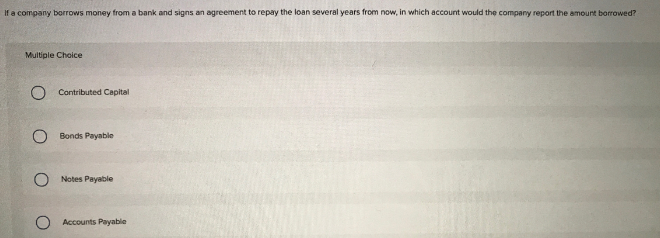

If a company borrows money from a bank and signs an agreement to repay the loan several years from now, in which account would the company report the amount borrowed? Multiple Choice O Contributed Capital Bonds Payable Notes Payable Accounts Payable

If a company borrows money from a bank and signs an agreement to repay the loan several years from now, in which account would the company report the amount borrowed? Multiple Choice O Contributed Capital Bonds Payable Notes Payable Accounts Payable

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 4MC: A ski company takes out a $400,000 loan from a bank. The bank requires eight equal repayments of the...

Related questions

Question

Transcribed Image Text:If a company borrows money from a bank and signs an agreement to repay the loan several years from now, in which account would the company report the amount borrowed?

Multiple Choice

O Contributed Capital

Bonds Payable

Notes Payable

Accounts Payable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning