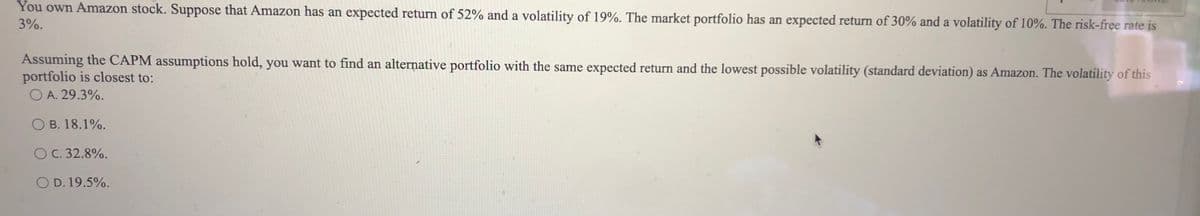

You own Amazon stock. Suppose that Amazon has an expected return of 52% and a volatility of 19%. The market portfolio has an expected return of 30% and a volatility of 10%. The risk-free rate is 3%. Assuming the CAPM assumptions hold, you want to find an alternative portfolio with the same expected return and the lowest possible volatility (standard deviation) as Amazon. The volatility of this portfolio is closest to: O A. 29.3%. O B. 18.1%. OC. 32.8%. O D. 19.5%.

Q: SureStep is currently getting 160 regular-time hours from each worker per month. This is actually…

A: Productivity and complete output standards are met in an organization where the workers work with…

Q: A buyer for a large sporting goods store chain must place orders for professional footballs with the…

A: a) Let us consider the following given above data Here we first construct the payoff table. We know…

Q: Salalah Methanol company management is considering three competing investment Projects Option1:…

A: a) Payback period Declaration presentation cumulative cash flow Sohar

Q: Well-known financial writer Andrew Tobias argues that he can earn 177 percent per year buying wine…

A: The cost of a case of wine is 10 percent less than the cost of 12 individual bottles, so the cost of…

Q: W. L. Brown, a direct marketer of women’s clothing,must determine how many telephone operators…

A: The aforementioned question is answered as below:

Q: 3. ND: Referring to the Z-Table, calculate the probability that each alternative will turn out at…

A: Find the Given details below: Given details: Alternatives States of Nature Recession…

Q: Determine the optimal action based on the maximax criterion ii. Determine the optimal action based…

A: The investor who has certain amount of money to be invested, has assigned probability based on his…

Q: A computer reseller needs to decide how many laptops to order next month. The lowest end laptop…

A: From the above mentioned information the demand probabilities for, P (0) = 0.3, P (1) = 0.4, P(2)…

Q: Q3. What are the objective coefficient ranges for the four stocks? Show the relevant portion of the…

A:

Q: My current income is $40,000. I believe that I owe$8,000 in taxes. For $500, I can hire a CPA to…

A:

Q: ltaneously choose the action Left or Right. The payoff matrix/table that follows shows the payoff…

A: In game hypothesis, vital predominance happens when one procedure is superior to another methodology…

Q: Investments: Financial Stocks During the first quarter of 2015, Toronto Dominion Bank (TD) stock…

A: From the given description, the objective is to minimize the total risk index. The risk index is…

Q: A computer reseller needs to decide how many laptops to order next month. The lowest end laptop…

A: Hi There, thanks for posting the question. But as per Q&A authoring guidelines, we must answer…

Q: The Schoch Museum (see Problem 30 in Chapter 11) is embarking on a five-year fundraising campaign.…

A: Donation refers to the instance of act concerning which a contribution, grant or gift is being…

Q: You own a coffee shop in a metro Toronto shopping mall. It is Friday evening and you are trying to…

A: We have to find the value of payoff for quality baked(Q)+demand(D) by using below formula

Q: A company operates under hard budget constraints and has a WACC of 12%. In the current year it can…

A: Below is the solution:-

Q: You are also given the following table of average returns over the last 50 years: Stocks T-Bonds…

A: (a) Utilizing the historical methodology, the estimate to calculate risk premium for Steel Products…

Q: A forest consists of two types of trees: those that are 0–5 ft and those that are taller than 5 ft.…

A: Step 1: As each year 40% of all 0-5ft trees die and other 10% are sold. That means the probability…

Q: Compute the expected opportunity loss (EOL) for each investment v. Explain the meaning of the…

A: Expected Monitory value indicating a decision making tool where the future remains as uncertain.…

Q: Two companies are producing widgets. It costs the first company q12 dollars to produce q1 widgets…

A: Given: First company Second company q12 dollars 0.5q22 dollars

Q: I own a single share of Wivco stock. I must sell myshare at the beginning of one of the next 30…

A:

