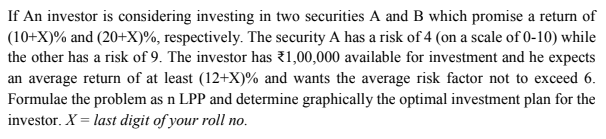

If An investor is considering investing in two securities A and B which promise a return of (10+X)% and (20+X)%, respectively. The security A has a risk of 4 (on a scale of 0-10) while the other has a risk of 9. The investor has 71,00,000 available for investment and he expects an average return of at least (12+X)% and wants the average risk factor not to exceed 6. Formulae the problem as n LPP and determine graphically the optimal investment plan for the investor. X = last digit of your roll no.

Q: Donald Harris received a windfall and needs to invest it for tax reasons. He went to his…

A: Given data, Future Air Traffic Strategies Major Downturn Downturn Upturn Major Upturn…

Q: You have made it to the final round of “Let’s Make aDeal.” You know there is $1 million behind…

A: The theory of probability helps an organization in analyzing and assessing the uncertainty providing…

Q: The Megabus operates between New York City and Philadelphia and is a popular mode of transportation…

A: # of Passengers Who Show Up Probability 28 0.05 29 0.25 30 0.5 31 0.15 32 0.05

Q: You are attempting to establish the utility that your boss assigns to a payoff of $1,000. You have…

A: Below is the solution:-

Q: A 5-year annuity of ten $5,300 semiannual payments will begin 9 years from now, with the first…

A: The timeline is: The cash flows in this problem are semiannual, so we need the effective semiannual…

Q: Which of the following gambles has the largest objective risk? 20% chance of winning $100 and 80%…

A: 20% chance of winning $100 and 80% chance of losing $100 In this Option, We have an 80 %…

Q: A NY Times best-selling author wants to write a new book as either volume II of her earlier…

A: Note: - As we can answer only up to three subparts we will answer the first three subparts here.…

Q: Consider a project with the following cash flows: year 1, 2$400; year 2, $200; year 3, $600; year 4,…

A: Year Cash Flows ($) Discounted factor Present Value 1 400 0.870 348 2 200 0.756 151.2 3 600…

Q: A nuclear power company is deciding whether or not tobuild a nuclear power plant at Diablo Canyon or…

A: Let E denote the event that an earthquake will occur in the next five years. Let G denote the event…

Q: A bakery must decide how many pies to prepare for the upcoming weekend. The bakery has the option to…

A: Given Information; Cost Price of a pie = $ 5 Selling Price of a pie = $ 7 Demand Probability…

Q: Considering a used car market seller 10,000 2000 buyer 12,000 1000 A Good Car A lemon 1. Under…

A: The above question gives an explanation idea about the expectations of the prices between buyers and…

Q: Your firm is considering purchasing an old office building with an estimated remaining service life…

A:

Q: You are given a payoff table: Positive market Negative market Probabililty 0.40 0.60 Alternatives Go…

A: NO GO is the best alternative as lo as long as the probability of option as it have higher expected…

Q: Comerstone Solutions, LLC. is deciding between developing an advanced thought-activated software, or…

A: Given data is Price of new thought activated software = $15.5 million Probability of successful…

Q: Oilco must determine whether or not to drill for oil in the South China Sea. It costs $100,000, and…

A: The rise in anticipated value owing to obtaining additional knowledge about an unknown quantity is…

Q: A retailer must decide whether to build a small or a large facility at a new location. Demand at the…

A: The decision tree and expected payoff based on given information is as follows:

Q: A manager is deciding whether to build a small or a large facility. Much depends on the future…

A: As mentioned in the table, based on the demand, the payoffs can be different for small or large…

Q: The management of a company is interested in using simulation to estimate the profit per unit for a…

A: From the given data we found that Selling price = $45/unit Purchase cost ($) Labour cost…

Q: A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the…

A: The farmer decided to take a protective action to limit damage of his grapefruit crop . There are…

Q: Private Insurance provides coverages that can be used to meet specific loss situations. For each of…

A: A. The type of insurance coverage will be "Payment Protection Insurance". This type of insurance…

Q: Suppose my utility function for asset position x is givenby u(x) ln x.a Am I risk-averse,…

A: a. Utility function u(x) = ln(x) Now, we will find the value of u''(x). u'(x) = 1/x u''(x) = -1/x^2…

Q: A large steel manufacturing company has three options with regard to production: Produce…

