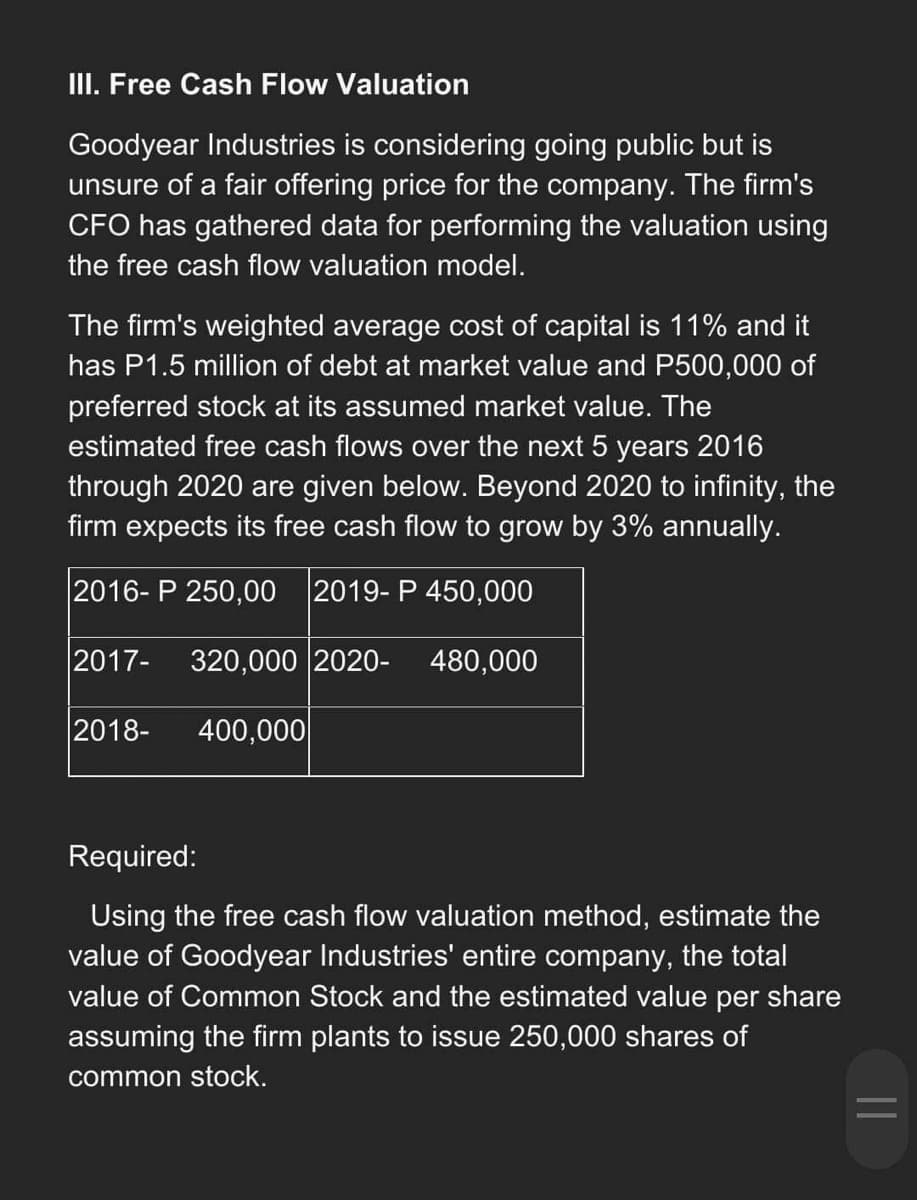

III. Free Cash Flow Valuation Goodyear Industries is considering going public but is unsure of a fair offering price for the company. The firm's CFO has gathered data for performing the valuation usin the free cash flow valuation model. The firm's weighted average cost of capital is 11% and it has P1.5 million of debt at market value and P500,000 o preferred stock at its assumed market value. The

Q: Hood Corp bonds have 19 years remaining until maturity, a 7% coupon rate, and a YTM of 4.2%. What is…

A: Compound = semiannual = 2 Time = t = 19 * 2 = 38 Coupon rate = 7 / 2 = 3.5% Yield To maturity = ytm…

Q: figure out how much total interest that you earn when you reach your investment goal, you…

A: When the investment is made then there are certain rate of interest that is charged upon such…

Q: Senate Inc. is considering two alternative methods for producing playing cards. Method 1 involves…

A: cashflow Disounted Cashflow year project S Project L PVF@ 9% project S Project L 0…

Q: Find the ratio of the present value of B's share to D's share.

A: Let's denote the payment amount as P, and the present value of A's share as V_A, B's share as V_B,…

Q: Illustration 2 • Annual returns for three funds and a market index are given below: Rp Op Fund A…

A: So when are we are analysing the performance of different fund we will be considering the total risk…

Q: Sazi Corporation is considering issuing long-term debt. The debt would have a 30 year maturity and a…

A: Data given: Description Data FV ($) 1000 Coupon rate 10% Discount 5% Flotation cost 5%…

Q: A Machine costs $20,000 and can be depreciated over its useful life of 5 years. The Machine can be…

A: The after-tax cost of a lease program refers to the net cost incurred by the lessee or lessor after…

Q: An analyst has gathered the following information about ABC Inc. and DEF Inc. The respective credit…

A: Credit spread is the difference in the market rates of two bonds with same maturity but different…

Q: The most recent financial statements for Mandy Company are shown here: Income Statement Balance…

A: Sustainable growth rate means the rate at which company is expecting to grow with the retained…

Q: Maulis Inc. is considering a project that has the following cash flow and WACC data. What is the…

A: A capital budgeting technique used to assess how profitable a project is the discounted payback…

Q: A firm has $60 million in equity and $40 million of debt, it pays dividends of 20% of net income,…

A: Equity=$60 million Debt=$40 million Net Income=$20 million Dividend=20% Required: Sustainable Growth…

Q: Presented below is information related to Al-Arab Company. Its capital structure consists of 80,000…

A: I will assume a tax rate of 30% for this example. Income Statement for Al-Arab Company (2020): Sales…

Q: The current price of a non-dividend-paying stock is $30. Over the next six months it i expected to…

A: Put options gives you opportunity to sell stock on maturity but there is no obligations to do that…

Q: b : Finance Pls answer very faast.I ll upvote. Thank You 10-yr bond, par value = $1000 Selling…

A: Some bond have option to call back after certain period of time this is done to give exist investors…

Q: SHARPE RATIO: TREYNOR RATIO JENSEN'S ALPHA INFORMATION RATIO R-SQUARED

A: First, we need to determine the following of each of the assets.Average return with excel function…

Q: Which has the greater future value after 5 years, $1000 invested at 8% with annual compounding or…

A: Here, Part A. Particulars Option 1 Option 2 Amount invested (PV) $1,000.00 $1,000.00…

Q: A company will buy a packaging machine. Information about the machines is given below. Which of the…

A: It is a case where the best machine is to be selected on the basis of net present value. A machine…

Q: An investment of Php5,000 is now valued at Php15,000. The annual interest rate is 3% compounded…

A: Compounding is an important part of the financial decision because the compounding is said to be the…

Q: Hansi is promised to receive $89 in 9 years. Hansi, being profligate, prefers to spend this promised…

A: Future value = fv = $89 Time = t = 9 years Interest rate = r = 6%

Q: An investment with a cost of capital higher than its internal rate of return should be accepted.…

A: Internal rate of return is also known as IRR. It is a capital budgeting techniques which help in…

Q: Hamlin Steel Company wishes to determine the value of Craft Foundry, a firm that it is considering…

A: The dividend discount model refers to the method of calculation of the share price based on the…

Q: The price of a stock is $64. A trader buys 1 put option contract (each contract is for 100 options)…

A: Put option gives the holder of option , right and not obligation to sell underlying asset at a…

Q: If the volatility of a non-dividend-paying stock is 20% per year and a risk-free rate is 5% per…

A: Here, Particulars Values Volatility 20% Risk-free rate 5% Time period 3 Total number of…

Q: A firm has sales of R23, total assets of R39 and total debt of R7. The net profit margin is 4%. What…

A: Return on equity; A measure of financial performance calculated by dividing net profit by…

Q: Assume that two stocks are available. The first stock (Stock A) has an expected return of 25% and a…

A: The minimum variance portfolio refers to the mix of risky assets taken in such a proportion as to…

Q: Bobbie has $6,000 that she wants to invest today to grow into $50,000. She finds an investment that…

A: Future value refers to the function of time, value, and money used for estimating the value of the…

Q: Which of the following is generally excluded in estimating the weighted average cost of capital? a.…

A: Weighted Average Cost of Capital is a weighted average of the components costs of long-term debt,…

Q: Which of the following describes a short put option? The obligation to sell an asset for a certain…

A: The put option give the right to the holder to sell the Asset by certain by certain date certain…

Q: Jeffersons are considering selling their current residence, buying a small home near Avery’s parents…

A: Mortgage loans are very common when buying homes and these secured loans against home as collateral…

Q: h plc has estimated the potential cash flows that would arise if they were successful in taking over…

A: NPV is a capital budgeting tool to help in deciding whether the capital project should be accepted…

Q: Your company is considering the purchase of new equipment. The equipment costs R350 000, and an…

A: Net present value (NPV) is computed by deducting initial investment from present value of cash…

Q: Suppose now that your portfolio must yield an expected return of 13% and be efficient, that is, on…

A: The expected return of a portfolio consisting of three securities is calculated as shown below.…

Q: which the property is expected to be sold

A: To calculate the internal rate of return (IRR) of the investment opportunity, we need to calculate…

Q: Give typing answer with explanation and conclusion 6. Six years ago, ABC Company invested $47,871 in…

A: Terminal cash flow are the generally the cash flows after all expenses and tax deductions, at the…

Q: When a client has elected to pay their advisory fees from the Program Brokerage account, who is…

A: Brokerage accounts are the Investment accounts through which investors can buy or sell different…

Q: DeltaCo has a payout ratio of 0.6 and it reinvests the remainder of earnings in new projects. If…

A: Payout ratio = 0.60 Earnings per share = $7.18 Expected return = 15% Required rate of return = 10.8%

Q: A stock's beta is 1.8 and the market risk premium is 6.6%. If the risk-free rate is 3.1%, what is…

A: The risk premium refers to the extra return over the risk-free rate that the stock provides for its…

Q: Calculate the cost of capital of a bond selling to yeild 13% for the purchaser of the bond. The…

A: Yield to purchaser = r = 13% Tax rate = t = 34%

Q: Find the periodic payment R required to accumulate a sum of S dollars over t years with interest…

A: The FV of an investment refers to the cumulative value of its cash flows at a future date assuming…

Q: Lavender Plantations Pty Ltd is contemplating acquiring a new machine to be used for a relatively…

A: The payback period calculation is all about knowing the investment that has been made by the company…

Q: Microsoft is considering issuing bonds that will mature in 20% with an 8% annual coupon rate. The…

A: 1. Price of bond = Present value of coupon payments + present value of maturity amount of bond 2.…

Q: Two enterprises, X and Y, own 100% of the stock of JV, a joint venture. All the equity, $10…

A: It is a case of variable interest entity (VIE) that is also applicable in the context of joint…

Q: For a $26,000 student loan with a 6% APR, how much of the payment will go toward the principal and…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: QUESTION TWO a) The fair value of a bond is based on the present value of expected future cash…

A: Bond valuation is the technique of determining theoretical fair price of a Bond. Fair Value of bond…

Q: You earn $17.50/hr and work 40 hr/wk. Your deductions are FICA (7.65%), federal tax withholding…

A: Emergency fund refers to the amount of cash that is kept aside as a reserve for the expenses that…

Q: A financial institution uses a loan base rate of 4.35% and sets the credit risk premium at 6.68%.…

A: Given: Loan origination Fee LOF = 1.5% Base loan rate = 4.35% Credit risk premium CRP = 6.68%…

Q: Q7: A father wants to save for his eight-year-old son's college expenses. The son will enter college…

A: Amount needed in 10 years = 40000 ( 1+0.06)^10 = $71,633 Year Amount needed in Constant $…

Q: Sub : Finance Pls answer very fast.I ll upvote. Thank You 10-yr bond, par value = $1000 Selling…

A: YTC is also called as Yield to call. It is a capital budgeting techniques which help in decision…

Q: The following financial data for a firm is provided to you. Calculate the Operating Cash Flow and…

A: Operating cash flow (OCF) the cash flow a firm generates from its normal operations calculated as…

Q: The management of the BST Inn estimated that they can generate $182,000 an- $190,000 in room…

A: The Management of the BST inn estimated that they can generate $182,000 and $190,000 in room revenue…

Step by step

Solved in 3 steps

- Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 12 %, and it has $3,060,000 of debt at market value and $610,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table. Beyond 2024 to infinity, the firm expects its free cash flow to grow by 6 % annually. Year (t) Free Cash Flow (FCF) 2020 $260,000 2021 $330,000 2022 $380,000 2023 $430,000 2024 $480,000 a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b.…Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 13%, and it has $1,720,000 of debt at market value and $340,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 1 through 5, 1 230,0002 270,0003 330,0004 360,0005 420,000After year 5, the firm expects its free cash flow to grow by 3% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If…Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 15 %, and it has $ 1,670,000 of debt at market value and $ 330,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table, Year (t) Free cash flow (FCF) 2020 $230,000 2021 $260,000 2022 $330,000 2023 $370,000 2024 $440,000 Beyond 2024 to infinity, the firm expects its free cash flow to grow by 5% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a,…

- (b) The Chief financial officer of Kurdishy Oil has given you the assignment of estimating thefirm’s cost of capital. The present capital structure, which is considered optimal, is as follows:Market ValueDebt $40 millionPreferred stock 5 millionCommon equity 55 millionThe anticipated financing opportunities are:1) Debt can be issued with a 15 percent before-tax cost.2) Preferred stock will be $100 par, carry a dividend of 13 percent, and can be sold at $96per share.3) Common equity has a beta of 1.20, rM = 17% and rf = 12%.Kurdishy’s tax rate is 40%.(i) Calculate the after-tax cost of debt, cost of preferred stock and cost of equity of GalaxyOil. (ii) What is the cost of capital of Kurdishy Oil? (iii) The CEO of Kurdishy asks you about the company’s capital structure. She wants toknow why the company doesn't use more preferred stock financing as it costs less thandebt. What would you tell the president? [Note: Confine your answer to no more acouple of lines.]Based on the free cash flow valuation model, you estimate Tigers Construction's value of operations is $750 million. Its balance sheet shows $50 million of short-term investments that are unrelated to operations, $100 million of accounts payable, $100 million of notes payable, $200 million of long-term debt, $40 million of common stock, and $160 million of retained earnings. Tigers has 10 million shares of stock outstanding. What is the best estimate for the stock price per share ? a. $45.1 b. $52.5 c. $47.5 d. $50.0 e. $42.9A group of investors is intent on purchasing a publicly traded company and wants to estimate the highest price they can reasonably justify paying. The target company’s equity beta is 1.20 and its debt-to-firm value ratio, measured using market values, is 60 percent. The investors plan to improve the target’s cash flows and sell it for 12 times free cash flow in year five. Projected free cash flows and selling price are as follows. ($ millions) Year 1 2 3 4 5 Free cash flows $38 $53 $58 $63 $ 63 Selling price $ 756 Total free cash flows $38 $53 $58 $63 $ 819 To finance the purchase, the investors have negotiated a $530 million, five-year loan at 8 percent interest to be repaid in five equal payments at the end of each year, plus interest on the declining balance. This will be the only interest-bearing debt outstanding after the acquisition. Selected Additional Information Tax rate 40 percent Risk-free interest rate 3 percent Market risk…

- A group of investors is intent on purchasing a publicly traded company and wants to estimate the highest price they can reasonably justify paying. The target company’s equity beta is 1.20 and its debt-to-firm value ratio, measured using market values, is 60 percent. The investors plan to improve the target’s cash flows and sell it for 12 times free cash flow in year five. Projected free cash flows and selling price are as follows. ($ millions) Year 1 2 3 4 5 Free cash flows $38 $53 $58 $63 $ 63 Selling price $ 756 Total free cash flows $38 $53 $58 $63 $ 819 To finance the purchase, the investors have negotiated a $530 million, five-year loan at 8 percent interest to be repaid in five equal payments at the end of each year, plus interest on the declining balance. This will be the only interest-bearing debt outstanding after the acquisition. Selected Additional Information Tax rate 40 percent Risk-free interest rate 3 percent Market risk…Summarize and discuss the implications of the findings for the business or potential business transaction. ---------------- McCaffrey's Inc. has never paid a dividend, and when the firm might begin paying dividends is not known. Its current free cash flow (FCF) is $100,000, and this FCF is expected to grow at a constant 7% rate. The weighted average cost of capital (WACC) is 11%. McCaffrey's currently holds $325,000 of non-operating marketable securities. Its long-term debt is $1,000,000, but it has never issued preferred stock. McCaffrey's has 50,000 shares of stock outstanding. McCaffrey's value of operations - $2,675,000 The company's total value - $3,000,000 The estimated value of common equity - $2,000,000 The estimated per-share stock price - $40Bakery co. make these assumptions for valuation purposes: a. The firm consists of a single asset that will generate pretax net cash flows of P3,000,000 per year forever. b. The income tax rate is 25%. c. After making paying taxes, the firm pays dividends to distribute any remaining cash flows to the equity shareholders each year. d. Equity shareholders have financed the asset entirely with P100,000,000 of equity capital. e. The cost of equity capital is 12%. 1. Compute for the dividend amount each year to the shareholders. 2. Compute for the dividend amount each year to the shareholders.

- A group of investors is intent on purchasing a publicly traded company and wants to estimate the highest price they can reasonably justify paying. The target company’s equity beta is 1.20 and its debt-to-firm value ratio, measured using market values, is 60 percent. The investors plan to improve the target’s cash flows and sell it for 12 times free cash flow in year five. Projected free cash flows and selling price are as follows. ($ millions) Year 1 2 3 4 5 Free cash flows $33 $48 $53 $58 $ 58 Selling price $ 696 Total free cash flows $33 $48 $53 $58 $ 754 To finance the purchase, the investors have negotiated a $480 million, five-year loan at 8 percent interest to be repaid in five equal payments at the end of each year, plus interest on the declining balance. This will be the only interest-bearing debt outstanding after the acquisition. Selected Additional Information Tax rate 40 percent Risk-free interest rate 3 percent Market risk…National Co. make these assumptions for valuation purposes:a. The firm consists of a single asset that will generate pretax net cash flows of P3,000,000 per year forever.b. The income tax rate is 25%.c. After making paying taxes, the firm pays dividends to distribute any remaining cash flows to the equity shareholders each year.d. Equity shareholders have financed the asset entirely with P100,000,000 of equity capital.e. The cost of equity capital is 12%.Compute for the value of the firm to the shareholders using dividend discount model?National Co. make these assumptions for valuation purposes:a. The firm consists of a single asset that will generate pretax net cash flows of P3,000,000 per year forever.b. The income tax rate is 25%.c. After making debt service payments and paying taxes, the firm pays dividends to distribute any remaining cash flows to the equity shareholders each year.d. The equity shareholders finance a portion of the investment in the asset with P60,000,000 of equity capital. (Equity ratio = 6/10 = 60%)e. The firm finances the remainder of the asset using P40,000,000 of debt capital. (Debt ratio = 40% = 4/10)f. This amount of debt in the firm’s capital structure does not alter substantially the risk of the firm to the equity investors, so they continue to require a 12% rate of return.g. The debt is issued at par, and it is less risky than equity; so the debt-holders demand interest of only 7% each year, payable at the end of each year.h. Interest expense is deductible for income tax…