Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 59E

Effects of an Error in Ending Inventory

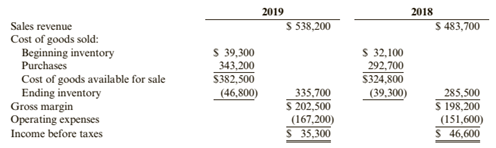

Waymire Company prepared the partial income statements presented below for 2019 and 2018.

During 2020, Waymire’s accountant discovered that ending inventory for 2018 had been understated by $6,500.

Required:

1. Prepare corrected income statements for 2019 and 2018.

2. Prepare a schedule showing each financial statement item affected by the error and the amount of the error for that item (ignore the effect of income taxes). Indicate whether each error is an overstatement (+) or an understatement (-).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Cornerstones of Financial Accounting

Ch. 6 - Prob. 1DQCh. 6 - Describe the types of inventories used by...Ch. 6 - Compare the flow of inventory costs between...Ch. 6 - What are the components of cost of goods available...Ch. 6 - How is cost of goods sold determined?Ch. 6 - How do the perpetual and periodic inventory...Ch. 6 - Why are perpetual inventory systems more expensive...Ch. 6 - Prob. 8DQCh. 6 - Prob. 9DQCh. 6 - Prob. 10DQ

Ch. 6 - Prob. 11DQCh. 6 - Why do the four inventory costing methods produce...Ch. 6 - The costs of which units of inventory (oldest or...Ch. 6 - If inventory prices are rising, which inventory...Ch. 6 - How would reported income differ if LIFO rather...Ch. 6 - Prob. 16DQCh. 6 - Why are inventories written down to the lower of...Ch. 6 - What is the effect on the current period income...Ch. 6 - What do the gross profit and inventory turnover...Ch. 6 - Prob. 20DQCh. 6 - How does an error in the determination of ending...Ch. 6 - ( Appendix 6A) What accounts are used to record...Ch. 6 - ( Appendix 6B) For each inventory costing method,...Ch. 6 - If beginning inventory is $20,000, purchases are...Ch. 6 - Which of the following transactions would not...Ch. 6 - Briggs Company purchased $15,000 of inventory on...Ch. 6 - Prob. 4MCQCh. 6 - U-Save Automotive Group purchased 10 vehicles...Ch. 6 - Refer to the information for Morgan Inc. above. If...Ch. 6 - Prob. 7MCQCh. 6 - Refer to the information for Morgan Inc. above. If...Ch. 6 - When purchase prices are rising, which of the...Ch. 6 - Prob. 10MCQCh. 6 - Which of the following statements regarding the...Ch. 6 - Which of the following statements is true with...Ch. 6 - An increasing inventory turnover ratio indicates...Ch. 6 - Ignoring taxes, if a company understates its...Ch. 6 - Prob. 15MCQCh. 6 - ( Appendix 6B) Refer to the information for Morgan...Ch. 6 - ( Appendix 6B) Refer to the information for Morgan...Ch. 6 - Prob. 18MCQCh. 6 - Prob. 19CECh. 6 - Use the following information for Cornerstone...Ch. 6 - Use the following information for Cornerstone...Ch. 6 - Inventory Costing: FIFO Refer to the information...Ch. 6 - Inventory Costing: LIFO Refer to the information...Ch. 6 - Inventory Costing: Average Cost Refer to the...Ch. 6 - Effects of Inventory Costing Methods Refer to your...Ch. 6 - Lower of Cost or Market The accountant for Murphy...Ch. 6 - Inventory Analysis Singleton Inc. reported the...Ch. 6 - Inventory Errors McLelland Inc. reported net...Ch. 6 - Prob. 29CECh. 6 - ( Appendix 6B) Inventory Costing Methods: Periodic...Ch. 6 - ( Appendix 6B) Inventory Costing Methods: Periodic...Ch. 6 - ( Appendix 6B) Inventory Costing Methods: Periodic...Ch. 6 - Prob. 33BECh. 6 - Prob. 34BECh. 6 - Inventory Costing Methods Refer to the information...Ch. 6 - Effects of Inventory Costing Methods Refer to the...Ch. 6 - Lower of Cost or Market Garcia Company uses FIFO,...Ch. 6 - Inventory Analysis Callahan Company reported the...Ch. 6 - Prob. 39BECh. 6 - ( Appendix 6A) Recording Purchase and Sales...Ch. 6 - ( Appendix 6B) Inventory Costing Methods: Periodic...Ch. 6 - Prob. 42ECh. 6 - Prob. 43ECh. 6 - Perpetual and Periodic Inventory Systems Below is...Ch. 6 - Recording Purchases Compass Inc. purchased 1,250...Ch. 6 - Recording Purchases Dawson Enterprises uses the...Ch. 6 - Recording Purchases and Shipping Terms On May 12,...Ch. 6 - Prob. 48ECh. 6 - Recording Purchases and Sales Printer Supply...Ch. 6 - Inventory Costing Methods Crandall Distributors...Ch. 6 - Inventory Costing Methods On June 1, Welding...Ch. 6 - Financial Statement Effects of FIFO and LIFO The...Ch. 6 - Effects of Inventory Costing Methods Jefferson...Ch. 6 - Inventory Costing Methods Neyman Inc. has the...Ch. 6 - Effects of FIFO and LIFO Sheepskin Company sells...Ch. 6 - Lower of Cost or Market Merediths Appliance Store...Ch. 6 - Lower of Cost or Market Shaw Systems sells a...Ch. 6 - Analyzing Inventory The recent financial...Ch. 6 - Effects of an Error in Ending Inventory Waymire...Ch. 6 - Prob. 60ECh. 6 - ( Appendices 6A and 6B) Recording Purchases and...Ch. 6 - Prob. 62ECh. 6 - ( Appendix 6B) Inventory Costing Methods: Periodic...Ch. 6 - ( Appendix 6B) Inventory Costing Methods: Periodic...Ch. 6 - Applying the Cost of Goods Sold Model The...Ch. 6 - Recording Sale and Purchase Transactions Alpharack...Ch. 6 - Inventory Costing Methods Andersons Department...Ch. 6 - Inventory Costing Methods Gavin Products uses a...Ch. 6 - Lower of Cost or Market Sue Stone, the president...Ch. 6 - Inventory Costing and LCM Ortman Enterprises sells...Ch. 6 - Effects of an Inventory Error The income...Ch. 6 - ( Appendices 6A and 6B) Inventory Costing Methods...Ch. 6 - ( Appendix 6B) Inventory Costing Methods Jet Black...Ch. 6 - Prob. 65BPSBCh. 6 - Recording Sale and Purchase Transactions Jordan...Ch. 6 - Inventory Costing Methods Ein Company began...Ch. 6 - Inventory Costing Methods Terpsichore Company uses...Ch. 6 - Prob. 69BPSBCh. 6 - Prob. 70BPSBCh. 6 - Prob. 71BPSBCh. 6 - ( Appendices 6A and 6B) Inventory Costing Methods...Ch. 6 - ( Appendix 6B) Inventory Costing Methods Grencia...Ch. 6 - Prob. 74.1CCh. 6 - Prob. 74.2CCh. 6 - Prob. 75.1CCh. 6 - Inventory Costing When Inventory Quantities Are...Ch. 6 - Inventory Purchase Price Volatility In 2019, Steel...Ch. 6 - Prob. 77.1CCh. 6 - Prob. 77.2CCh. 6 - Errors in Ending Inventory From time to time,...Ch. 6 - Prob. 78.2CCh. 6 - Prob. 79.1CCh. 6 - Ethics and Inventory An electronics store has a...Ch. 6 - Ethics and Inventory An electronics store has a...Ch. 6 - Prob. 80.1CCh. 6 - Prob. 80.2CCh. 6 - Prob. 80.3CCh. 6 - Prob. 80.4CCh. 6 - Prob. 80.5CCh. 6 - Prob. 80.6CCh. 6 - Comparative Analysis: Under Armour, Inc., vs....Ch. 6 - Comparative Analysis: Under Armour, Inc., vs....Ch. 6 - Comparative Analysis: Under Armour, Inc., vs....Ch. 6 - Prob. 81.4CCh. 6 - Comparative Analysis: Under Armour, Inc., vs....Ch. 6 - Prob. 82.1CCh. 6 - CONTINUING PROBLEM: FRONT ROW ENTERTAINMENT In...Ch. 6 - Prob. 82.3C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Effects of an Inventory Error The income statements for Graul Corporation for the 3 years ending in 2019 appear below. During 2019, Graul discovered that the 2017 ending inventory had been misstated due to the following two transactions being recorded incorrectly. a. A purchase return of inventory costing $42,000 was recorded twice. b. A credit purchase of inventory' made on December 20 for $28,500 was not recorded. The goods were shipped F.O.B. shipping point and were shipped on December 22, 2017. Required: 1. Was ending inventory for 2017 overstated or understated? By how much? 2. Prepare correct income statements for all 3 years. 3. CONCEPTUAL CONNECTION Did the error in 2017 affect cumulative net income for the 3-year period? Explain your response. 4. CONCEPTUAL CONNECTION Why was the 2019 net income unaffected?arrow_forwardInventory Errors McLelland Inc. reported net income of $175,000 for 2019 and $210,000 for 2020. Early in 2020, McLelland discovers that the December 31, 2019 ending inventory was overstated by $20,000. For simplicity, ignore taxes. Required: 1. What is the correct net income for 2019? For 2020? 2. Assuming the error was not corrected, what is the effect on the balance sheet at December 31, 2019? At December 31, 2020?arrow_forwardAt the end of 2019, Manny Company recorded its ending inventory at 350,000 based on a physical count. During 2020, the company discovered that the correct inventory value at the end of 2019 should have been 400,000 because it made a counting error. Upon discovery of this error in 2020, what correcting journal entry will Manny make? Ignore income taxes.arrow_forward