Q: A person wants to invest in one of three alternative investment plans: stocks, bonds or a savings…

A: Following is the given information:

Q: A local finance company quotes a 16 percent interest rate on one-year loans. So, if you borrow…

A: The timeline is: To find the APR and EAR, we need to use the actual cash flows of the loan. In…

Q: Appliances Unlimited (AU) sells refrigerators. Anyrefrigerator that fails before it is three years…

A: Warranty refers to a facility that is provided to consumers in case of any malfunctioning product…

Q: The alternatives shown are to be compared on the basis of their present worth values. At an interest…

A: Given- Particular Alternative B Alternative B First Year -10000 -25000 M/O Cost/year…

Q: You have $50,000 to invest in three stocks. Let Ri be the random variable representing the annual…

A: The question can be solved using Excel solver. Objective: To find a minimum variance (minimum risk)…

Q: A trust officer at the Blacksburg National Bank needs to determine how to invest $100,000 in the…

A: Given data: Bond Annual Return Maturity Risk Tax-Free A 9.5% Long High Yes…

Q: Let Xi be the price (in dollars) of stock i one year fromnow. X1 is N(15, 100) and X2 is N(20,…

A: Let Xi be the price of stock i year from now. For all i = 1,2 As per the given information, X1 and…

Q: Pete is considering placing a bet on the NCAA playoffgame between Indiana and Purdue. Without any…

A: The calculation for EVSI is:

Q: Suppose that Pizza King and Noble Greek stopadvertising but must determine the price they will…

A: Let us first find all the possible actions available to Pizza King in this case: 1) Pizza King sell…

Q: The Smiths save £32,000 per year for retirement. They are now in their mid-thirties, and they expect…

A:

Q: You are thinking of starting Peaco, which will produce Peakbabies, a product that competes with Ty’s…

A:

Q: The Acme Company is developing a product, the fixed costs are estimated to be $6000. and the unit…

A:

Q: In the time interval between t and t 1 seconds beforethe departure of Braneast Airlines Flight 313,…

A: The capacity of Flight is 100 passengers Duration is (t tp t-1) seconds the reservation probability…

Q: The manager of a bakery knows that the number of chocolate cakes he can sell on any given day is a…

A:

Q: ayue Is The company is evaluating three different expansion plans: Minor, moderate, or major. They…

A:

Q: Assume that $1,285,673 is to be invested in a project whose annual projected cash flows are as…

A: The net present value shows the capital appreciation from a project. This means that the net present…

Q: If An investor is considering investing in two securities A and B which promise a return of (10+X)%…

A: SOLUTION:

Q: An investor has a certain amount of money available to invest now. Three alternative investments are…

A: Hello thank you for the question. As per guidelines, we would provide only first three sub-parts at…

Q: Suppose an investor has the opportunity to buy the followingcontract, a stock call option, on March…

A: The following decision tree shows the problem in the most illustrative manner. The optimal…

Q: A salesperson for Fuller Brush has three options: quit,put forth a low-effort level, or put forth a…

A:

Q: We are going to invest $1,000 for a period of 6 months.Two potential investments are available:…

A:

Q: Nippon Steel's expenses for heating and cooling a large manufacturing facility are expected to…

A: Computation of Present Worth Year Cash Flow ($) PV Factor @11% Discounted Cash Flows ($) (A)…

Q: The daily demand for a product in a shop can assume one of the following values: 100, 120, or 130…

A: The optimal stock assigns the specific measure of stock a business needs to satisfy routine interest…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Amanda has 30 years to save for her retirement. At the beginning of each year, she puts 5000 into her retirement account. At any point in time, all of Amandas retirement funds are tied up in the stock market. Suppose the annual return on stocks follows a normal distribution with mean 12% and standard deviation 25%. What is the probability that at the end of 30 years, Amanda will have reached her goal of having 1,000,000 for retirement? Assume that if Amanda reaches her goal before 30 years, she will stop investing. (Hint: Each year you should keep track of Amandas beginning cash positionfor year 1, this is 5000and Amandas ending cash position. Of course, Amandas ending cash position for a given year is a function of her beginning cash position and the return on stocks for that year. To estimate the probability that Amanda meets her goal, use an IF statement that returns 1 if she meets her goal and 0 otherwise.)Suppose you currently have a portfolio of three stocks, A, B, and C. You own 500 shares of A, 300 of B, and 1000 of C. The current share prices are 42.76, 81.33, and, 58.22, respectively. You plan to hold this portfolio for at least a year. During the coming year, economists have predicted that the national economy will be awful, stable, or great with probabilities 0.2, 0.5, and 0.3. Given the state of the economy, the returns (one-year percentage changes) of the three stocks are independent and normally distributed. However, the means and standard deviations of these returns depend on the state of the economy, as indicated in the file P11_23.xlsx. a. Use @RISK to simulate the value of the portfolio and the portfolio return in the next year. How likely is it that you will have a negative return? How likely is it that you will have a return of at least 25%? b. Suppose you had a crystal ball where you could predict the state of the economy with certainty. The stock returns would still be uncertain, but you would know whether your means and standard deviations come from row 6, 7, or 8 of the P11_23.xlsx file. If you learn, with certainty, that the economy is going to be great in the next year, run the appropriate simulation to answer the same questions as in part a. Repeat this if you learn that the economy is going to be awful. How do these results compare with those in part a?Suppose you begin year 1 with 5000. At the beginning of each year, you put half of your money under a mattress and invest the other half in Whitewater stock. During each year, there is a 40% chance that the Whitewater stock will double, and there is a 60% chance that you will lose half of your investment. To illustrate, if the stock doubles during the first year, you will have 3750 under the mattress and 3750 invested in Whitewater during year 2. You want to estimate your annual return over a 30-year period. If you end with F dollars, your annual return is (F/5000)1/30 1. For example, if you end with 100,000, your annual return is 201/30 1 = 0.105, or 10.5%. Run 1000 replications of an appropriate simulation. Based on the results, you can be 95% certain that your annual return will be between which two values?

