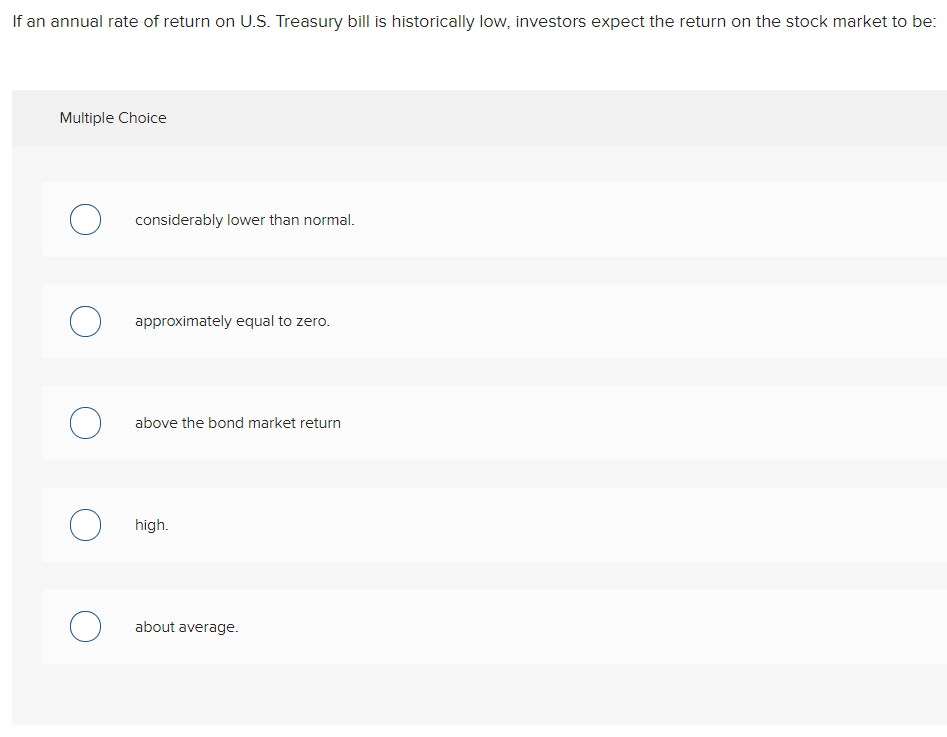

If an annual rate of return on U.S. Treasury bill is historically low, investors expect the return on the stock market to be: Multiple Choice considerably lower than normal. approximately equal to zero. above the bond market return high. about average.

Q: What is the approximate and exact nominal rate of return on the common stock of Mountain Unequipped…

A: The approximate rate of return is the unadjusted rate of return that an investment provides to its…

Q: Use the following table: Series Large stocks Small stocks Average return 11.88 % 16.58 6.29…

A: Return on Portfolio = (W1 x Average Return on S1)+ (W2 x Average Return S2)

Q: culate the required rate of return for Campbell Corp. common stock. The stock has a beta of 1.3, and…

A: The minimum profit (return) that an investor must seek or obtain in exchange for taking on the risk…

Q: Under the Pure Expectations Theory, if these investors believe that interest rates will rise in the…

A: According to pure expectation theory, current long-term interest rates will be the basis for future…

Q: returns by buying or selling stocks after the announcement of an abnormal rise in earnings. Managers…

A: The true option id D

Q: Under the liquidity preference theory, if inflation is expected to be falling over the next few…

A: As per liquidity preference theory, interest rates are said to be higher than short term rate when…

Q: Consider the following:…

A: Expected Return of Stock = State of Economy Probability of state of economy Returns Recession…

Q: Use the following table: Series Average return Large stocks 11.76 % Small stocks 16.46…

A: The return of portfolio can be calculated as expected return of the portfolio. The expected return…

Q: Which of the following statements is the least accurate? a. Security returns are composed of…

A: The required rate of return is the minimum rate of return on investment. formula: Required rate of…

Q: RATE OF RETURN Stocks &Bonds Scenario Probability Stocks Bonds Recession 0.20…

A: Bonds are debt instruments which carry fixed interest rates to be paid.But stock do not carry any…

Q: Suppose the real risk-free rate is 3.00%, the average expected future inflation rate is 6.60%, and a…

A: Pure Expectations Theory refers to the theory which says that the future short term interest rates…

Q: Over the past 4 years, large-company stocks and U.S. Treasury bills have produced the returns stated…

A: real rate of return=1+nominal rate of return1+inflation-1.....(1)

Q: Suppose the real risk-free rate is 4.20%, the average expected future inflation rate is 4.20%, and a…

A: Required Rate of Return: It is the rate which should be the minimum earning on an investment to keep…

Q: Which of the following hypothetical phenomena would be either consistent with or a violation of the…

A: EMH states that prices reflect all available information.

Q: The rate of return on the U.S. government treasury bill is 0.03 and the expected rate of return on…

A: In this question we need to compute the required rate of return for a stock. Required rate of return…

Q: Assume these were the inflation rates and U.S. stock market and Treasury bill returns between 1929…

A: NOTE: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: (Inflation and Interest Rates) What would you expect the nominal rate of interest to be if the real…

A: Hey, since there are multiple questions posted, we will answer the first question. If you want any…

Q: Suppose that due to high inflation, interest rates rise and pull the preferred stock's yield to…

A: Preferred stocks are issued to investors who receive a fix regular income on their investment.…

Q: Assume these are the stock market and Treasury bill returns for a 5-year period: ITT Stock Market…

A: Risk premium is the extra return that the investor expects to get for bearing the risk on a stock.

Q: a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in…

A: a. Yes. The expected return of treasury bonds during recession is 3.20%. The expected return of…

Q: The level of the Syldavian market index is 21,300 at the start of the year and 25,800 at the end.…

A: Part (a)As a first step let's assign a symbol to all the information we have in the question.I0 =…

Q: Assume that over the last several decades, the annual returns on large-company common stocks…

A: Excess return earned by long-term government bonds = (long-term government bonds -U.S. T-bills)…

Q: You've observed the following returns on Yamauchi Corporation's stock over the past five years:…

A:

Q: The following information is provided: average annual rate of return for common stocks is 8.0%, •…

A: Market risk premium depicts the excess of the return generated by investing in equities over the…

Q: The attached file contains hypothetical data for working this problem. Goodman Corporation’s and…

A: Here, Risk-Free Rate is 8.04% Market Risk Premium is 6% In order to calculate the required return of…

Q: Consider the following scenario analysis: Rate of Return Scenario Probability Stocks Bonds Recession…

A: Expected Return is average return that an investor will earn over time. Standard Deviation measures…

Q: The broad stock market's P/E ratio (the inverse of its earnings yield) tends to rise as treasury…

A: With increase in yield on the treasury will increase the earning expectation of the market and…

Q: 2) Historically, stocks have delivered a ________ return on average compared to Treasury bills but…

A: Stocks can be the shares of the private or government corporations traded in the secondary market.…

Q: Refer the table below on the average excess return of the U.S. equity market and the standard…

A: The question is based on the concept of portfolio theory and management. The portfolio is a…

Q: Assume these are the stock market and Treasury bill returns for a 5-year period: Stock Market T-Bill…

A: Given:

Q: eturn of Sandhill Cyclicals common shares is 1.2 times as sensitive to macroeconomic information as…

A: Given information :

Q: Suppose that the Treasury bill rate is 7% rather than 5%, as we assumed in Table 12.1, and the…

A: b. Formulas:

Q: You’ve observed the following returns on Crash-n-Burn Computer’s stock over the past five years: 14…

A: Inflation rate=3.5%T-bill rate=4.2%

Q: Corps has a beta of 1.4. If the rate on U.S. Treasury bills is 4.5% and the expected rate of return…

A: In the above question we need to compute the cost of common equity from the below given details :…

Q: For the cost of equity (stock) is it better to use the current US Treasury bill rate or a…

A: For determining the cost of equity we often use the CAPM model. The CAPM model states that: Cost of…

Q: Consider the following scenario analysis: Rate of Return Scenario Recession Normal economy…

A: To Find:- Expected Return Standard Deviation

Q: Suppose that the Treasury bill rate is 9% rather than 6%, as we assumed in Table 12.1, and the…

A: Note: Since both the parts are asking the same thing that is the expected return of the stock at a…

Q: The returns on small company stocks are 10.7%, U.S. Treasury bill offer a 1.5% return and a bank…

A: Market risk premium describes the relationship between returns from an equity market portfolio and…

Q: Suppose that the Treasury bill rate is 6% rather than 3%, as we assumed in Table 12.1, and the…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: Consider the following data State of Nature Prob. Stock A Return Boom 0.3 16.00% Normal 0.6 14.20%…

A: The expected return refers to the return expected by the investor on an investment. The expected…

Q: Assume the return on large-company stocks is currently 11.5 percent. The risk premium on…

A: Return means get something form the investment. Return is directly (positively) relates with the…

Q: is FALSE? The plot of the relationship between the investment risk and the interest rate is called…

A: YEILD curve refers to bonds and this is CURVE which graph of yeild on bonds and with maturity of…

Q: What was the average real risk-free rate over this time period? (Do not round intermediate…

A: Given information: Average inflation rate = 3.25% Average risk free rate = 4.30% Return on stock for…

Q: Consider the following scenario analysis: Rate of Return Scenario Probability Stocks Bonds…

A: Yes. It is reasonable to assume that Treasury bonds will provide higher returns in recessions than…

F1

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Assume that inflation is expected to steadily increase in the years ahead, but that the real risk-free rate r*, is expected to remain constant. Which of the following statements is most correct? None of the answers are correct. The treasury yield curve must be upward sloping. If the expectations theory holds, the treasury yield curve must be downward sloping. If the expectations theory holds, the yield curve for corporate securities must be downward sloping.For the cost of equity (stock) is it better to use the current US Treasury bill rate or a longer-termgovernment bond rate as the risk-free rate of return?Does the rate you use as the risk-free rate have an impact on what market premium might beappropriate? Historically, large-company stocks have earned an average return of 12.1% per annum, while US Treasury bills and long-term government bonds have earned average returns of 3.5% and5.9% respectively.Suppose that Federal Reserve actions have caused an increase in the risk-free rate, rRF. Meanwhile, investors are afraid of a recession, so the market risk premium, (rM - rRF), has increased. Under these conditions, with other things held constant, which of the following statements is most correct and why? A. The required return on all stocks would increase, but the increase would be greatest for stocks with betas of less than 1.0. B. The prices of all stocks would decline, but the decline would be greatest for the highest-beta stocks. C. The prices of all stocks would increase, but the increase would be greatest for the highest-beta stocks. D. The required return on all stocks would increase by the same amount.

- Suppose that Federal Reserve actions have caused an increase in the risk-free rate, rRF. Meanwhile, investors are afraid of a recession, so the market risk premium, (rM − rRF), has increased. Under these conditions, with other things held constant, which of the following statements is most correct? a. The required return on all stocks would increase, but the increase would be greatest for stocks with betas of less than 1.0. b. Stocks' required returns would change, but so would expected returns, and the result would be no change in stocks' prices. c. The prices of all stocks would decline, but the decline would be greatest for high-beta stocks. d. The prices of all stocks would increase, but the increase would be greatest for high-beta stocks. e. The required return on all stocks would increase by the same amount.Assume the following: The real risk-free rate, r*, is expected to remain constant at 3%. Inflation is expected to be 3% next year and then to be constant at 2% a year thereafter. The maturity risk premium is zero. Given this information, which of the following statements is CORRECT? a. A 5-year corporate bond must have a lower yield than a 7-year Treasury security. b. The yield curve for U.S. Treasury securities will be upward sloping. c. A 5-year corporate bond must have a lower yield than a 5-year Treasury security. d. The real risk-free rate cannot be constant if inflation is not expected to remain constant. e. This problem assumed a zero maturity risk premium, but that is probably not valid in the real world.The real risk-free rate is 2.70%, inflation is expected to be 3.45% this year, and the maturity risk premium is zero. Ignoring any cross-product terms, i.e., if averaging is required, use the arithmetic average, what is the equilibrium rate of return on a 1-year Treasury bond? Please explain process and show calculations

- Which of the following statements is true? If investors believe inflation will be subsiding in the future, the prevailing yield curve will have a positive slope. The longer the maturity of a security, the greater its interest rate risk. The interest rate risk premium always adds a downward bias to the slope of the yield curve. The real rate of interest varies with the business cycle, with the lowest rates at the end of a period of business expansion and the highest at the bottom of a recession.Use the data in the tables below to answer the following questions: Average rates of return on Treasury bills, government bonds, and common stocks, 1900–2020. Portfolio Average Annual Rate of Return (%) Average Premium (Extra return versus Treasury bills) (%) Treasury bills 3.7 Treasury bonds 5.4 1.7 Common stocks 11.5 7.8 Standard deviation of returns, 1900–2020. Portfolio Standard Deviation (%) Treasury bills 2.8 Long-term government bonds 8.9 Common stocks 19.5 What was the average rate of return on large U.S. common stocks from 1900 to 2020? What was the average risk premium on large stocks? What was the standard deviation of returns on common stocks? Note: Enter your answer as a percent rounded to 1 decimal place.Assume the average return on utility stocks was 8.9% over the past 40 years. �If the average return on Treasury bills was 3.8% over that period, what is the historical risk premium for utility stocks?

- The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. Based on the pure expectations theory, is the following statement true or false? The pure expectations theory assumes that investors do not consider long-term bonds to be riskier than short-term bonds. True False The yield on a one-year Treasury security is 4.6900%, and the two-year Treasury security has a 6.3315% yield. Assuming that the pure expectations theory is correct, what is the market’s estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 10.1585% 7.9988% 6.799% 9.1186% Recall that on a one-year Treasury security the yield is 4.6900% and 6.3315% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and it is 0.5%. What is…2) Historically, stocks have delivered a ________ return on average compared to Treasury bills but have experienced ________ fluctuations in values. A) higher, higherB) higher, lowerC) lower, higherD) lower, lowerUnder the liquidity preference theory, if inflation is expected to be falling over the next few years, long-term interest rates will be higher than short-term rates. True/false/uncertain? Why?