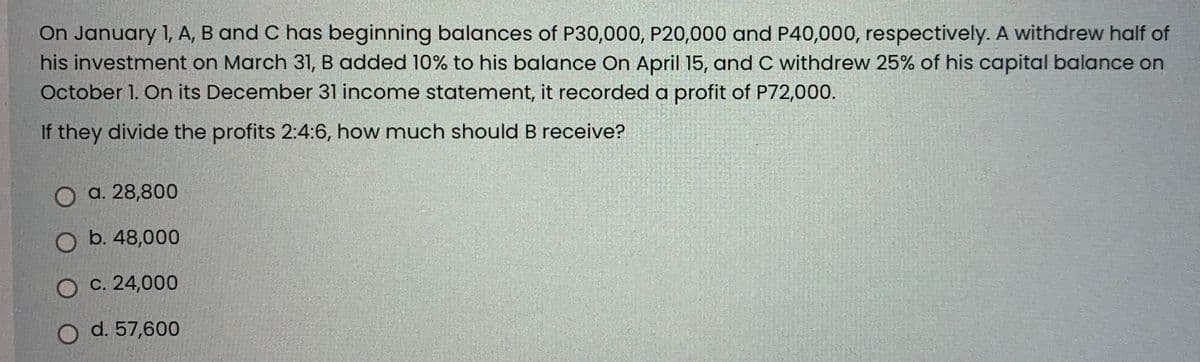

If they divide the profits 2:4:6, how much should B receive?

Q: 55. On March 1, 2021, a company issued a four-year, P3,000,000 face value, 11% term bonds for…

A:

Q: Dream Big Pillow Co., pays 65% of its purchases in the month of purchase, 30% the month after the…

A: The cash payment to suppliers is recorded in the cash disbursement schedule.

Q: s basis was $1,800, and land in which interest was $25,000, gain or loss on the distribution?

A: In case of liquidating contribution, partner's basis must be reduced to zero in all cases. Cash,…

Q: QUESTION 28 During the year of 2021, Johnson Corporation, an S Corporation has a recognized Built-in…

A:

Q: 10. Which of the following statements is correct concerning legal capital? Group of answer choices…

A: LEGAL CAPITAL IS THE CAPITAL CONTRIBUTED BY SHAREHOLDERS COMES FROM SALE OF SHARES OF STOCK .…

Q: On March 1, 2021, BabyM company issued a four-year, P3,000,000 face value, 11% term bonds for…

A: Bonds issued at Premium: When a bond is issued at a premium, that means that the bond is sold for an…

Q: B. While examining the accounts of Granny Co. on December 31, 2020, the following errors were…

A: Part1: Corrected Net Income of 2019 Unadjusted Net Income of 2019…

Q: For each of the following statements indicate if the statement is true or false. In your answer book…

A:

Q: 10 In a liquidating distribution Ann receives cash of $3,000, inventory in which the partnership's…

A: A corporation is liquidated by selling its assets and using the proceeds to pay creditors &…

Q: Donahue Oil has an account titled Oil and Gas Properties. Donahue paid $6,700,000 for oil reserves…

A: Depletion expense is the reduction in the value of asset due to its use. Depletion is a…

Q: The following information has been extracted from the financial statements of Muggie Pty. Ltd., a…

A: Net profit is the net income of the business after considering all the expenses and all the incomes…

Q: Assume a company is considering adding a new product. The expected cost and revenue data for this…

A: Contribution margin per unit = Selling price - Variable Cost

Q: How to help improve or increase the current ratio of a rural bank? How to increase ROA and ROE?

A: Current ratio tells about the liquidity status of the organization, it can be ascertained…

Q: A company has suffered operating losses for some time but is now operating profitably and expects to…

A: When there lies a deficit in the retained earnings on the balance sheet of a company then quasi…

Q: a. Break down the material cost variance into different related variances: price variance, usage…

A:

Q: King Mattresses sells both mattress sets and bed frames. Last quarter, total sales were $62,000 for…

A: Total Return on Sales: Return on sales is a financial statistic that determines how well a firm is…

Q: Exchange differences arising from the translation of financial statemen of a foreign operation shall…

A: When company has subsidiary in the foreign country than the assets and liabilities are to be…

Q: On January 1, 2022, A company issued 1,000 of its January 1, 2017, 8%, 10 year, P1,000 face value…

A:

Q: True or False: Borrowing and repaying debt principal does not impact net worth. Select one: O True…

A: Introduction: The net worth of a firm is that the total of its assets minus its liabilities as…

Q: What is the advantage of adopting environmental accounting as part of their accounting system in a…

A: Environmental accounting refers to maintaining accounts for costs and benefits associated with the…

Q: A company reported the following information on December 31, 2021: Preference share, P100 par…

A: Total shareholders' equity is the amount of funds of the shareholders outstanding in the statement…

Q: B. On January 1, 20X3, GG Co. purchased a new machine for P600,000. The machine had an es- timated…

A: Depreciation Expenses There are different method which are used to calculate the deprecation cost of…

Q: 6. Business A and Business B are both engaged in retailing, but seem to take a different approach to…

A: INTRODUCTION: The aim of the financial statements is to provide financial information about a…

Q: The auditor assigned to audit the property, plant and equipment requested a schedule of property…

A: 1. Completeness assertions : This assertion asserts that all the transactions are recorded in…

Q: Donahue Oil has an account titled Oil and Gas Properties. Donahue paid $6,700,000 for oil reserves…

A: Journal entry is the primary step to record the transaction in the books of account. The debit and…

Q: 10 In a liquidating distribution Ann receives cash of $3,000, inventory in which the partnership's…

A: Gain / (Loss) on distribution= Interest - Cash received - Inventory - Land basis. = $25000 - $3000 -…

Q: . X assigned his partnership shares to Y. X did not get the consent from the other partners but he…

A: Comment- We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: Adjusted trial balance Format on the photo attached

A: FALLEN MOON legal services Adjusted Trail Balance on 31, December 20x0 Account no. Account title…

Q: C) majority and mino:

A: Stockholders are the people associated with the company but have a separate entity so they are…

Q: dentify w

A: Shareholders also invest money in the company and in return they become the owners in proportion to…

Q: Problemt No. 1- Fallen Moon Legal Services Below are the details from the books of Fallen Moon Legal…

A: Adjusting entries are passed at the end of an accounting period to record any unrecorded income or…

Q: Which of the following considerations would not be relevant in determining the entity's functional…

A: As per IAS 21 , Effects of changes in foreign exchange rates The entity should measure its assets,…

Q: She Company granted 200 share appreciation rights to each of the 1,000 employees on January 1, 2021.…

A: Share appreciation rights are the employee compensation that is linked to the stock price of the…

Q: Santa Maria College, Inc. a proprietary educational institution, spent P 20,000,000 for the…

A: Building is an asset and must be depreciated as per the method employed by the owner of the Asset.…

Q: Wynn Farms reported a net operating loss of $180,000 for financial reporting and tax purposes in…

A: 1. Net Operating loss carryback Amount Rate of Tax Tax Recorded as Carried back - 2017 $0 30%…

Q: 3. Buildz Manufacturing currently produces 1,000 tables per month. The following per unit data for…

A: Total variable cost per table = 50+10+15 = £75

Q: On the part of the debtor, debt restructuring generally will result in Group of answer choices a.…

A: debt restructuring the process that can reduce the interest on the loan for extend the due date for…

Q: C) the board of d. the corporation.

A: Stockholders are the Persons of entities whom the company issues its ownership rights in the form of…

Q: Nicanor, single, received the following in 2022: Proceeds of his life insurance paid at annual…

A: Proceeds of his life insurance paid at an annual premium of P15,000 within 25 years - P2,000,000…

Q: If treasury shares are subsequently retired and the cost of the treasury shares exceeds the par…

A: Solution: When treasury shares subsequently retired where cost exceeds par value, then difference is…

Q: In translating a foreign subsidiary's financial statements, which exchange rates does the current…

A: Introduction:- As per U.S. GAAP the current rate method is required for translating (assets and…

Q: A, B, C and D are known robbers in their community. They created a Jewelry-on-hand Partnership so…

A: In any partnership, there are two or more partners who are responsible for running the business…

Q: 9. Which of the following items would be excluded from current liabilities? Group of answer choices…

A: According to IFRS, a liability is classified as ‘current’ if it meets any of the following…

Q: Boa City had the following fixed assets: Fixed Assets used in proprietary fund activities Fixed…

A: Government wide statement of net position is overall net fixed invested by government in different…

Q: what are the top 3 most important sources of revenues, and the top 3 most important sources of…

A: a. sales ( Accounts Receivable) b. interest on temporary investment c. other income ( supplies)

Q: Exercise 18-20 (Algorithmic) (LO. 3) Included in Mary's gross estate are the following assets. Fair…

A: Introduction: A stock is a type of instrument that shows the holder has proportional ownership in…

Q: On January 4, 2021, Jonathan Company purchased 75% interest in Monica Corporation for P300,000.…

A:

Q: A was the designated managing partner in the Articles of Partnership. One day, A received an order…

A: A was the designated managing partner in the Articles of Partnership. One day, A received an order…

Q: Bonita Corporation’s December 31, 2020 balance sheet showed the following: 9% preferred stock, $10…

A: Stockholders' equity represents the difference of total assets and total liabilities of the company.…

Q: In what way is compensation similar to payment? Explain each by giving examples or cases that you…

A: Compensation : It a payment given in exchange of services. It is a form of a payment. It can only…

Step by step

Solved in 2 steps

- Assume that as of January 1, 20Y8, Sylvester Con- suiting has total assets of $500,000 and total assets of $150,000. As of December 31, 20Y8, Sylvester has total liabilities of $200,000 and total stockholders’ equity of $400,000. (a) What was Sylvester’s stockholders’ equity as of January 1, 20Y8? (b) Assume that Sylvester did not pay any dividends during 20Y8. What was the amount of net income for 20Y8?For the current year, Vidalia Company reported revenues of 250,000 and expenses of 225,000. At the beginning of the year, its retained earnings had a balance of 95,000. During the year, Vidalia paid 11,000 dividends to shareholders. Its contributed capital was 56,000 at the beginning of the year, and it did not issue any new stock during the year. Vidalias assets total 237,500 on December 31 of the current year. What are Vidalias total liabilities on December 31 of the current year?Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of goods sold was 240,000, its operating expenses were 50,000, its interest revenue was 2,000, and its interest expense was 12,000. Brandts income tax rate is 30%. Prepare Brandts multiple-step income statement for the current year.

- Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of $78,000 and $55,000, respectively, on January 1, 20Y4, the beginning of the fiscal year. On March 10, Grecco invested an additional $8,000. During the year, Grecco and Rosenfeld withdrew $41,000 and $33,000, respectively, and net income for the year was $104,000. Revenues were $525,000, and expenses were $421,000. The articles of partnership make no reference to the division of net income. Question Content Area a. Journalize the entry to close the revenues and expenses. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - Question Content Area Journalize the entry to close the drawing accounts. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - - Select - - Select - -…The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of $45,730 and $70,240, respectively, on January 1, 20Y4, the beginning of the fiscal year. On March 10, Grecco invested an additional $7,700. During the year, Grecco and Rosenfeld withdrew $32,920 and $38,850, respectively, and net income for the year was $62,000. Revenues were $483,000, and expenses were $421,000. The articles of partnership make no reference to the division of net income. a. Journalize the entries to close (1) the revenues and expenses and (2) the drawing accounts on December 31. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. b. Prepare a statement of partnership equity for the current year for the partnership of Grecco and Rosenfeld. Be sure to…

- The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of $44,880 and $71,910, respectively, on January 1, 20Y4, the beginning of the fiscal year. On March 10, Grecco invested an additional $7,750. During the year, Grecco and Rosenfeld withdrew $30,730 and $38,870, respectively, and net income for the year was $62,000. Revenues were $483,000, and expenses were $421,000. The articles of partnership make no reference to the division of net income. Required: a. Journalize the entries to close (1) the revenues and expenses and (2) the drawing accounts on December 31. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. b. Prepare a statement of partnership equity for the current year for the partnership of Grecco and Rosenfeld. Be…The capital accounts of Moli and Golu showed balances of Rs.40,000 andRs. 20,000 as on April 01, 2016. They shared profits in the ratio of 3:2. Theyallowed interest on capital @ 10% p.a. and interest on drawings, @ 12 p.a. Golu advanced a loan of Rs. 10,000 to the firm on August 01, 2016.During the year, Moli withdrew Rs. 1,000 per month at the beginning of every month whereas Golu withdrew Rs. 1,000 per month at the end of every month. Profit for the year, before the above mentioned adjustments was Rs.20,950. Calculate intereston drawings show distribution of profits and prepare partner’s capital accounts.On May 1, Republic Corporation purchased 400 shares of stock for P114 per share and held it as FVTPL financial assets. The price decreased to P106 per share on August 1 and then increased to P122 on December 31. During the year, the company received dividends of P3.50 per share. At what amount should the investment be valued in the December 31 balance sheet?

- On January 1, 2021, the balance of Owner's Capital of FDN Company is P440,000. During the year the company has Sales of P500,000 with P350,000 as cost of sales and expenses resulting to net income of P150,000. Also, during the year, the owner made additional investment of P600,000 and withdrew P500,000. How much is the Owner's Capital on December 31, 2021?The Distance Plus parnership has the following capital balances at the beginning of the current year. Tiger (40% of profits and losses) $65,000 Phil (20%) $35,000 Ernie (40%) $50,000 Each of the following questions should be viewed independently. a. If Sergio invests $70,000 in cash in the business for a 30% interest, what journal entry is recorded. Assume the bonus method is used. b. If Sergio invests $60,000 in cash in the business for a 30% interest, what journal entry is recorded. Assume the bonus method is used. c. If Sergio invests $72,000 in cash in the business for a 30% interest, what journal entry is recorded. Assume the goodwill method is used.