- Schmidt Company began operations on January 1, 2018, and used the LIFO inventory method for both financial reporting and income taxes. However, at the beginning of 2020, Schmidt decided to switch to the average cost inventory method for financial and income tax reporting. It had previously reported the following financial statement information for 2019: An analysis of the accounting records discloses the following cost of goods sold under the LIFO and average cost inventory methods: There are no indirect effects of the change in inventory method. Revenues for 2020 total 130,000; operating expenses for 2020 total 30,000. Schmidt is subject to a 21% income tax rate in all years; it pays all income taxes payable in the next quarter. Assume that any deferred tax liability was paid in the subsequent year. Schmidt had 10,000 shares of common stock outstanding during all years; it paid dividends of 1 per share in 2020. At the end of 2020, Schmidt had cash of 15,600, inventory of 34,000, other assets of 76,000, income taxes payable of 4,200, and accounts payable of 3,000. It desires to show financial statements for the current year and previous year in its 2020 annual report. Required: 1. Prepare the journal entry to reflect the change in method at the beginning of 2020. Show supporting calculations. 2. Prepare the 2020 financial statements. Notes to the financial statements are not necessary. Show supporting calculations.arrow_forwardKoopman Company began operations on January 1, 2018, and uses they FIFO inventory method for financial reporting and the average cost inventory method for income taxes. At the beginning of 2020, Koopman decided to switch to the average cost inventory method for financial reporting. It had previously reported the following financial statement information for 2019: An analysis of the accounting records discloses the following cost of goods sold under the FIFO and average cost inventory methods: There are no indirect effects of the change in inventory method. Revenues for 2020 total 130,000; operating expenses for 2020 total 30,000. Koopman is subject to a 21% income tax rate in all years; it pays the income taxes payable of a current year in the first quarter of the next year. Koopman had 10,000 shares of common stock outstanding during all years; it paid dividends of 1 per share in 2020. At the end of 2020, Koopman had cash of 10,000, inventory of 24,000, other assets of 70,800, accounts payable of 4,500, and income taxes payable of 6,000. It desires to show financial statements for the current year and previous year in its 2020 annual report. Required: 1. Prepare the journal entry to reflect the change in methods at the beginning of 2020. Show supporting calculations. 2. Prepare the 2020 financial statements. Notes to the financial statements are not necessary. Show supporting calculations.arrow_forwardBorys Companys periodic inventory at December 31, 2019, is understated by 10,000, but purchases are correct. Johnson correctly values its 2020 ending inventory. What is the effect of this error on Boryss 2019 and 2020 financial statements?arrow_forward

- Company Edgar reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 12,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?arrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the allowance method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the direct method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forward

- Company Elmira reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 32,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?arrow_forwardInventory Valuation You are engaged in an audit of Roche Mfg. Company for the year ended December 31, 2019. To reduce the workload at year-end, Roche took its annual physical inventory under your observation on November 30, 2019. Roches inventory account, which includes raw materials and work in process, is on a perpetual basis, and it uses the first-in, first-out method of pricing. It has no finished goods inventory. The companys physical inventory revealed that the book inventory of 60,570 was understated by 3,000. To avoid distorting the interim financial statements, Roche decided not to adjust the book inventory until year-end except for obsolete inventory items. Your audit revealed this information about the November 30 inventory: Pricing tests showed that the physical inventory was overpriced by 2,200. Footing and extension errors resulted in a 150 understatement of the physical inventory. Direct labor included in the physical inventory amounted to 10,000. Overhead was included at the rate of 200% of direct labor. You determined that the amount of direct labor was correct and the overhead rate was proper. The physical inventory included obsolete materials recorded at 250. During December, these materials were removed from the inventory account by a charge to cost of sales. Your audit also disclosed the following information about the December 31, 2019, inventory. Total debits to certain accounts during December are: The cost of sales of 68,600 included direct labor of 13,800. Normal scrap loss on established product lines is negligible. However, a special order started and completed during December had excessive scrap loss of 800 which was charged to Manufacturing Overhead Expense. Required: 1. Compute the correct amount of the physical inventory at November 30, 2019. 2. Without prejudice to your solution to Requirement 1, assume that the correct amount of the inventory at November 30, 2019, was 57,700. Compute the amount of the inventory at December 31,2019.arrow_forwardGrimstad Company uses FIFO for internal reporting purposes and LIFO for financial reporting and income tax purposes. At the end of 2019, the following information was obtained from the inventory records: Required: 1. Prepare the necessary adjusting journal entry assuming that Grimstad converts the accounts to LIFO at the end of 2019. 2. Indicate how Grimstad would disclose the inventory value on its comparative balance sheets prepared at the end of 2019. 3. Next Level By how much would Grimstads cost of goods sold differ in 2019 if it used FIFO for external reporting?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License