preparation of pension worksheet are as follows

Q: Peaceful Enterprises financial statements for the year ended December 31, 2021 are authorized for is...

A: Adjusting events are those events that occurs after reporting date ( i.e. balance sheet date ) but u...

Q: Which of the following is not a characteristic of non-counterbalancing error? Group of answer choic...

A: Non counter balancing errors are those errors which will not be automatically corrected in the next ...

Q: The following data taken from the books of the taxpayer are for th Revenues P2,000,000 Hotel rooms D...

A: In this question, we have to find output vat for the quarter, Creditable VAT for the quarter, and VA...

Q: Upon inspection of the records of Eisenhower Company in connection to its financial statement audit ...

A: To find a correct income need to add back the expense that does not belong to a year 2021 and less i...

Q: 1. Prepare a table that shows how the cost of supervision behaves in total and on per-unit basis as ...

A: Fixed costs are those costs which will not change with change in activity level. These costs will be...

Q: The data shown were obtained from the financial records of Italian Exports, Inc., for March: Estima...

A: The budgeted income statement contains all of the line items found in a typical income statement, wi...

Q: Three partners A,B and C shared the profit in a software business in the ratio 5:7:8. They had partn...

A: Solution Partnership is a formal arrangement by two or more parties to manage and operate a business...

Q: REQUIRED: Prepare the required entry to record the issuance of the ordinary shares under each of the...

A: Journal entries refers to the official book of a company which is used to record the day to day tran...

Q: Non-recognition of deferral at the end of the accounting period will Group of answer choices unders...

A: Ans. In case of non-recognition of deferral the income or expenses which is deferred but not recogni...

Q: A Bank granted a loan to a borrower in the amount of P5,000,000 on January 1, 2021, The interest rat...

A: Solution Carrying amount is the cost of an asset less accumulated depreciation.

Q: n order to make CDs look more attractive as an investment than they really are, some banks advertis...

A: calculation of compound interest yield rate are as follows.

Q: Pro a land as held for sale. On December 31, 2021, the fair value less cost of disposal of the land ...

A: Impairment loss can be calculated as :- Recoverable amount - carrying amount Recoverable amou...

Q: Overhead Variances, Two- And Three-Variance Analyses Oerstman, Inc., uses a standard costing system ...

A: given The budget is based on an expected annual output of 123,000 units requiring 492,000 direct lab...

Q: Calculating the Direct Labor Mix Variance Mangia Pizza Company makes frozen pizzas that are sold thr...

A: Mix varaince = [Actual Mix - Standard Mix] x Standard Price If actual mix is less than standard mi...

Q: Mahon Corporation has two production departments, Casting and Customizing. The company uses a job-or...

A: Applied overhead is recorded as a kind of direct overhead charge in the cost-accounting technique. T...

Q: Beginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inv...

A: Inventory valuation is based on the flow of exemption used by the company. There are many methods fo...

Q: True or False A NY LLC owned solely by a NY nonresident individual is sold during the tax year. ...

A: The following are subject to tax on NY source income: Non-resident individual Estate Trust Part-yea...

Q: Non-recording of purchases during the current and the non-inclusion of the goods purchased in ending...

A: Solution Concept Purchase is the recorded in the debit side of the income statement Purchase is the ...

Q: Miriam deposite an amount of php89632.37 from abc bank on the 7th birthday of her daughter that pays...

A: Interest is the amount which has been earned by the company or the depositor on the money which has ...

Q: Activity 1. Prepare an CFI/SCF Instruction: Show you solution in a sheet of paper with a complete re...

A: 1. Statement of Cash Flow - Statement of Cash flow is the statement that shows the actual cash posit...

Q: The invoice date for a bill is April 14 with the terms 2/15 ROG. If the goods were received on June ...

A: The Receipt-of-goods (ROG) is the method of payment, wherein the date of commencement is the day on ...

Q: In which of the following methods, issues of materials are priced at pre-determined rate? None of th...

A: Solution Standard price is the predetermined price and both the receipts and issues will be valued a...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- A company had WACC (weighted average cost of capital) equal to 8. % If the company pays off mortgage bonds with an interest rate of 4% and issues an equal amount of new stock considered to be relatively risky by the market, which of the following is true? a. residual income will increase. b. ROI will decrease. c. WACC will increase. d. WACC will decrease.The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure. Q1. ________is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. Q2. Avery Co. has $3.9 million of debt, $2 million of preferred stock, and $2.2 million of common equity. What would be its weight on debt? a. 0.27 b. 0.25 c. 0.48 d. 0.20 Q1. Option 1 rS or Option 2 rD or Option 3 rP or Option 4 rE Please provide the correct answers. Thank you!a)Assume that the following data is extracted from the financial statements of Richy-Rich bank: equity is $350 million, interest expense is $115 million, provision for loan loss (P) is $35 million, noninterest income is $30 million, noninterest expense is $50 million and a tax rate is 33%. What is the minimum total interest income required to give a return on equity (ROE) of 20%? Show workings when necessary. b) Be-smart Bank reported an equity multipler ratio of 6.5 at the end of year 2021. If the bank’s total debt at the end of year 2021 was $5 million, how much of its assets were financed with equity? Show calculations when necessary. c) What are the main sources of funding for commercial banks? Using bullet points, classify these sources and briefly describe each category.

- Suppose that the Tier 1 equity ratio for a bank is 6%. What is the maximum dividend, as a percent of earnings, that can be paid if (a) there is no countercyclical buffer and (b) there is a 2.5% countercyclical buffer?For a particular firm, the purchasers of common stock require an 11% rate of return, bonds are sold at a 7% interest rate, and bank loans are available at 9%. Compute the cost of capital or WACC for the following capital structureA bank has risk-weighted assets or $425 million and the following sources of regulatory capital (in $ millions): Allowance for Loan Losses $3.02 Common Stock (Par) $0.85 Intermediate-Term Preferred Stock $4.87 Perpetual Preferred Stock $3.43 Subordinated Debt $3.24 Surplus $7.83 Undivided Profit $20.04 What is the bank's ratio of Tier 2 capital to risk-weighted assets? _______ . Calculate the answer by read surrounding text. Express in %, to the nearest 0.01%; drop the % symbol.

- The following data pertains to Xena Corp. Xena Corp. Total Assets $21,249 Interest-Bearing Debt (market value) $11,070 Average borrowing rate for debt 10.2% Common Equity: Book Value $5,535 Market Value $23,247 Marginal Income Tax Rate 19% Market Beta 1.64 A. Using the information from the table, and assuming that the risk-free rate is 4.5% and the market risk premium is 6.2%, calculate Xena's weighted-average cost of capital: B. Using the information from the table, determine the weight on equity capital that should be used to calculate Xena's weighted-average cost of capital.The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure. is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. Raymond Co. has $1.4 million of debt, $3 million of preferred stock, and $1.2 million of common equity. What would be its weight on debt? 0.59 0.25 0.49 0.21Alpha Corporation has average annual free cashflows to the equity holder and to the firmof P3,000,000 and P3,350,000 respectively. Assuming that the weighted average cost ofcapital and actual return of on assets is 16.75% while the market return on Alpha's debt is7%, what is the value of its equity? a. P34,358,974.36 b.P15,000,000.00 c.P17,910,447.76 d.P20,000,000.00

- The following were gathered for estimating the cost of equity of KKK Corporation: Return on Treasury Bonds = 4%; Return on the Market = 10%; Return on KKK Bonds = 6%. Upon analysis, you determined that the beta of KKK shares relating to the market return is 1.2 while a risk premium of 4% should be given to KKK's investors over its creditors. How much is the cost of equity using the capital asset pricing model?What does tangible common equity reflect? Suppose that a bank has common stock of par value $200m with retained earnings of $3m and intangible assets of $4m. What will be tangible common equity ratio if total assets are $1000m? Do it correctly with explanationAnalyze and compare the following firms financial ratio results. Which seems to be in a better financial position? Why? Ratio Firm A Firm B Debt-To-Equity 0.65 2.23 Current Ratio 1.74 0.83 Net Profit Margin 8.07% 9.59% Return On Equity 12.81% 47.17% -