Which of the following statements, if any, is false? O An individual can get lower Federal tax rates on long-term capital gains as compared to short-term capital gains. O A corporation can get lower Federal tax rates on long-term capital gains as compared to short-term capital gains. DAn individual has a taxable capital gain if they sell their personal car at a gain O Normally a taxpayer must own a capital asset for more than one year in order to get long-term capital gain (or loss) treatment on the sale of that asset. None of the above - they are all true statements.

Which of the following statements, if any, is false? O An individual can get lower Federal tax rates on long-term capital gains as compared to short-term capital gains. O A corporation can get lower Federal tax rates on long-term capital gains as compared to short-term capital gains. DAn individual has a taxable capital gain if they sell their personal car at a gain O Normally a taxpayer must own a capital asset for more than one year in order to get long-term capital gain (or loss) treatment on the sale of that asset. None of the above - they are all true statements.

Chapter3: Tax Formula And Tax Determination; An Overview Of property Transactions

Section: Chapter Questions

Problem 19DQ

Related questions

Question

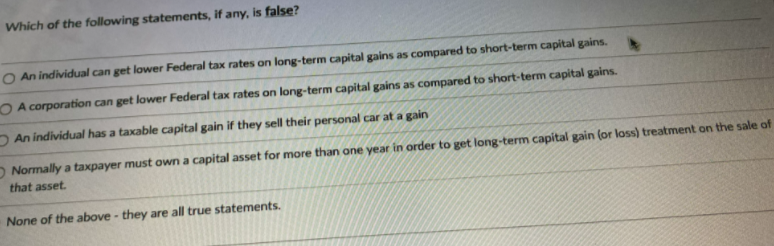

Transcribed Image Text:Which of the following statements, if any, is false?

O An individual can get lower Federal tax rates on long-term capital gains as compared to short-term capital gains.

O A corporation can get lower Federal tax rates on long-term capital gains as compared to short-term capital gains.

DAn individual has a taxable capital gain if they sell their personal car at a gain

O Normally a taxpayer must own a capital asset for more than one year in order to get long-term capital gain (or loss) treatment on the sale of

that asset.

None of the above - they are all true statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT