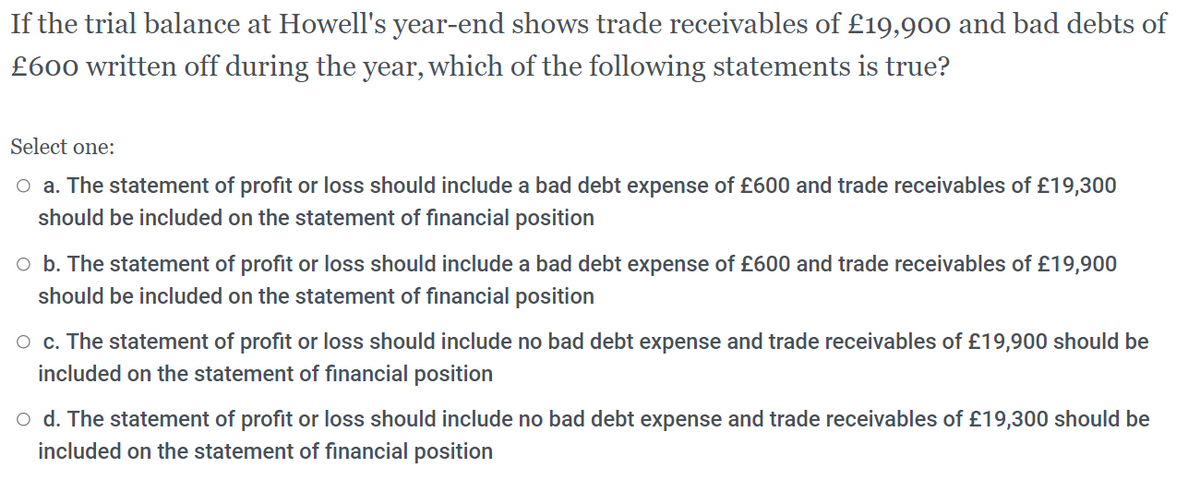

If the trial balance at Howell's year-end shows trade receivables of £19,900 and bad debts of £600 written off during the year, which of the following statements is true? Select one: O a. The statement of profit or loss should include a bad debt expense of £600 and trade receivables of £19,300 should be included on the statement of financial position o b. The statement of profit or loss should include a bad debt expense of £600 and trade receivables of £19,900 should be included on the statement of financial position o c. The statement of profit or loss should include no bad debt expense and trade receivables of £19,900 should be included on the statement of financial position o d. The statement of profit or loss should include no bad debt expense and trade receivables of £19,300 should be included on the statement of financial position

If the trial balance at Howell's year-end shows trade receivables of £19,900 and bad debts of £600 written off during the year, which of the following statements is true? Select one: O a. The statement of profit or loss should include a bad debt expense of £600 and trade receivables of £19,300 should be included on the statement of financial position o b. The statement of profit or loss should include a bad debt expense of £600 and trade receivables of £19,900 should be included on the statement of financial position o c. The statement of profit or loss should include no bad debt expense and trade receivables of £19,900 should be included on the statement of financial position o d. The statement of profit or loss should include no bad debt expense and trade receivables of £19,300 should be included on the statement of financial position

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 12EB: Clovis Enterprises reports $845,500 in credit sales for 2018 and $933,000 in 2019. It has a $758,000...

Related questions

Question

How to do? 2

Transcribed Image Text:If the trial balance at Howell's year-end shows trade receivables of £19,900 and bad debts of

£600 written off during the year, which of the following statements is true?

Select one:

O a. The statement of profit or loss should include a bad debt expense of £600 and trade receivables of £19,300

should be included on the statement of financial position

o b. The statement of profit or loss should include a bad debt expense of £600 and trade receivables of £19,900

should be included on the statement of financial position

O c. The statement of profit or loss should include no bad debt expense and trade receivables of £19,900 should be

included on the statement of financial position

o d. The statement of profit or loss should include no bad debt expense and trade receivables of £19,300 should be

included on the statement of financial position

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,