- In August of the current year, a car dealer is trying to determine how many cars of the next model year to order. Each car ordered in August costs 20,000. The demand for the dealers next year models has the probability distribution shown in the file P10_12.xlsx. Each car sells for 25,000. If demand for next years cars exceeds the number of cars ordered in August, the dealer must reorder at a cost of 22,000 per car. Excess cars can be disposed of at 17,000 per car. Use simulation to determine how many cars to order in August. For your optimal order quantity, find a 95% confidence interval for the expected profit.Based on Kelly (1956). You currently have 100. Each week you can invest any amount of money you currently have in a risky investment. With probability 0.4, the amount you invest is tripled (e.g., if you invest 100, you increase your asset position by 300), and, with probability 0.6, the amount you invest is lost. Consider the following investment strategies: Each week, invest 10% of your money. Each week, invest 30% of your money. Each week, invest 50% of your money. Use @RISK to simulate 100 weeks of each strategy 1000 times. Which strategy appears to be best in terms of the maximum growth rate? (In general, if you can multiply your investment by M with probability p and lose your investment with probability q = 1 p, you should invest a fraction [p(M 1) q]/(M 1) of your money each week. This strategy maximizes the expected growth rate of your fortune and is known as the Kelly criterion.) (Hint: If an initial wealth of I dollars grows to F dollars in 100 weeks, the weekly growth rate, labeled r, satisfies F = (I + r)100, so that r = (F/I)1/100 1.)In the financial world, there are many types of complex instruments called derivatives that derive their value from the value of an underlying asset. Consider the following simple derivative. A stocks current price is 80 per share. You purchase a derivative whose value to you becomes known a month from now. Specifically, let P be the price of the stock in a month. If P is between 75 and 85, the derivative is worth nothing to you. If P is less than 75, the derivative results in a loss of 100(75-P) dollars to you. (The factor of 100 is because many derivatives involve 100 shares.) If P is greater than 85, the derivative results in a gain of 100(P-85) dollars to you. Assume that the distribution of the change in the stock price from now to a month from now is normally distributed with mean 1 and standard deviation 8. Let EMV be the expected gain/loss from this derivative. It is a weighted average of all the possible losses and gains, weighted by their likelihoods. (Of course, any loss should be expressed as a negative number. For example, a loss of 1500 should be expressed as -1500.) Unfortunately, this is a difficult probability calculation, but EMV can be estimated by an @RISK simulation. Perform this simulation with at least 1000 iterations. What is your best estimate of EMV?

