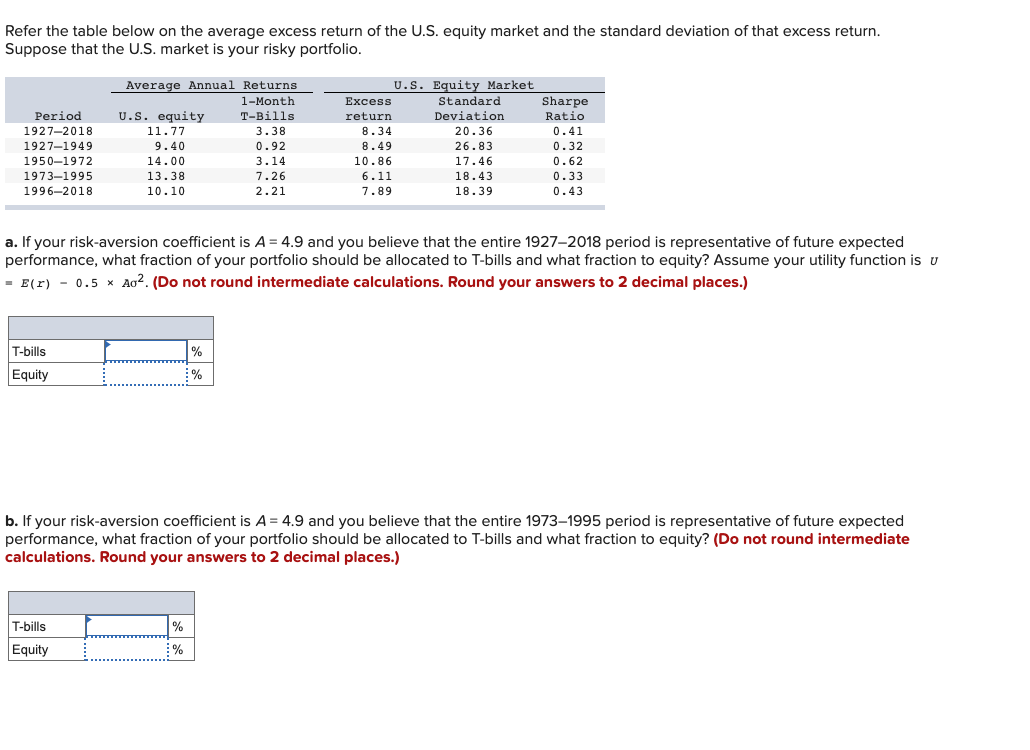

Refer the table below on the average excess return of the U.S. equity market and the standard deviation of that excess return. Suppose that the U.S. market is your risky portfolio. Average Annual Returns 1-Month U.S. Equity Market Standard Sharpe Ratio 0.41 Еxcess Period 1927-2018 1927-1949 U.S. equity 11.77 T-Bills 3.38 Deviation 20.36 26.83 return 8.34 0.41 9.40 14.00 13.38 10.10 0.92 8.49 0.32 1950-1972 3.14 10.86 17.46 0.62 7.26 18.43 18.39 1973–1995 6.11 0.33 1996–2018 2.21 7.89 0.43 a. If your risk-aversion coefficient is A = 4.9 and you believe that the entire 1927–2018 period is representative of future expected performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? Assume your utility function is u - E(r) - 0.5 x Ao². (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills % Equity b. If your risk-aversion coefficient is A = 4.9 and you believe that the entire 1973–1995 period is representative of future expected performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills % Equity %

Refer the table below on the average excess return of the U.S. equity market and the standard deviation of that excess return. Suppose that the U.S. market is your risky portfolio. Average Annual Returns 1-Month U.S. Equity Market Standard Sharpe Ratio 0.41 Еxcess Period 1927-2018 1927-1949 U.S. equity 11.77 T-Bills 3.38 Deviation 20.36 26.83 return 8.34 0.41 9.40 14.00 13.38 10.10 0.92 8.49 0.32 1950-1972 3.14 10.86 17.46 0.62 7.26 18.43 18.39 1973–1995 6.11 0.33 1996–2018 2.21 7.89 0.43 a. If your risk-aversion coefficient is A = 4.9 and you believe that the entire 1927–2018 period is representative of future expected performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? Assume your utility function is u - E(r) - 0.5 x Ao². (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills % Equity b. If your risk-aversion coefficient is A = 4.9 and you believe that the entire 1973–1995 period is representative of future expected performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills % Equity %

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 15P

Related questions

Question

4

Transcribed Image Text:Refer the table below on the average excess return of the U.S. equity market and the standard deviation of that excess return.

Suppose that the U.S. market is your risky portfolio.

U.S. Equity Market

Standard

Average Annual Returns

1-Month

Excess

Sharpe

Period

U.S. equity

T-Bills

return

Deviation

Ratio

1927-2018

11.77

3.38

8.34

20.36

0.41

9.40

14.00

13.38

1927-1949

0.92

8.49

26.83

0.32

1950-1972

3.14

10.86

17.46

0.62

1973–1995

1996-2018

0.33

0.43

7.26

6.11

18.43

10.10

2.21

7.89

18.39

a. If your risk-aversion coefficient is A = 4.9 and you believe that the entire 1927–2018 period is representative of future expected

performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? Assume your utility function is u

- E(r) - 0.5 x Ao2. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

T-bills

%

Equity

%

b. If your risk-aversion coefficient is A = 4.9 and you believe that the entire 1973–1995 period is representative of future expected

performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? (Do not round intermediate

calculations. Round your answers to 2 decimal places.)

T-bills

%

Equity

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning