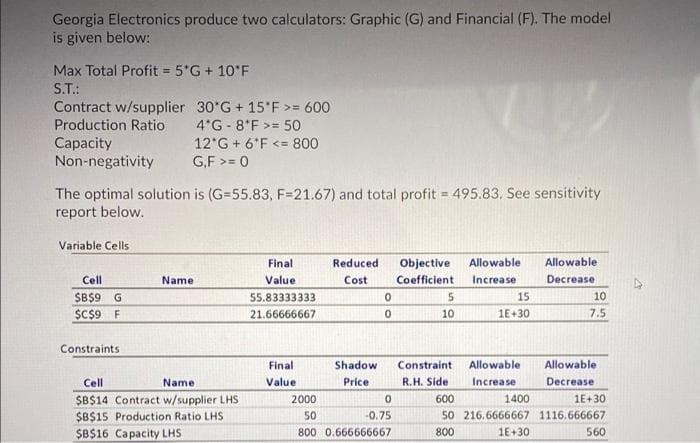

If profit contribution for G increases by 12, from 5 to 17, Since the optimal solution will change, I need to re-run SOLVER Optimal solution will change, new total profit 1165.83 Both optimal solution and total profit will remain the same Optimal solution remains the same, new total profit = 1165.83 %3D

Q: The Friendly Sausage Factory (FSF) can produce hot dogs at a rate of 5,000 per day. FSF supplies hot...

A: Here, I need to determine the optimal run size, the number of runs for each year and the number of d...

Q: Distributors for a furniture manufacturer are complaining that the billing for goods they order is f...

A: Database management is described as a task that is associated with the protection of organizational ...

Q: What type of business incorporates proactive CSR into the companies foundation believing that a comp...

A: There are four different views that characterize CSR methods. One of these is proactive CSR, which i...

Q: ’s code of ethics to guide their decision making, what good are the codes?

A: An organization's code of ethics serves as a set of standards for employees, outlining acceptable co...

Q: What are demand forecasting and capacity strategy? Give an example of demand forecasting for a busi...

A: A company's decision-making is heavily influenced by demand. In a competitive industry, it is critic...

Q: What is the estimated expected (mean) time for project completion?

A: A project network diagram is a visual representation of a project which identifying the activity rel...

Q: You work for the Brad's Nailer Company which manufactures three types of nailers: a pneumatic model,...

A: X = Units of Pneum to be produced Y = Units of ProLine to be produced Z = Units of Cordless to be pr...

Q: a. The expected project completion time for this problem is and the standard deviation is . b. The...

A:

Q: What information do you need to clarify with service providers to ensure they know their roles and r...

A: Individualized planning assists individuals in: enhancing natural supports such as friendships, neig...

Q: How many direct hours are required to produce the 30th unit? How many total hours are needed to prod...

A: A Small Introduction about Forecasting Forecasting is done to comprehend the interest that might ...

Q: At a car washing service facility customers arrive at the rate of 8 cars per hour. The service can m...

A: This is a single-server model, we can understand that and the arrival rate (λ) = 8 cars/hr and servi...

Q: It is necessary for the owners and top managers to demonstrate the importance of internal controls i...

A: Organizational goals are described as the strategic objectives that guide the efforts of the employe...

Q: What are the Basic Concepts of Total Quality Management?

A: The term TQM (total quality management) was created in the 1950s and is currently mostly used in Jap...

Q: How does MRP II differ from MRP?

A: A Material Requirements Planning often called MRP framework can be stated as the planning and decisi...

Q: Can you provide an example of the things that differentiate an employee from an independent contrac...

A: The employees are paid wages constantly, get employee benefits, get their taxes deducted from the wa...

Q: Sycamore Plastics (SP) is a manufacturer of polyethylene plastic pellets used es a row material by m...

A: Unit transportation cost and demand supply Combined costs per 1000 l...

Q: The Laurenster Corporation is getting into the construction business. A list of activities and their...

A: ES = maximum (EF of all immediate predecessor) EF = ES + duration Minimum project duration = largest...

Q: Chapter 6. Solve the following Linear Program using the Solver method and answer the questions given...

A: Maximize: 12A + 15B s.t. 3A + 7B <= 250 5A + 2B <= 200 B <= 25 A, B >= 0

Q: As part of their application for a loan to buy Lakeside Farm, a property they hope to develop as a b...

A: Breakeven is that point where revenue is equal to cost

Q: As the production planner for Xiangling Hu Products, Inc., you have been given a bill of material fo...

A: The product structure is developed as follows:

Q: a) Given the product structure and master production scheduleshown in Figure 14.12, develop a gross ...

A: A Small Introduction about Production Management Production the executives is a course of arrangi...

Q: ct plans from the knowledge areas base on the Components of the Scope Management plan

A: Project management plan

Q: 1 Determine the optimal order size. .Find the length of an order cycle.

A: Economic Order Quantity is a method of managing inventory which helps to maintain a lowest cost for ...

Q: Assess the impact of this situation on business performance and management decision making.

A: Given the fact that Synders works at a very large scale globally, it will have massive data collecti...

Q: Sovenir Ltd. Does production of 2 lakhs units per month and the various inputs used by the company (...

A: Given: The Total Units Produced in a month = 2,00,000 Labour input (monthly) = 92000/12 = Rs. 7...

Q: 100% Inspection means every part is inspected in other words all parts or characteristics of a parti...

A: Definitions: Sampling: - Sampling is a process of checking each item or product from the lot or batc...

Q: What is the rationale for (a) a phantom bill of material, (b) aplann ing bill of material, and (c) a...

A: In the construction, production, or maintenance of any product or service, a bill of materials (BOM)...

Q: 2. A retail store sold in the month of April 5,000 products that produced $45,000 in sales. In the m...

A: Productivity is the process of manufacturing the products and services most effectively and efficien...

Q: Cycle Time and Throughput Rate. b. Identify the bottlene...

A: Cycle time is the proportion between required demand and total available time. Throughput time indic...

Q: What are the options for the production planner who has:a) scheduled more than capacity in a work ce...

A: Production planning is the planning of production and manufacturing modules in a business or industr...

Q: Remit ancillaries plans to set up a production unit for 1000 motors and the management has identifie...

A: Given: Faridabad: Fixed cost = Rs. 64,00,000 Variable cost = 970 x 90,000 = Rs. 8,73,00,000 Ghazia...

Q: QUESTIONS Write a vision and a mission statement for Cutey Barber Salon. Why is it important for t...

A: Note: “Since you have asked multiple questions, we will solve the first question for you. If you wan...

Q: However, with the economic situation now coming to normaley, the company bagged some new projects. I...

A: Experimentation is the demo, cycle, or exercise of testing.

Q: Demand 7 9 5 11 10 13 The least squares regression equation that shows the best relationship between...

A: To get the relationship between demand and period, here, first, I would determine the intercept and ...

Q: ctual demand was 210 lakhs of saops , now using the smoothing constant choosen by the management of ...

A:

Q: With the use of a diagram, show (illustrate) the typical levels of project staffing related to each...

A: A project is initiated with an objective and to fulfill the objective the company defines the budget...

Q: Networks may be used to represent assignment problems. Discuss

A: An assignment problem can be stated as the particular type of problem associated with linear program...

Q: Determine the assignment of customer zones to distribution centers that will minimize cost. Write th...

A: The assignment issue is a sort of linear programming problem that deals with the one-to-one allocati...

Q: Once a material requirements plan (MRP) has been established, what other managerial applications mig...

A: Material requirements planning often called MRP can be stated as the framework or system for determi...

Q: You have a new job as a Financial Planning assistant. Your client wants to invest money in stocks, ...

A: In this problem We're attempting to maximize or decrease the value of this linear function, such as ...

Q: What are two basic approaches to research. Briefly explain them.

A: Planning is an interdisciplinary field in which the research might be conducting in number of ways. ...

Q: Your stockroom manager, Mehmet Altag, arrivedat your desk just a fter you had completed the net requ...

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question s...

Q: How many direct hours are required to produce the 30th unit? How many total hours are needed to prod...

A:

Q: b) The Scott Tractor Company ships tractor parts from Omaha to St. Louis by railroad. However, a con...

A: The objective of the maximal flow network diagram is to find the maximum output the firm can get fro...

Q: Which of the following statement regarding liability risk is (are) TRUE? There is no maximum upper l...

A: Liability risk means where the firm has to bear for the specific type of losses incurred by his empl...

Q: determine the break-even point of the firm.

A: Breakeven point is the number of unit or total value of the sales revenue which indicating no profit...

Q: A manager wants to assign tasks to workstations as efficiently as possible and achieve an hourly out...

A: Given- Production time in minutes = 60 minutes Demand units = 30 units

Q: The Company makes TSHIRTS at their facility in chicago and Minnesota. The process involves three dep...

A: Capacity utilization = (Available time hours / used time hours) x 100 %

Q: Explain the dimension of power in an organisation: First dimension (managing resources) Second dimen...

A: Organizational management is described as the process of controlling, leading, planning, and organiz...

Q: Describe the role of Presentations in Stakeholder Management and how Pecha Kucha can help you in Pro...

A: Project management is the use of specialized knowledge, skills, tools, and processes to give somethi...

Step by step

Solved in 2 steps

- Seas Beginning sells clothing by mail order. An important question is when to strike a customer from the companys mailing list. At present, the company strikes a customer from its mailing list if a customer fails to order from six consecutive catalogs. The company wants to know whether striking a customer from its list after a customer fails to order from four consecutive catalogs results in a higher profit per customer. The following data are available: If a customer placed an order the last time she received a catalog, then there is a 20% chance she will order from the next catalog. If a customer last placed an order one catalog ago, there is a 16% chance she will order from the next catalog she receives. If a customer last placed an order two catalogs ago, there is a 12% chance she will order from the next catalog she receives. If a customer last placed an order three catalogs ago, there is an 8% chance she will order from the next catalog she receives. If a customer last placed an order four catalogs ago, there is a 4% chance she will order from the next catalog she receives. If a customer last placed an order five catalogs ago, there is a 2% chance she will order from the next catalog she receives. It costs 2 to send a catalog, and the average profit per order is 30. Assume a customer has just placed an order. To maximize expected profit per customer, would Seas Beginning make more money canceling such a customer after six nonorders or four nonorders?Assume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.Lemingtons is trying to determine how many Jean Hudson dresses to order for the spring season. Demand for the dresses is assumed to follow a normal distribution with mean 400 and standard deviation 100. The contract between Jean Hudson and Lemingtons works as follows. At the beginning of the season, Lemingtons reserves x units of capacity. Lemingtons must take delivery for at least 0.8x dresses and can, if desired, take delivery on up to x dresses. Each dress sells for 160 and Hudson charges 50 per dress. If Lemingtons does not take delivery on all x dresses, it owes Hudson a 5 penalty for each unit of reserved capacity that is unused. For example, if Lemingtons orders 450 dresses and demand is for 400 dresses, Lemingtons will receive 400 dresses and owe Jean 400(50) + 50(5). How many units of capacity should Lemingtons reserve to maximize its expected profit?

- The Pigskin Company produces footballs. Pigskin must decide how many footballs to produce each month. The company has decided to use a six-month planning horizon. The forecasted monthly demands for the next six months are 10,000, 15,000, 30,000, 35,000, 25,000, and 10,000. Pigskin wants to meet these demands on time, knowing that it currently has 5000 footballs in inventory and that it can use a given months production to help meet the demand for that month. (For simplicity, we assume that production occurs during the month, and demand occurs at the end of the month.) During each month there is enough production capacity to produce up to 30,000 footballs, and there is enough storage capacity to store up to 10,000 footballs at the end of the month, after demand has occurred. The forecasted production costs per football for the next six months are 12.50, 12.55, 12.70, 12.80, 12.85, and 12.95, respectively. The holding cost incurred per football held in inventory at the end of any month is 5% of the production cost for that month. (This cost includes the cost of storage and also the cost of money tied up in inventory.) The selling price for footballs is not considered relevant to the production decision because Pigskin will satisfy all customer demand exactly when it occursat whatever the selling price is. Therefore. Pigskin wants to determine the production schedule that minimizes the total production and holding costs. Can you guess the results of a sensitivity analysis on the initial inventory in the Pigskin model? See if your guess is correct by using SolverTable and allowing the initial inventory to vary from 0 to 10,000 in increments of 1000. Keep track of the values in the decision variable cells and the objective cell.The Pigskin Company produces footballs. Pigskin must decide how many footballs to produce each month. The company has decided to use a six-month planning horizon. The forecasted monthly demands for the next six months are 10,000, 15,000, 30,000, 35,000, 25,000, and 10,000. Pigskin wants to meet these demands on time, knowing that it currently has 5000 footballs in inventory and that it can use a given months production to help meet the demand for that month. (For simplicity, we assume that production occurs during the month, and demand occurs at the end of the month.) During each month there is enough production capacity to produce up to 30,000 footballs, and there is enough storage capacity to store up to 10,000 footballs at the end of the month, after demand has occurred. The forecasted production costs per football for the next six months are 12.50, 12.55, 12.70, 12.80, 12.85, and 12.95, respectively. The holding cost incurred per football held in inventory at the end of any month is 5% of the production cost for that month. (This cost includes the cost of storage and also the cost of money tied up in inventory.) The selling price for footballs is not considered relevant to the production decision because Pigskin will satisfy all customer demand exactly when it occursat whatever the selling price is. Therefore. Pigskin wants to determine the production schedule that minimizes the total production and holding costs. As indicated by the algebraic formulation of the Pigskin model, there is no real need to calculate inventory on hand after production and constrain it to be greater than or equal to demand. An alternative is to calculate ending inventory directly and constrain it to be nonnegative. Modify the current spreadsheet model to do this. (Delete rows 16 and 17, and calculate ending inventory appropriately. Then add an explicit non-negativity constraint on ending inventory.)The Pigskin Company produces footballs. Pigskin must decide how many footballs to produce each month. The company has decided to use a six-month planning horizon. The forecasted monthly demands for the next six months are 10,000, 15,000, 30,000, 35,000, 25,000, and 10,000. Pigskin wants to meet these demands on time, knowing that it currently has 5000 footballs in inventory and that it can use a given months production to help meet the demand for that month. (For simplicity, we assume that production occurs during the month, and demand occurs at the end of the month.) During each month there is enough production capacity to produce up to 30,000 footballs, and there is enough storage capacity to store up to 10,000 footballs at the end of the month, after demand has occurred. The forecasted production costs per football for the next six months are 12.50, 12.55, 12.70, 12.80, 12.85, and 12.95, respectively. The holding cost incurred per football held in inventory at the end of any month is 5% of the production cost for that month. (This cost includes the cost of storage and also the cost of money tied up in inventory.) The selling price for footballs is not considered relevant to the production decision because Pigskin will satisfy all customer demand exactly when it occursat whatever the selling price is. Therefore. Pigskin wants to determine the production schedule that minimizes the total production and holding costs. Modify the Pigskin model so that there are eight months in the planning horizon. You can make up reasonable values for any extra required data. Dont forget to modify range names. Then modify the model again so that there are only four months in the planning horizon. Do either of these modifications change the optima] production quantity in month 1?