A: A Small Introduction about manufacturing company Manufacturing is the large-scale manufacturing of…

Q: The management of Brinkley Corporation is interested in using simulation to estimate the profit per…

A: Hello thank you for the question. As per guidelines, we would provide only one answer at a time.…

Q: Two opposing armies, Red and Blue, must each decide whether to attack or defend. These decisions are…

A: Given, gains of one = loss of another this means probability of attack by one = probability of…

Q: A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the…

A: The farmer must decide whether to take protective action to limit damage to his grapefruit crop…

Q: Johnson Chemicals is considering two options for itssupplier portfolio. Option I uses two local…

A: The term "probability" simply means "the chance of something happening." When we're unsure about the…

Q: er to market a new А compan product. Assume, for simplicity, that if this product is marketed, there…

A: Think about the advertising of another item. Let the likelihood of progress or disappointment is p…

Q: Assuming homogenous and independent exposures, the effects of risk pooling arrangements can be…

A: Risk pooling is an arrangement where all risk is shared amongest a group of insurance companies…

Q: You are attempting to establish the utility that your boss assigns to a payoff of $1,200. You have…

A: To find out? The utility function of $1200

Q: You are attempting to establish the utility that your boss assigns to a payoff of $1,500. You have…

A: As per the question Given Information is: Utility of $0 = 0 Utility of $ 10,000 = 1 Here it is given…

Q: A company is considering whether to market a new product. Assume, for simplicity, that if this…

A:

Q: In the following game, Player 1 makes a low bid or high bid, and Player 2 reacts in an easygoing or…

A: Easy Tough Low 5,1 -10,-10 High 3,3 -1,1

Q: Michelle owns a house in which she keeps valuables worth 100,000 which can get stolen with…

A: Given information, Michelle worth = 10, 000 Probability = 1% Puchasing Coverage = C ( 0; 100,000)…

Q: The expected value of perfect information is the A. Same as the expected profit under certainty…

A: Perfect information is the knowledge that a future state of nature will occur with certainty.

Q: Construct a decision tree to help the farmer make his decision. What should he do? Explain your…

A: A decision tree is the analysis of the options that are to be considered or chosen among to take the…

Q: A firm that plans to expand its product line must decide whether to build a small or a large…

A:

Q: 10. An investor must decide between two alternative investments-stocks and bonds. The return for…

A: A payoff table refers to a table that can be used to represent and analyze a scenario that has a…

Q: What is false about service level and stock out? Service level and stock out risk are probabilities…

A: It is true that the service level and stock out risk are probabilities of mutually exclusive events…

Q: Stocks A and B have the following probability distributions ofexpected future returns:Probability…

A: 1. A B C Probability Return A Probability * Return 1 0.1 -10% -1.00% 2 0.2 2% 0.40%…

Q: You are attempting to establish the utility that your boss assigns to a payoff of $2,000. You have…

A: Small Introduction about Payoff Your payback amount is the amount you'll have to pay in order to…

Q: The ultimate objective of a business is to maximize wealth of shareholders. Along with that it also…

A: THE ANSWER IS AS FOLLOWS:

Q: You have been äsked to estimate the probability of default of a manufacturing company, which has…

A: Corporate bonds provide a larger return than other fixed-income investments, but at the cost of…

Q: The Dallas Mavericks trail by two points and have theball with 10 seconds remaining. They must…

A:

Q: (a) I can choose 'a', 'b' or 'c'. If I choose 'b' then I get $200. If I choose 'c' then one of three…

A: THE ANSWER IS AS BELOW:

Q: You own Amazon stock. Suppose that Amazon has an expected return of 52% and a volatility of 19%. The…

A: SD(RxCML) = xSD(RMkt).23 = x(.16) → x = .23/.16 = 1.4375, so long 144% market and short 44%…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- You now have 10,000, all of which is invested in a sports team. Each year there is a 60% chance that the value of the team will increase by 60% and a 40% chance that the value of the team will decrease by 60%. Estimate the mean and median value of your investment after 50 years. Explain the large difference between the estimated mean and median.Based on Kelly (1956). You currently have 100. Each week you can invest any amount of money you currently have in a risky investment. With probability 0.4, the amount you invest is tripled (e.g., if you invest 100, you increase your asset position by 300), and, with probability 0.6, the amount you invest is lost. Consider the following investment strategies: Each week, invest 10% of your money. Each week, invest 30% of your money. Each week, invest 50% of your money. Use @RISK to simulate 100 weeks of each strategy 1000 times. Which strategy appears to be best in terms of the maximum growth rate? (In general, if you can multiply your investment by M with probability p and lose your investment with probability q = 1 p, you should invest a fraction [p(M 1) q]/(M 1) of your money each week. This strategy maximizes the expected growth rate of your fortune and is known as the Kelly criterion.) (Hint: If an initial wealth of I dollars grows to F dollars in 100 weeks, the weekly growth rate, labeled r, satisfies F = (I + r)100, so that r = (F/I)1/100 1.)W. L. Brown, a direct marketer of womens clothing, must determine how many telephone operators to schedule during each part of the day. W. L. Brown estimates that the number of phone calls received each hour of a typical eight-hour shift can be described by the probability distribution in the file P10_33.xlsx. Each operator can handle 15 calls per hour and costs the company 20 per hour. Each phone call that is not handled is assumed to cost the company 6 in lost profit. Considering the options of employing 6, 8, 10, 12, 14, or 16 operators, use simulation to determine the number of operators that minimizes the expected hourly cost (labor costs plus lost profits).

- In August of the current year, a car dealer is trying to determine how many cars of the next model year to order. Each car ordered in August costs 20,000. The demand for the dealers next year models has the probability distribution shown in the file P10_12.xlsx. Each car sells for 25,000. If demand for next years cars exceeds the number of cars ordered in August, the dealer must reorder at a cost of 22,000 per car. Excess cars can be disposed of at 17,000 per car. Use simulation to determine how many cars to order in August. For your optimal order quantity, find a 95% confidence interval for the expected profit.A European put option allows an investor to sell a share of stock at the exercise price on the exercise data. For example, if the exercise price is 48, and the stock price is 45 on the exercise date, the investor can sell the stock for 48 and then immediately buy it back (that is, cover his position) for 45, making 3 profit. But if the stock price on the exercise date is greater than the exercise price, the option is worthless at that date. So for a put, the investor is hoping that the price of the stock decreases. Using the same parameters as in Example 11.7, find a fair price for a European put option. (Note: As discussed in the text, an actual put option is usually for 100 shares.)Suppose you currently have a portfolio of three stocks, A, B, and C. You own 500 shares of A, 300 of B, and 1000 of C. The current share prices are 42.76, 81.33, and, 58.22, respectively. You plan to hold this portfolio for at least a year. During the coming year, economists have predicted that the national economy will be awful, stable, or great with probabilities 0.2, 0.5, and 0.3. Given the state of the economy, the returns (one-year percentage changes) of the three stocks are independent and normally distributed. However, the means and standard deviations of these returns depend on the state of the economy, as indicated in the file P11_23.xlsx. a. Use @RISK to simulate the value of the portfolio and the portfolio return in the next year. How likely is it that you will have a negative return? How likely is it that you will have a return of at least 25%? b. Suppose you had a crystal ball where you could predict the state of the economy with certainty. The stock returns would still be uncertain, but you would know whether your means and standard deviations come from row 6, 7, or 8 of the P11_23.xlsx file. If you learn, with certainty, that the economy is going to be great in the next year, run the appropriate simulation to answer the same questions as in part a. Repeat this if you learn that the economy is going to be awful. How do these results compare with those in part a?

- In Example 11.1, the possible profits vary from negative to positive for each of the 10 possible bids examined. a. For each of these, use @RISKs RISKTARGET function to find the probability that Millers profit is positive. Do you believe these results should have any bearing on Millers choice of bid? b. Use @RISKs RISKPERCENTILE function to find the 10th percentile for each of these bids. Can you explain why the percentiles have the values you obtain?A common decision is whether a company should buy equipment and produce a product in house or outsource production to another company. If sales volume is high enough, then by producing in house, the savings on unit costs will cover the fixed cost of the equipment. Suppose a company must make such a decision for a four-year time horizon, given the following data. Use simulation to estimate the probability that producing in house is better than outsourcing. If the company outsources production, it will have to purchase the product from the manufacturer for 25 per unit. This unit cost will remain constant for the next four years. The company will sell the product for 42 per unit. This price will remain constant for the next four years. If the company produces the product in house, it must buy a 500,000 machine that is depreciated on a straight-line basis over four years, and its cost of production will be 9 per unit. This unit cost will remain constant for the next four years. The demand in year 1 has a worst case of 10,000 units, a most likely case of 14,000 units, and a best case of 16,000 units. The average annual growth in demand for years 2-4 has a worst case of 7%, a most likely case of 15%, and a best case of 20%. Whatever this annual growth is, it will be the same in each of the years. The tax rate is 35%. Cash flows are discounted at 8% per year.Amanda has 30 years to save for her retirement. At the beginning of each year, she puts 5000 into her retirement account. At any point in time, all of Amandas retirement funds are tied up in the stock market. Suppose the annual return on stocks follows a normal distribution with mean 12% and standard deviation 25%. What is the probability that at the end of 30 years, Amanda will have reached her goal of having 1,000,000 for retirement? Assume that if Amanda reaches her goal before 30 years, she will stop investing. (Hint: Each year you should keep track of Amandas beginning cash positionfor year 1, this is 5000and Amandas ending cash position. Of course, Amandas ending cash position for a given year is a function of her beginning cash position and the return on stocks for that year. To estimate the probability that Amanda meets her goal, use an IF statement that returns 1 if she meets her goal and 0 otherwise.)

- If you own a stock, buying a put option on the stock will greatly reduce your risk. This is the idea behind portfolio insurance. To illustrate, consider a stock that currently sells for 56 and has an annual volatility of 30%. Assume the risk-free rate is 8%, and you estimate that the stocks annual growth rate is 12%. a. Suppose you own 100 shares of this stock. Use simulation to estimate the probability distribution of the percentage return earned on this stock during a one-year period. b. Now suppose you also buy a put option (for 238) on the stock. The option has an exercise price of 50 and an exercise date one year from now. Use simulation to estimate the probability distribution of the percentage return on your portfolio over a one-year period. Can you see why this strategy is called a portfolio insurance strategy? c. Use simulation to show that the put option should, indeed, sell for about 238.Based on Babich (1992). Suppose that each week each of 300 families buys a gallon of orange juice from company A, B, or C. Let pA denote the probability that a gallon produced by company A is of unsatisfactory quality, and define pB and pC similarly for companies B and C. If the last gallon of juice purchased by a family is satisfactory, the next week they will purchase a gallon of juice from the same company. If the last gallon of juice purchased by a family is not satisfactory, the family will purchase a gallon from a competitor. Consider a week in which A families have purchased juice A, B families have purchased juice B, and C families have purchased juice C. Assume that families that switch brands during a period are allocated to the remaining brands in a manner that is proportional to the current market shares of the other brands. For example, if a customer switches from brand A, there is probability B/(B + C) that he will switch to brand B and probability C/(B + C) that he will switch to brand C. Suppose that the market is currently divided equally: 10,000 families for each of the three brands. a. After a year, what will the market share for each firm be? Assume pA = 0.10, pB = 0.15, and pC = 0.20. (Hint: You will need to use the RISKBINOMLAL function to see how many people switch from A and then use the RISKBENOMIAL function again to see how many switch from A to B and from A to C. However, if your model requires more RISKBINOMIAL functions than the number allowed in the academic version of @RISK, remember that you can instead use the BENOM.INV (or the old CRITBENOM) function to generate binomially distributed random numbers. This takes the form =BINOM.INV (ntrials, psuccess, RAND()).) b. Suppose a 1% increase in market share is worth 10,000 per week to company A. Company A believes that for a cost of 1 million per year it can cut the percentage of unsatisfactory juice cartons in half. Is this worthwhile? (Use the same values of pA, pB, and pC as in part a.)In the financial world, there are many types of complex instruments called derivatives that derive their value from the value of an underlying asset. Consider the following simple derivative. A stocks current price is 80 per share. You purchase a derivative whose value to you becomes known a month from now. Specifically, let P be the price of the stock in a month. If P is between 75 and 85, the derivative is worth nothing to you. If P is less than 75, the derivative results in a loss of 100(75-P) dollars to you. (The factor of 100 is because many derivatives involve 100 shares.) If P is greater than 85, the derivative results in a gain of 100(P-85) dollars to you. Assume that the distribution of the change in the stock price from now to a month from now is normally distributed with mean 1 and standard deviation 8. Let EMV be the expected gain/loss from this derivative. It is a weighted average of all the possible losses and gains, weighted by their likelihoods. (Of course, any loss should be expressed as a negative number. For example, a loss of 1500 should be expressed as -1500.) Unfortunately, this is a difficult probability calculation, but EMV can be estimated by an @RISK simulation. Perform this simulation with at least 1000 iterations. What is your best estimate of EMV?