- If you own a stock, buying a put option on the stock will greatly reduce your risk. This is the idea behind portfolio insurance. To illustrate, consider a stock that currently sells for 56 and has an annual volatility of 30%. Assume the risk-free rate is 8%, and you estimate that the stocks annual growth rate is 12%. a. Suppose you own 100 shares of this stock. Use simulation to estimate the probability distribution of the percentage return earned on this stock during a one-year period. b. Now suppose you also buy a put option (for 238) on the stock. The option has an exercise price of 50 and an exercise date one year from now. Use simulation to estimate the probability distribution of the percentage return on your portfolio over a one-year period. Can you see why this strategy is called a portfolio insurance strategy? c. Use simulation to show that the put option should, indeed, sell for about 238.You are considering a 10-year investment project. At present, the expected cash flow each year is 10,000. Suppose, however, that each years cash flow is normally distributed with mean equal to last years actual cash flow and standard deviation 1000. For example, suppose that the actual cash flow in year 1 is 12,000. Then year 2 cash flow is normal with mean 12,000 and standard deviation 1000. Also, at the end of year 1, your best guess is that each later years expected cash flow will be 12,000. a. Estimate the mean and standard deviation of the NPV of this project. Assume that cash flows are discounted at a rate of 10% per year. b. Now assume that the project has an abandonment option. At the end of each year you can abandon the project for the value given in the file P11_60.xlsx. For example, suppose that year 1 cash flow is 4000. Then at the end of year 1, you expect cash flow for each remaining year to be 4000. This has an NPV of less than 62,000, so you should abandon the project and collect 62,000 at the end of year 1. Estimate the mean and standard deviation of the project with the abandonment option. How much would you pay for the abandonment option? (Hint: You can abandon a project at most once. So in year 5, for example, you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned. Also, once you abandon the project, the actual cash flows for future years are zero. So in this case the future cash flows after abandonment should be zero in your model.)A common decision is whether a company should buy equipment and produce a product in house or outsource production to another company. If sales volume is high enough, then by producing in house, the savings on unit costs will cover the fixed cost of the equipment. Suppose a company must make such a decision for a four-year time horizon, given the following data. Use simulation to estimate the probability that producing in house is better than outsourcing. If the company outsources production, it will have to purchase the product from the manufacturer for 25 per unit. This unit cost will remain constant for the next four years. The company will sell the product for 42 per unit. This price will remain constant for the next four years. If the company produces the product in house, it must buy a 500,000 machine that is depreciated on a straight-line basis over four years, and its cost of production will be 9 per unit. This unit cost will remain constant for the next four years. The demand in year 1 has a worst case of 10,000 units, a most likely case of 14,000 units, and a best case of 16,000 units. The average annual growth in demand for years 2-4 has a worst case of 7%, a most likely case of 15%, and a best case of 20%. Whatever this annual growth is, it will be the same in each of the years. The tax rate is 35%. Cash flows are discounted at 8% per year.

- The IRR is the discount rate r that makes a project have an NPV of 0. You can find IRR in Excel with the built-in IRR function, using the syntax =IRR(range of cash flows). However, it can be tricky. In fact, if the IRR is not near 10%, this function might not find an answer, and you would get an error message. Then you must try the syntax =IRR(range of cash flows, guess), where guess" is your best guess for the IRR. It is best to try a range of guesses (say, 90% to 100%). Find the IRR of the project described in Problem 34. 34. Consider a project with the following cash flows: year 1, 400; year 2, 200; year 3, 600; year 4, 900; year 5, 1000; year 6, 250; year 7, 230. Assume a discount rate of 15% per year. a. Find the projects NPV if cash flows occur at the ends of the respective years. b. Find the projects NPV if cash flows occur at the beginnings of the respective years. c. Find the projects NPV if cash flows occur at the middles of the respective years.In Problem 11 from the previous section, we stated that the damage amount is normally distributed. Suppose instead that the damage amount is triangularly distributed with parameters 500, 1500, and 7000. That is, the damage in an accident can be as low as 500 or as high as 7000, the most likely value is 1500, and there is definite skewness to the right. (It turns out, as you can verify in @RISK, that the mean of this distribution is 3000, the same as in Problem 11.) Use @RISK to simulate the amount you pay for damage. Run 5000 iterations. Then answer the following questions. In each case, explain how the indicated event would occur. a. What is the probability that you pay a positive amount but less than 750? b. What is the probability that you pay more than 600? c. What is the probability that you pay exactly 1000 (the deductible)?Based on Grossman and Hart (1983). A salesperson for Fuller Brush has three options: (1) quit, (2) put forth a low level of effort, or (3) put forth a high level of effort. Suppose for simplicity that each salesperson will sell 0, 5000, or 50,000 worth of brushes. The probability of each sales amount depends on the effort level as described in the file P07_71.xlsx. If a salesperson is paid w dollars, he or she regards this as a benefit of w1/2 units. In addition, low effort costs the salesperson 0 benefit units, whereas high effort costs 50 benefit units. If a salesperson were to quit Fuller and work elsewhere, he or she could earn a benefit of 20 units. Fuller wants all salespeople to put forth a high level of effort. The question is how to minimize the cost of encouraging them to do so. The company cannot observe the level of effort put forth by a salesperson, but it can observe the size of his or her sales. Thus, the wage paid to the salesperson is completely determined by the size of the sale. This means that Fuller must determine w0, the wage paid for sales of 0; w5000, the wage paid for sales of 5000; and w50,000, the wage paid for sales of 50,000. These wages must be set so that the salespeople value the expected benefit from high effort more than quitting and more than low effort. Determine how to minimize the expected cost of ensuring that all salespeople put forth high effort. (This problem is an example of agency theory.)