← Quantitative Analytics BUS260 C chegg.com/homework-help/qu X Answered: ^^QG... | bartle My first project - MyBib + → C n qmplus.qmul.ac.uk/pluginfile.php/3569556/mod_resource/content/2/BUS260_Week10.pdf Quantitative Analytics - BUS260 - Forecasting 1 - Week 10 24 25 26 27 Exponential thing-Excel -52 FTSE 250 +0.70% 28 Q Search 28 / 28 172% + BUS260 - School of Business and Management 27/28 Exponential Smoothing - Excel Step 2 A B D E F G H 1 J K 1 Optimal Smoothing Constant (a) Q ✩ វា ☐ 2 3 α 0.1 Data Table for Replication for each smoothing constant 4 5 Period Demand Forecast Error² a 6 1 42 MSE 2.4141 Mean Squared Error 7 2 40 42 4 8 3 43 41.8 9 4 40 10 5 41 11 41.92 41.728 MSE 1.44 3.6864 0.529984 2.414096 12 0.05 2.44173 0.1 2.4141 0.15 2.41351 0.2 2.4371 0.25 2.48267 0.3 2.54856 4 13 0.35 2.63368 14 0.4 2.73738 15 16 17 18 2 8 རྞ ཀྵུ རྞ ཀྵུ 0.45 0.5 0.55 3.15967 0.6 3.33938 0.65 3.54043 2.85942 0 0.7 3.76456 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4 0.45 0.5 0.55 0.6 0.65 0.7 0.75 0.8 0.85 0.9 0.95 Smoothing constant (a) 0.75 4.01392 0.8 4.2911 0.85 4.59926 0.9 4.9421 0.95 5.32398 BUS260- School of Business and Management 28/28 to. > | 0 ✓ I New Chrome available: 11:15 12/04/2024 PRE III Quantitative Analytics - BUS260 C chegg.com/homework-help/qu b Answered: ^^^ G... | bartle X My first project - MyBib × + qmplus.qmul.ac.uk/pluginfile.php/3569556/mod_resource/content/2/BUS260_Week10.pdf Quantitative Analytics - BUS260 - Forecasting 1 - Week 10 20 21 24 / 28 156% + | 0 ☑ Q ✩ New Chrome available: Repeating sequentially the same argument, we obtain Ft= = aАt−1+α(1−a)At−2+a(1-a)² At−3+a(1−a)³At−4+…… BUS260- School of Business and Management 23/28 Exponential Smoothing - Example 2 Period t α t-1 a(1-a) Weight 0.2 0.16 0.4 0.24 t-2 a(1-a)² 0.128 22 t-3 a(1-a)³ t-4 a(1-a)4 0.1024 0.08192 0.144 0.0864 0.05184 0.45 0.4 0.35 t-5 a(1-a)5 0.065536 0.031104 0.3 t-6 a(1-a)6 0.052429 0.018662 t-7 a(1-a)' 0.041943 0.011197 t-8 a(1-a)8 Weights 0.25 0.2 0.033554 0.006718 0.15 t-9 a(1-a)⁹ 0.026844 0.004031 t-10 a(1-α) 10 0.1 0.021475 0.002419 t-11 a(1-a)¹¹ 23 t-12 a(1-a) 12 t-13 a(1-a) 13 t-14 a(1-a) 14 t-15 a(1-a) 15 t-16 a(1-a)16 t-17 a(1-a) 17 0.01718 0.001451 0.013744 0.000871 0.010995 0.000522 0.008796 0.000313 0.007037 0.000188 0.005629 0.000113 0.004504 6.77E-05 0.05 0 t-18 a(1-a) 18 0.003603 4.06E-05 t-19 a(1-a) 19 0.002882 2.44E-05 t-20 a(1-a) 20 0.002306 1.46E-05 FTSE 250 24 +0.70% Ő Search Exponential weights -a-0.2-a-0.4 t t-1 t-2 t-3 t-4 t-5 t-6 t-7 t-8 t-9 t-10t-11t-12t-13t-14t-15t-16t-17t-18t-19-20 Period 9 0 11:14 12/04/2024 PRE

hello so i just learnt about

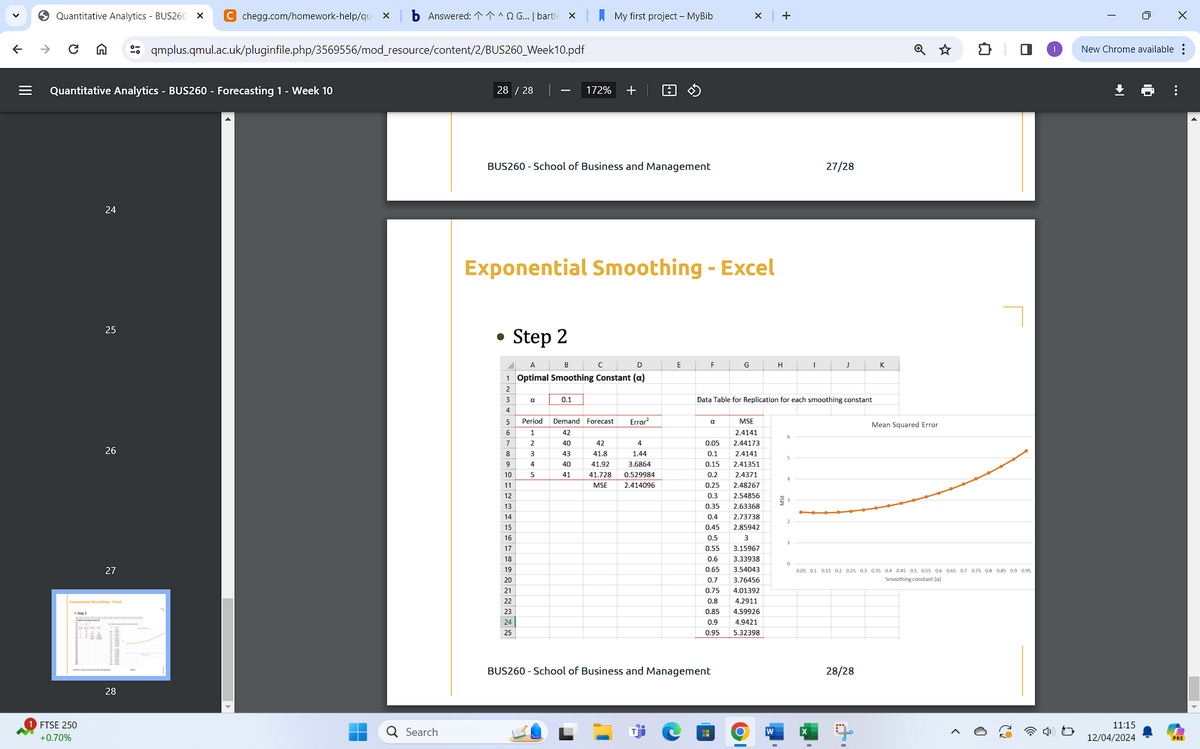

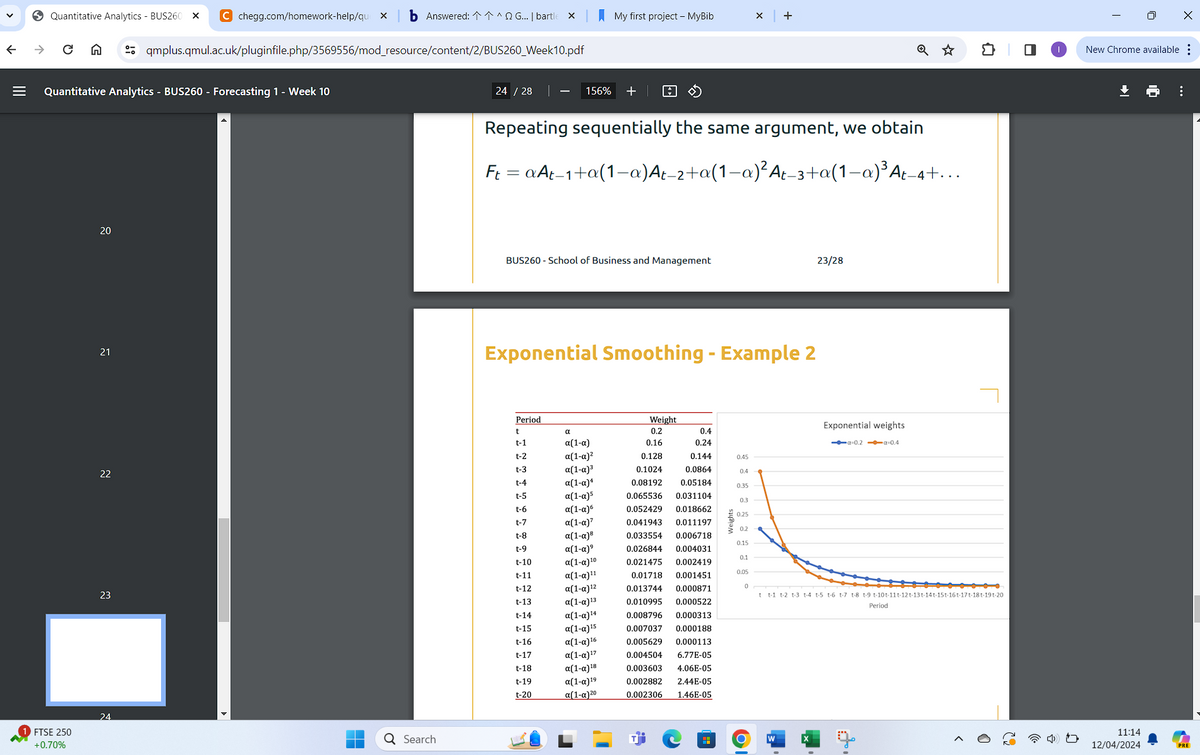

so question is about Forecasting in Picture 1 and 2 it shows what its meant to look like nothing to do with what i am gonna ask its just example but i still dont understand.

sorry for making this long i am not 100% sure if the pictures that i sent are example of what i am supposed to do for this question if you think its not just dont use it.

Here is the actual question:

| Month | Sales |

| Jan-16 | 747 |

| Feb-16 | 697 |

| Mar-16 | 1014 |

| Apr-16 | 1126 |

| May-16 | 1105 |

| Jun-16 | 1450 |

| Jul-16 | 1639 |

| Aug-16 | 1711 |

| Sep-16 | 1307 |

| Oct-16 | 1223 |

| Nov-16 | 975 |

| Dec-16 | 953 |

| Jan-17 | 1024 |

| Feb-17 | 928 |

| Mar-17 | 1442 |

| Apr-17 | 1371 |

| May-17 | 1536 |

| Jun-17 | 2004 |

| Jul-17 | 1854 |

| Aug-17 | 1951 |

| Sep-17 | 1516 |

| Oct-17 | 1642 |

| Nov-17 | 1166 |

| Dec-17 | 1106 |

| Jan-18 | 1189 |

| Feb-18 | 1209 |

| Mar-18 | 1754 |

| Apr-18 | 1843 |

| May-18 | 1769 |

| Jun-18 | 2207 |

| Jul-18 | 2471 |

| Aug-18 | 2288 |

| Sep-18 | 1867 |

| Oct-18 | 1980 |

| Nov-18 | 1418 |

| Dec-18 | 1333 |

| Jan-19 | 1333 |

| Feb-19 | 1370 |

| Mar-19 | 2142 |

| Apr-19 | 2138 |

| May-19 | 2078 |

| Jun-19 | 2960 |

| Jul-19 | 2616 |

| Aug-19 | 2861 |

| Sep-19 | 2237 |

| Oct-19 | 2225 |

| Nov-19 | 1590 |

| Dec-19 | 1659 |

| Jan-20 | 1613 |

| Feb-20 | 1605 |

| Mar-20 | 2349 |

| Apr-20 | 2468 |

| May-20 | 2532 |

| Jun-20 | 3127 |

| Jul-20 | 3288 |

| Aug-20 | 3285 |

| Sep-20 | 2485 |

| Oct-20 | 2723 |

| Nov-20 | 1835 |

| Dec-20 | 1894 |

(This is from Excel)

using the data above answer this:

Consider five years of monthly profit for a company

A) Plot the data and discuss its properties. Can you see any trend, seasonality or break?

B) Forecast monthly sales for 2022 choosing an appropriate method.

C) Discuss whether a simple exponential smoothing model works well with this data or not.

Step by step

Solved in 2 steps