If a company invests in production improvement option D that will boost labor productivity by 50%, while its annual depreciation costs will rise by an amount equal to 10% of the investment costs associated with installing option D, it is accurate to say that its labor costs per pair produced will decline a. the greatest in whichever company production facility currently has the lowest total employee compensation per year. b. by the same dollar amount in all of the company's production facilities that implement option D because the gains in labor productivity are 50% irrespective of what other differences in labor-related conditions may exist. c. from $5.00 per pair to $3.33 for a production facility in the Asia-Pacific that currently has labor productivity of 3,600 pairs per worker and total regular compensation (which does not include overtime pay) of $18,000 annually. d. from $4.61 per pair to $3.50 for a production facility in the Asia-Pacific that currently has labor productivity of 3,800 pairs per worker and total regular compensation (which does not include overtime pay) of $17,500 annually.

If a company invests in production improvement option D that will boost labor productivity by 50%, while its annual depreciation costs will rise by an amount equal to 10% of the investment costs associated with installing option D, it is accurate to say that its labor costs per pair produced will decline a. the greatest in whichever company production facility currently has the lowest total employee compensation per year. b. by the same dollar amount in all of the company's production facilities that implement option D because the gains in labor productivity are 50% irrespective of what other differences in labor-related conditions may exist. c. from $5.00 per pair to $3.33 for a production facility in the Asia-Pacific that currently has labor productivity of 3,600 pairs per worker and total regular compensation (which does not include overtime pay) of $18,000 annually. d. from $4.61 per pair to $3.50 for a production facility in the Asia-Pacific that currently has labor productivity of 3,800 pairs per worker and total regular compensation (which does not include overtime pay) of $17,500 annually.

Chapter16: Financial Planning And Control

Section: Chapter Questions

Problem 20PROB

Related questions

Question

Pls explain the correct as well as in incorrect option why they are incorrect.

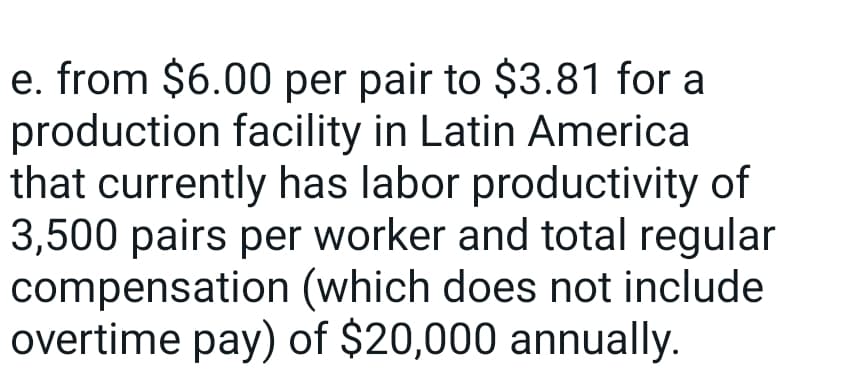

Transcribed Image Text:e. from $6.00 per pair to $3.81 for a

production facility in Latin America

that currently has labor productivity of

3,500 pairs per worker and total regular

compensation (which does not include

overtime pay) of $20,000 annually.

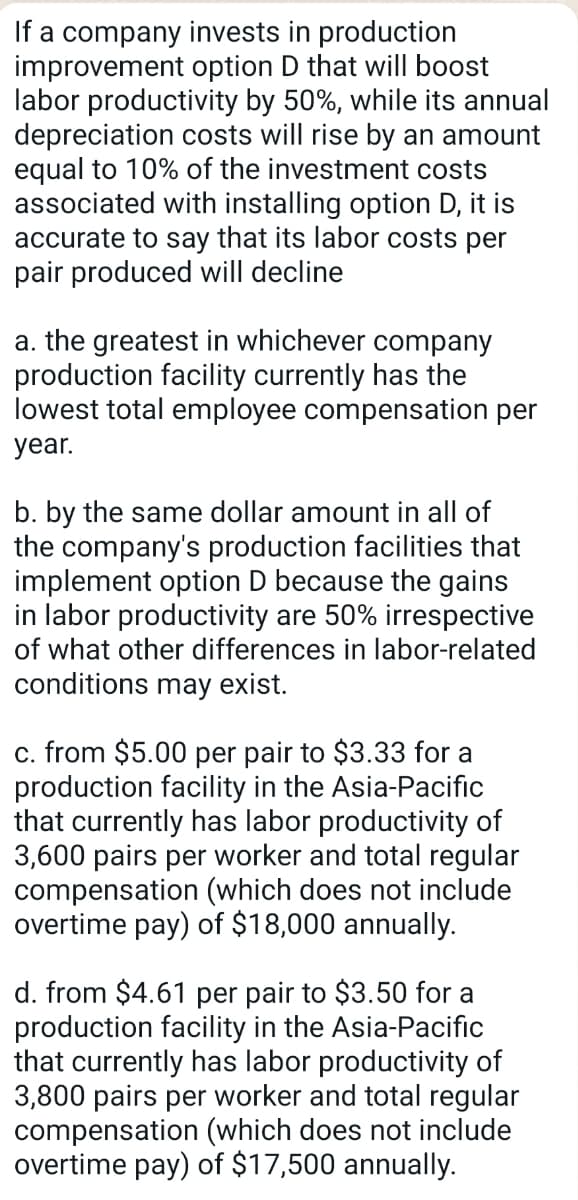

Transcribed Image Text:If a company invests in production

improvement option D that will boost

labor productivity by 50%, while its annual

depreciation costs will rise by an amount

equal to 10% of the investment costs

associated with installing option D, it is

accurate to say that its labor costs per

pair produced will decline

a. the greatest in whichever company

production facility currently has the

lowest total employee compensation per

year.

b. by the same dollar amount in all of

the company's production facilities that

implement option D because the gains

in labor productivity are 50% irrespective

of what other differences in labor-related

conditions may exist.

c. from $5.00 per pair to $3.33 for a

production facility in the Asia-Pacific

that currently has labor productivity of

3,600 pairs per worker and total regular

compensation (which does not include

overtime pay) of $18,000 annually.

d. from $4.61 per pair to $3.50 for a

production facility in the Asia-Pacific

that currently has labor productivity of

3,800 pairs per worker and total regular

compensation (which does not include

overtime pay) of $17,500 annually.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning