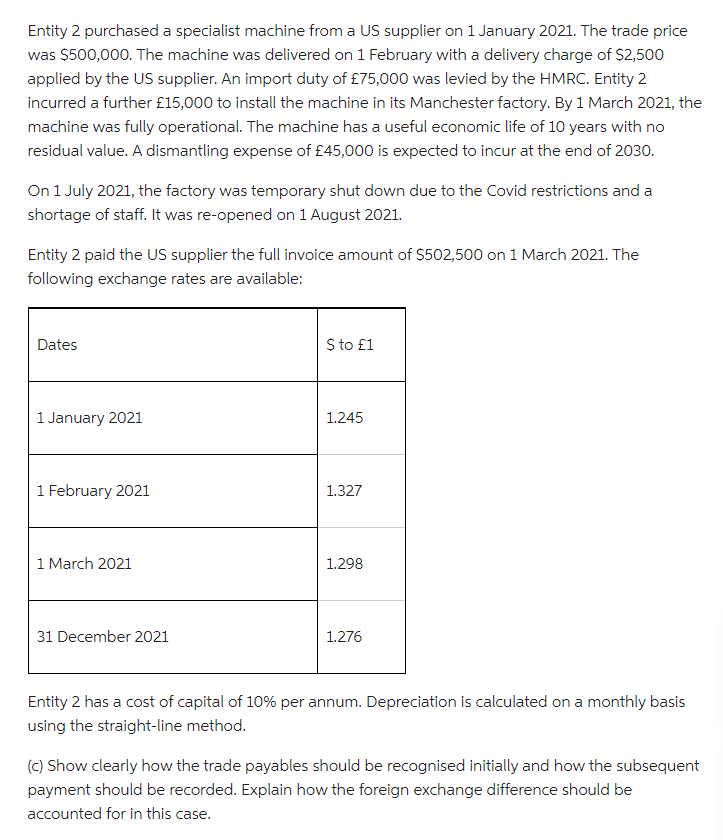

(c) Show clearly how the trade payables should be recognised initially and how the subsequent payment should be recorded. Explain how the foreign exchange difference should be accounted for in this case.

Q: The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to…

A: As per the guidelines we can solve only first three part in one time so please repost the rest of…

Q: Sharp Motor Company has two operating divisions-an Auto Division and a Truck Division. The company…

A: Cost Charged :- Cost include all type of variable Cost ( DM, DL, Variable manufacturing Cost,…

Q: Issuance of capital stock. Amortization of patent. Issuance of bonds for land. Purchase of land.…

A: Cash flow statement used to analyze various operating, financing and investing activities of an…

Q: (b) Assume Displays Incorporated $65,000 beginning balance of inventory comes from the base year…

A: Given in the question: Inventory at beginning of the year = $16,000 Cost index at the beginning of…

Q: Use the information given in the image to prepare the Income Statement for March 2022 according to…

A: An income statement is a financial statement that is prepared to ascertain the amount of profit…

Q: Use the information provided below to calculate the Internal Rate of Return (expressed to two…

A: IRR :- it is also called actual rate of return. IRR is the Discount rate at which, PV of cash inflow…

Q: 3.4 3.5 Samcor Limited manufactures tables. The following information was extracted from the budget…

A: Variable cost per unit = Direct Material cost per unit + Direct labour cost per unit + Overhead cost…

Q: Date Quantity Price Amount Quantity Price Amount Date 01 The following transactions of Franco…

A: Solution... As per the FIFO method of inventory valuation goods received first also sold first .…

Q: Please refer to the equity section of the balance sheet shown as follows: Preferred stock $100…

A: Common Stock shown in the Balance Sheet includes only Par Value of Shares issued. Amount received in…

Q: ohnson Manufacturing company, a manufacturer of custom-made drones, uses a job order cost system to…

A: Many Thanks for the Question Bartleby's Guideline “Since you have posted a question with multiple…

Q: GMA Corp. has the following information in its shareholders’ equity: Ordinary Share Capital, ₱100…

A: Contributed capital is the total amount contributed towards purchase of all shares of a company.…

Q: Beginning Inventory 3 units @ $4 $12 Purchases 10 units @ $7 $70 Sales 8 units What is ending…

A: Under FIFO Method, units which came in first will be sold first and the inventory will be out of the…

Q: Casas Modernas of Juarez, Mexico, is contemplating a major change in its cost structure. Currently,…

A: Introduction: The last line of the financial statements is net income. However, some income…

Q: gures are in millions. Total assets Total liabilities Net sales Net income December 31, 2019 $930.90…

A: The ratio analysis helps to analyse the financial statements of the business on the basis of various…

Q: What is the price at which the business would need to sell product Y such that it would be equally…

A: In order to find the selling price so that equal profit is to be generated while producing and…

Q: Based on the above journal: Prepare the company’s Stockholders equity section of the balance sheet…

A: Shareholders Equity Shareholders equity which is comprises of common stock and preference stock…

Q: Over absorption overhead occurs when ?

A: Over absorption :- Over Absorption means the actual Expenditure incurred lower then expected. For…

Q: The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall…

A: Ratio - Ratio analysis is the method of analyzing a company's financial statement in a systematic…

Q: What is evergreening in banking and why it may arise as an equilibrium choice of banks. Carefully…

A: Answer:- Evergreening:- Evergreening technically refers to the practice of "managing" the balance…

Q: Calculate Lise's annual automobile taxable benefit.

A: The assumption to be taken while solving the above-mentioned question is as follows: 1. 2% rate is…

Q: Accounting which public charity has unrelated business income?(1) wear it proud , a charity which…

A: A charitable trust is those entities that are engaged in the activities of charity like education or…

Q: Answer the questions from the information provided. 2.1 Use the information given below to prepare…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: G. Henry is employed by Royal Manufacturers and is paid R250 per hour. His normal working day is 9…

A: Straight piece rate is the plan in which the earnings of the persons employed is computed using the…

Q: Câu 3 A company manufactures two types of component, the XT1 and the XT2. Each component has first…

A: Calculation of Total Polishing hours required XT1 XT2 Total Budgeted Production in…

Q: On which one of these occasions does a company not record a change in the value of an asset? When…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Wesley Power Tools manufactures a wide variety of tools and accessories. One of its more popular…

A:

Q: Use the information provided below to calculate the following manufacturing variances for March…

A: The actual hours worked is the actual time taken to produce the unit. The standard hours allowed is…

Q: Date Quantity Price Amount Quantity Price Amount Date 01 The following transactions of Franco…

A: First in, first out also known as FIFO is an accounting method in which items purchased first are…

Q: BFAR Corp. was authorized to issue 500,000 ordinary shares with a par value of P10. One of its…

A: In case of subscriber of shares not paid total share subscription amount the subscription will be…

Q: Calculate the new total Marginal Income and Net Profit/Loss, if an increase in advertising expense…

A: New Total Marginal Income: Income at new 2800 units level (WN-1) - Income at 2400 units(WN-2)…

Q: uring 2020, Ma

A: Shareholders also invest money in the company and in return they become the owners in proportion to…

Q: You are required to prepare a trial balance for Alina, a sole proprietorship as at 31st December…

A: Trial Balance :— It is the list of Debit and Credit balances of All Ledger Accounts. Capital,…

Q: In additin to the above question: Prepare the company’s Stockholders equity section of the balance…

A: Introduction: Stockholders' equity is the total funds contributed by the shareholders of the company…

Q: Debtors Bank and cash Current liabilities Creditors Taxation Dividends Bank loans and overdraft Net…

A: While analysing the financial statements there are few areas which drew attention , based on which…

Q: Use the information provided below to prepare the following for January and February 2023 as per…

A: Cash Budget- A cash budget analyses the flow of cash in a company over the long or short term. So a…

Q: Changes in Current Operating Assets and Liabilities Paneous Corporation's comparative balance sheet…

A: Introduction: The cash flow statement (CFS) is a financial report that depicts the inflow and…

Q: Use the information provided below to prepare the Debtors Collection Schedule for January and…

A: Collection from debtor means collection from credit sales made. Working note : 65℅ of credit sales…

Q: 1.2 Study the information provided below and calculate the hourly recovery tariff per hour…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: A Company manufactures exclusive chairs. The company has a policy of maintaining a finished goods…

A: Formula to be used is Budgeted labor cost = Total labor hours x Budgeted direct labor rate

Q: Ripley Corporation's accumulated depreciation furniture account increased by $9,310, while $3,570 of…

A: Cash flow from operating activities is one of the three activities shown in the statement of cash…

Q: hat would be the maturity period if payments are bi-weekly? How much will the borrower pay in total…

A: The maturity period refers to the period by which total payment is settled i.e. loan amount getting…

Q: 4. Listed below are various types of accounting changes and errors. a) Nathalie Cole Inc. acquired…

A: While preparing the books of accounts there always remains a possibility of errors and omissions.…

Q: Pulsar Plc is considering of exporting its products to the Swedish market. It expects to earn an…

A: Formula = Economic profit / ( loss) = Revenue Less : opportunity cost Less : explicit cost

Q: PROBLEM IV Journalize the following transaction: Mar. 1 Received a 60-day, note…

A: A journal entry is the act of recording any transaction, whether one that is commercial or not. An…

Q: Tempo Company's fixed budget (based on sales of 16,000 units) for the first quarter reveals the…

A: Total Variable Cost :— It means cost which changes with change in units. It depends on Units.…

Q: Kaluwax Ltd. manufactures one product which it sells to the wholesale trade. The following trial…

A: Inventory- The things that a business keeps on hand in order to make money are referred to as…

Q: List Price Trade Discount Rate Trade Discount $282.00 25% Net Price

A: Discount means the reduction in the amount to be paid on purchase of something. It could be cash…

Q: alculate the total Marginal Income and Net Profit/Loss if all the tables are sold.…

A: "Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: You must prepare a return on investment analysis for the regional manager of Fast & Great Burgers.…

A: Return on Investment (ROI) :— It represents return or net income with respect to investments. It is…

Q: Beginning Inventory 3 units @ $4 $12 Purchases 10 units @ $7 $70 Sales 8 units What is ending…

A: LIFO: LIFO stands for Last-In, First-Out. In this method inventory purchased at last will be sold…

Step by step

Solved in 2 steps

- On September 30, 2020, Chicken Ltd., a Canadian company, entered into a contract to purchase goodsfrom Wing Ltd., a foreign corporation. The terms of the contract call for the goods to be delivered toChicken Ltd.'s Edmonton location on May 30, 2021. The cost of goods is EUR $1,000,000 to be settled onJuly 31, 2021. On September 30, 2020, Chicken Ltd. also arranged for a forward contract through its bank for EUR$1,000,000. The goods were delivered on time, and Chicken Ltd, settled with Wing Ltd. on July 31, 2021.Chicken Ltd. has a April 30 year-end.The spot and forward rates are as follows: Spot Rate ($CAD)1 USD = x.xX CAD Forward Rate($CAD)1 USD = XXX CAD September 30, 2020 $1.42 $1.46 April 30, 2021 $1.44 $1.48 May 30, 2021 $1.45 $1.49 July 31, 2021 $1.50 $1.50 RequiredPrepare Chicken Ltd.'s journal entries to reflect the above assuming that:a. the hedge is a cash flow hedge, andb. the hedge is a fair value hedge.Entity A is a Hong Kong-based limited company that participates in the building material industry for many years. It sells high-quality raw materials to different local and foreign manufacturers. Entity B is one of its loyal customers for more than 30 years. On 1 January 2020, Entity A received an advanced payment of $3,600,000 from Entity B through the Hong Kong City Bank for selling Material X. According to the contract terms, Entity A would only deliver Material X to Entity B on 31 December 2020. The regular cash-selling price of Material X was $3,600,000. The cost of sales of Material X was $2,563,000. On 1 January 2021, Entity A entered into another contract with Entity B. This contract stated that Entity A was required to transfer Material Y and Material Z to Entity B in exchange for $681,500. According to the contract terms, Entity A could invoice this full amount on 31 January 2021. Material Y was to be delivered on 28 February 2021 and Material Z was to be delivered on…Jackson, a U.S. company, acquires a variety of raw materials from foreign vendors with amounts payable in foreign currency (FC). The company needs to acquire 20,000 units of raw materials, and the goods are expected to have a price of 100,000 FC. Assume that the inventory can be subsequently sold to U.S. customers for $160,000. Jackson is contemplating committing to the purchase of the inventory on September 1 with delivery on November 1. However, rather than making a commitment, the company could forecast a probable purchase of inventory with delivery on November 1. In either case, assume that on September 1 the company would either (a) acquire a forward contract to buy 100,000 FC with a forward date of November 1 or (b) acquire an option to buy FC in November at a strike price of $1.250. The option premium is expected to cost $2,100.Various spot rates, forward rates, and option values are as follows: Spot Rate Forward Rate forNovember 1 Time Value ofOption September 1 . . . .…

- Clayton Industries sells medical equipment worldwide. On March 1 of the current year, the company sold equipment, with a cost of $160,000, to a foreign customer for 200,000 euros payable in 60 days. At the same time, the company purchased a forward contract to sell 200,000 euros in 60 days. In another transaction, the company committed, on March 15, to deliver equipment in May to a foreign customer in exchange for 300,000 euros payable in June. This equipment is anticipated to have a completed cost of $210,000. On March 15, the company hedged the commitment by acquiring a forward contract to sell 300,000 euros in 90 days. Changes in the value of the commitment are based on changes in forward rates, and all discounting is based on a 6% discount rate. Assume all hedges are accounted for as fair value hedges and that the spot-forward difference is included in the assessment of hedge effectiveness. Various spot and forward rates for the euro are as follows: Spot Rate Forward Rate for…On January 5, 2022, Mart company places an order for a machine from a company in Japan. The machine is delivered on January 31, 2020 and the invoice price is P 900,000 with a cash discount of 1% If paid within 30 days . Import duties and taxes amount to P 45,000. The following costs were also incurred: delivery and transport costs from Japan to Mart company factory, P 7,500; Installation and commissioning cost, P 34,500; administrative costs incurred in processing, P 15,000; and start-up and pre-production costs, P 30,000. At what amount should the machine be initially recorded?Brandlin Company of Anaheim, California, purchases materials from a foreign supplier on December 1, 2017, with payment of 32,000 korunas to be made on March 1, 2018. The materials are consumed immediately and recognized as cost of goods sold at the date of purchase. On December 1, 2017, Brandlin enters into a forward contract to purchase 32,000 korunas on March 1, 2018. Relevant exchange rates for the koruna on various dates are as follows: Date Spot Rate Forward Rate(to March 1, 2018) December 1, 2017 $ 5.00 $ 5.075 December 31, 2017 5.10 5.200 March 1, 2018 5.25 N/A Brandlin’s incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent (1 percent per month) is 0.9803. Brandlin must close its books and prepare financial statements at December 31. a-1. Assuming that Brandlin designates the forward contract as a cash flow hedge of a foreign currency payable and recognizes any…

- A Movers is a freight railway entity that enters a contract with a customer to transport goods from location A to location B for PhP 1,000,000 on December 28, 2021. The shipper has an unconditional obligation to pay for the service when the goods reach location B. A Movers were able to load the shipment on the night of December 29 and departed location A on December 30. If onDecember 31, 2021, the shipment is a quarter far from location B how much revenue should A Movers recognize on its Statement of Comprehensive Income?Please explain why did you have that answer.Local Corp imported a heavy machine from the US for US$50,000 on October 10, 2019. A letter of credit was opened with a Makati branch based on the commercial invoice for US$50,000, on which Local Corpl made a 100% deposit cover based on the exchange rate of $1.00 to P27.50. Shipment of the heavy machine was effected on December 30, 2019, at which time the exporter collected the proceeds of the letter of credit when the prevailing exchange rate was $1.00 to P28.00. From the exchange rate fluctuation, Local Corp realized: Group of answer choices A. P25,000 gain B.P25,000 loss C. P5,000 gain D. No gain, No lossEntity A is a manufacturer of consumer goods. On 1 January 2020, Entity A entered into a one-year contract to sell goods to a large global chain of retail stores. The customer committed to buying at least $90,000,000 of products in January. The contract required Entity A to make a non-refundable payment of $200,000 to the customer at the inception of the contract. The $200,000 payment is to compensate the customer for the changes required to its shelving to accommodate Entity A's products. Entity A duly paid this $200,000 to the customer on 3 January 2020. Entity A transferred goods with an invoice price of $98,000,000 to the customer on 31 January 2020. The customer agreed to settle the outstanding amount by two payments, i.e. 40% and 60% of the outstanding amount on 18 February 2020 and 31 March 2020 respectively. REQUIRED: Provide journal entries for Entity A from 1 January 2020 to 31 March 2020 under relevant accounting standards. ACCOUNT FOR INPUT: | Bank | Payable |…

- Eximco Corporation (based in Champaign, Illinois) has a number of transactions with companies in the country of Mongagua, where the currency is the mong. On November 30, 2017, Eximco sold equipment at a price of 500,000 mongs to a Mongaguan customer that will make payment on January 31, 2018. In addition, on November 30, 2017, Eximco purchased raw materials from a Mongaguan supplier at a price of 300,000 mongs; it will make payment on January 31, 2018. To hedge its net exposure in mongs, Eximco entered into a two-month forward contract on November 30, 2017, to deliver 200,000 mongs to the foreign currency broker in exchange for $104,000. Eximco properly designates its forward contract as a fair value hedge of a foreign currency receivable. The following rates for the mong apply: Date Spot Rate Forward Rate ( to January 31, 2018) November 30, 2017 $0.53 $0.52 December 31, 2017 0.50 0.48 January 31, 2018 0.49 N/A Eximco’s incremental borrowing rate is 12 percent. The…Eximco Corporation (based in Champaign, Illinois) has a number of transactions with companies in the country of Mongagua, where the currency is the mong. On November 30, 2017, Eximco sold equipment at a price of 500,000 mongs to a Mongaguan customer that will make payment on January 31, 2018. In addition, on November 30, 2017, Eximco purchased raw materials from a Mongaguan supplier at a price of 300,000 mongs; it will make payment on January 31, 2018. To hedge its net exposure in mongs, Eximco entered into a two-month forward contract on November 30, 2017, to deliver 200,000 mongs to the foreign currency broker in exchange for $104,000. Eximco properly designates its forward contract as a fair value hedge of a foreign currency receivable. The following rates for the mong apply:Eximco’s incremental borrowing rate is 12 percent. The present value factor for one month at an annual interest rate of 12 percent (1 percent per month) is 0.9901.a. Prepare all journal entries, including…On July 15, 2024, Ortiz & Company signed a contract to provide EverFresh Bakery with an ingredient-weighing system for a price of $94,800. The system included finely tuned scales that fit into EverFresh’s automated assembly line, Ortiz’s proprietary software modified to allow the weighing system to function in EverFresh’s automated system, and a one-year contract to calibrate the equipment and software on an as-needed basis. If Ortiz was to provide these goods or services separately, it would charge $64,000 for the scales, $10,000 for the software, and $26,000 for the calibration contract. Ortiz delivered and installed the equipment and software on August 1, 2024, and the calibration service commenced on that date. Assume that the scales, software and calibration service are all separate performance obligations. How much revenue will Ortiz recognize in 2024 for this contract?