If the firm's tax rate is 45%, what will be the beta of an all-equity firm if its operations were exactly the same? Now consider the case of another company: U.S. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 10%, and its tax rate is 45%. It currently has a levered beta of 1.10. The risk-free rate is 3.5%, and the risk premium on the market is 8%. U.S. Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before-tax cost of debt to increase to 12%. Use the Hamada equation to unlever and relever the beta for the new level of debt. What will the firm's weighted average cost of capital (WACC) be if it make this change in its capital structure?

If the firm's tax rate is 45%, what will be the beta of an all-equity firm if its operations were exactly the same? Now consider the case of another company: U.S. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 10%, and its tax rate is 45%. It currently has a levered beta of 1.10. The risk-free rate is 3.5%, and the risk premium on the market is 8%. U.S. Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before-tax cost of debt to increase to 12%. Use the Hamada equation to unlever and relever the beta for the new level of debt. What will the firm's weighted average cost of capital (WACC) be if it make this change in its capital structure?

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter13: Capital Structure And Leverage

Section: Chapter Questions

Problem 14SP: WACC AND OPTIMAL CAPITAL STRUCTURE Elliott Athletics is trying to determine its optimal capital...

Related questions

Question

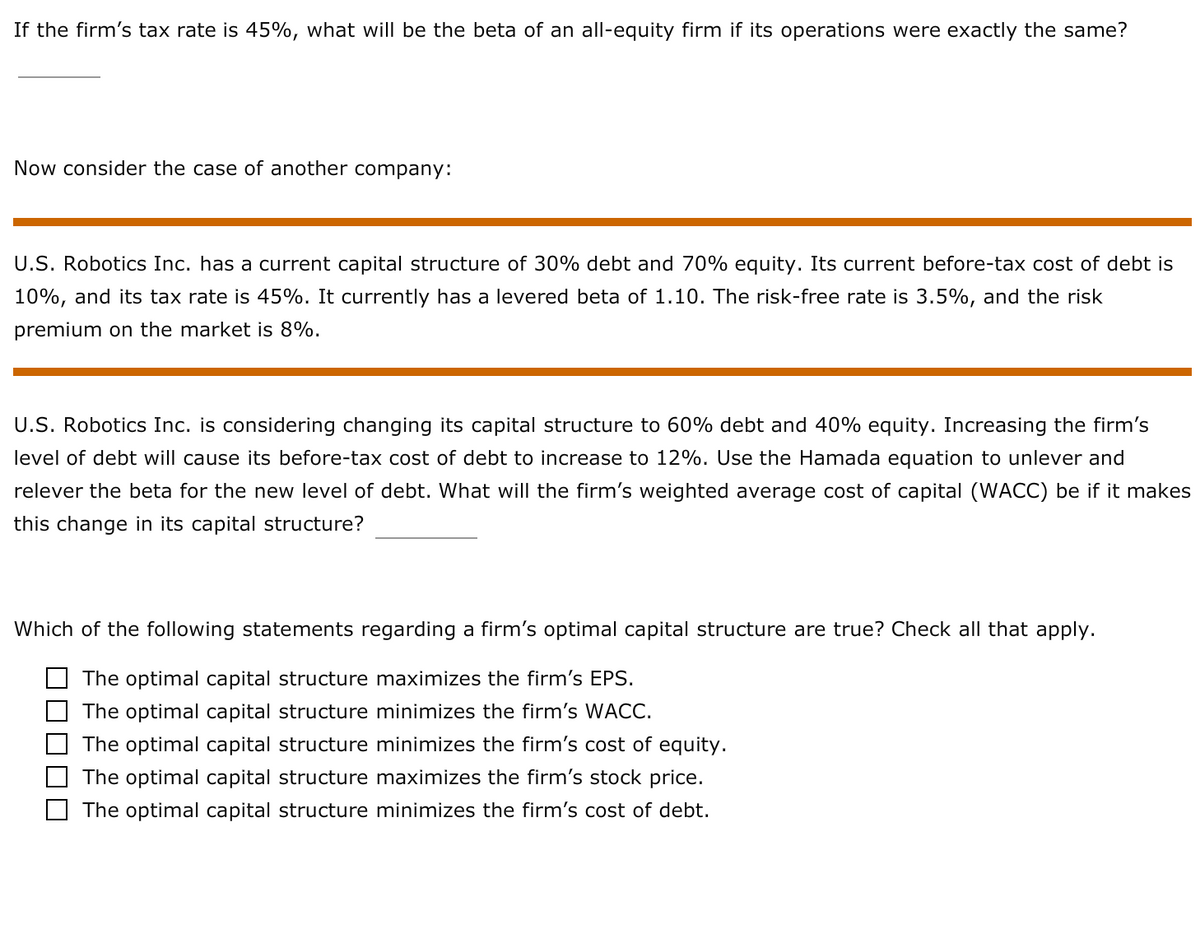

Transcribed Image Text:If the firm's tax rate is 45%, what will be the beta of an all-equity firm if its operations were exactly the same?

Now consider the case of another company:

U.S. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is

10%, and its tax rate is 45%. It currently has a levered beta of 1.10. The risk-free rate is 3.5%, and the risk

premium on the market is 8%.

U.S. Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's

level of debt will cause its before-tax cost of debt to increase to 12%. Use the Hamada equation to unlever and

relever the beta for the new level of debt. What will the firm's weighted average cost of capital (WACC) be if it makes

this change in its capital structure?

Which of the following statements regarding a firm's optimal capital structure are true? Check all that apply.

The optimal capital structure maximizes the firm's EPS.

O The optimal capital structure minimizes the firm's WACC.

The optimal capital structure minimizes the firm's cost of equity.

The optimal capital structure maximizes the firm's stock price.

The optimal capital structure minimizes the firm's cost of debt.

Transcribed Image Text:9. Determining the optimal capital structure

Aa Aa

Understanding the optimal capital structure

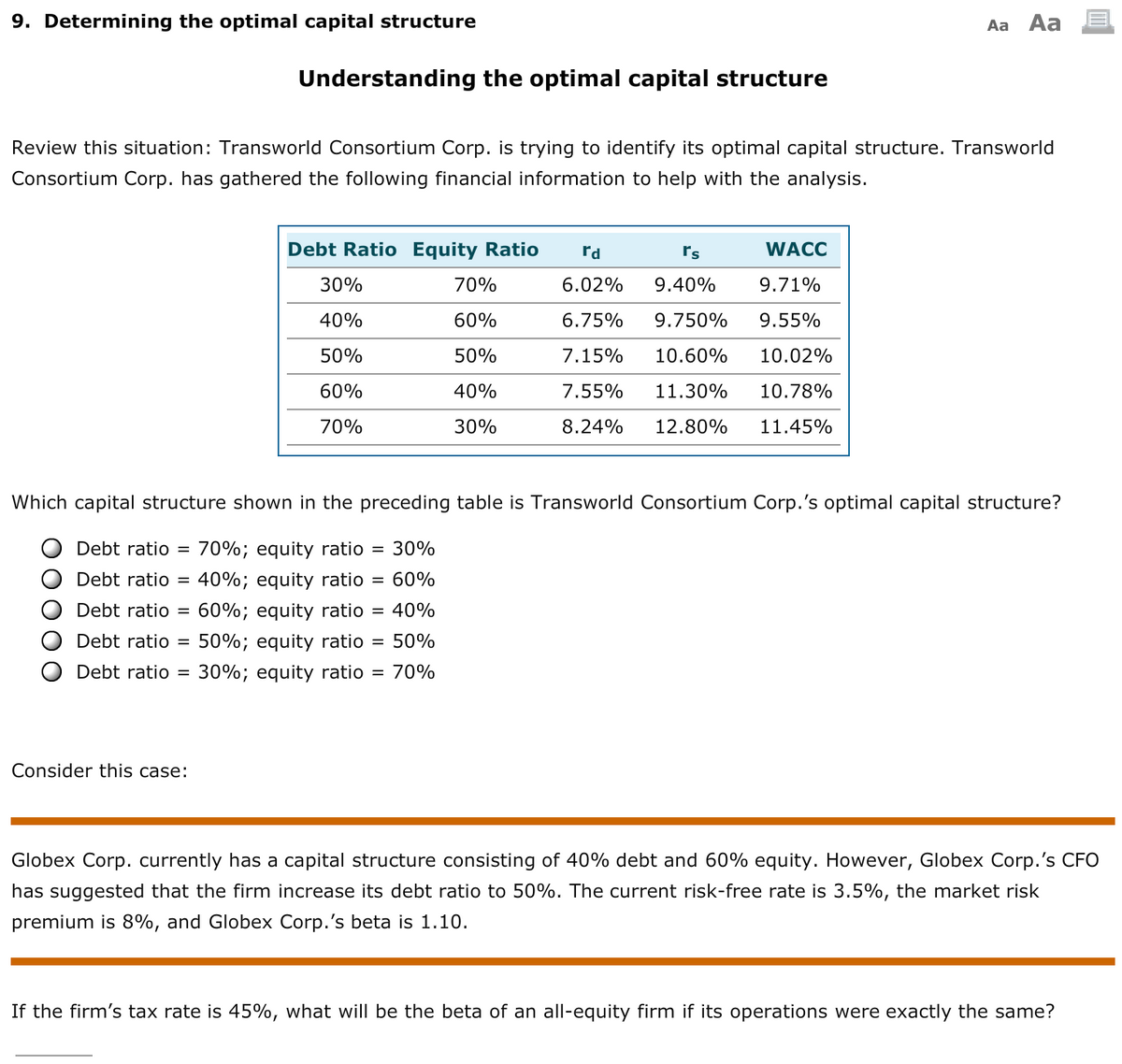

Review this situation: Transworld Consortium Corp. is trying to identify its optimal capital structure. Transworld

Consortium Corp. has gathered the following financial information to help with the analysis.

Debt Ratio Equity Ratio

rd

rs

WACC

30%

70%

6.02%

9.40%

9.71%

40%

60%

6.75%

9.750%

9.55%

50%

50%

7.15%

10.60%

10.02%

60%

40%

7.55%

11.30%

10.78%

70%

30%

8.24%

12.80%

11.45%

Which capital structure shown in the preceding table is Transworld Consortium Corp.'s optimal capital structure?

Debt ratio =

70%; equity ratio = 30%

Debt ratio =

40%; equity ratio = 60%

Debt ratio

60%; equity ratio = 40%

Debt ratio =

50%; equity ratio = 50%

Debt ratio =

30%; equity ratio = 70%

Consider this case:

Globex Corp. currently has a capital structure consisting of 40% debt and 60% equity. However, Globex Corp.'s CFO

has suggested that the firm increase its debt ratio to 50%. The current risk-free rate is 3.5%, the market risk

premium is 8%, and Globex Corp.'s beta is 1.10.

If the firm's tax rate is 45%, what will be the beta of an all-equity firm if its operations were exactly the same?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning