Ignoring income taxes, what is the total effect of the errors on 2022 net income? ( Leave the numerical figure positive, put a dash then identify if OVERSTATED or UNDERSTATED, example: 25000-OVERSTATED)

Ignoring income taxes, what is the total effect of the errors on 2022 net income? ( Leave the numerical figure positive, put a dash then identify if OVERSTATED or UNDERSTATED, example: 25000-OVERSTATED)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10MC: Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended...

Related questions

Question

Ignoring income taxes, what is the total effect of the errors on 2022 net income? ( Leave the numerical figure positive, put a dash then identify if OVERSTATED or UNDERSTATED, example: 25000-OVERSTATED)

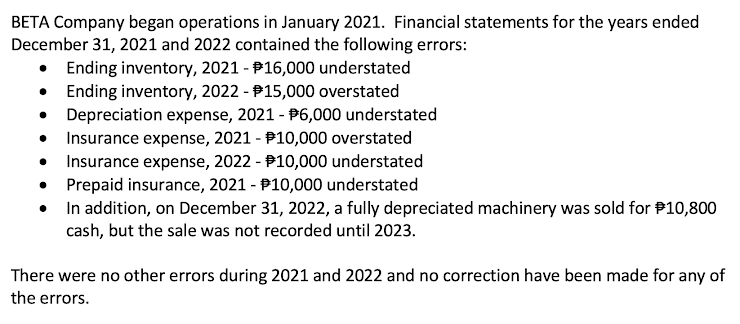

Transcribed Image Text:BETA Company began operations in January 2021. Financial statements for the years ended

December 31, 2021 and 2022 contained the following errors:

Ending inventory, 2021 - P16,000 understated

• Ending inventory, 2022 - P15,000 overstated

• Depreciation expense, 2021 - P6,000 understated

Insurance expense, 2021 - P10,000 overstated

Insurance expense, 2022 - P10,000 understated

• Prepaid insurance, 2021 - P10,000 understated

• In addition, on December 31, 2022, a fully depreciated machinery was sold for P10,800

cash, but the sale was not recorded until 2023.

There were no other errors during 2021 and 2022 and no correction have been made for any of

the errors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning