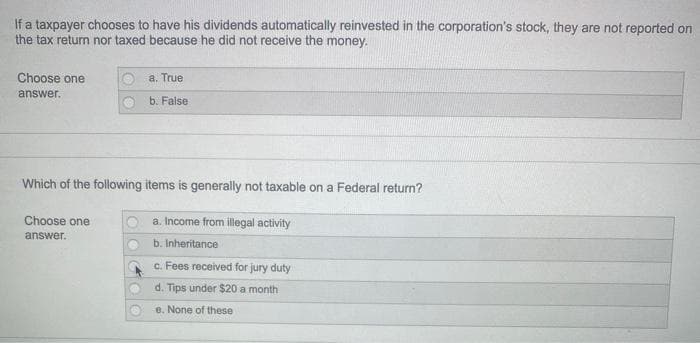

If a taxpayer chooses to have his dividends automatically reinvested in the corporation's stock, they are not reported on the tax return nor taxed because he did not receive the money. Choose one a. True answer. b. False Which of the following items is generally not taxable on a Federal return? Choose one a. Income from illegal activity answer. b. Inheritance c. Fees received for jury duty d. Tips under $20 a month e. None of these

If a taxpayer chooses to have his dividends automatically reinvested in the corporation's stock, they are not reported on the tax return nor taxed because he did not receive the money. Choose one a. True answer. b. False Which of the following items is generally not taxable on a Federal return? Choose one a. Income from illegal activity answer. b. Inheritance c. Fees received for jury duty d. Tips under $20 a month e. None of these

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 23P

Related questions

Question

Transcribed Image Text:If a taxpayer chooses to have his dividends automatically reinvested in the corporation's stock, they are not reported on

the tax return nor taxed because he did not receive the money.

Choose one

a. True

answer.

b. False

Which of the following items is generally not taxable on a Federal return?

Choose one

a. Income from illegal activity

answer.

b. Inheritance

c. Fees received for jury duty

d. Tips under $20 a month

e. None of these

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT