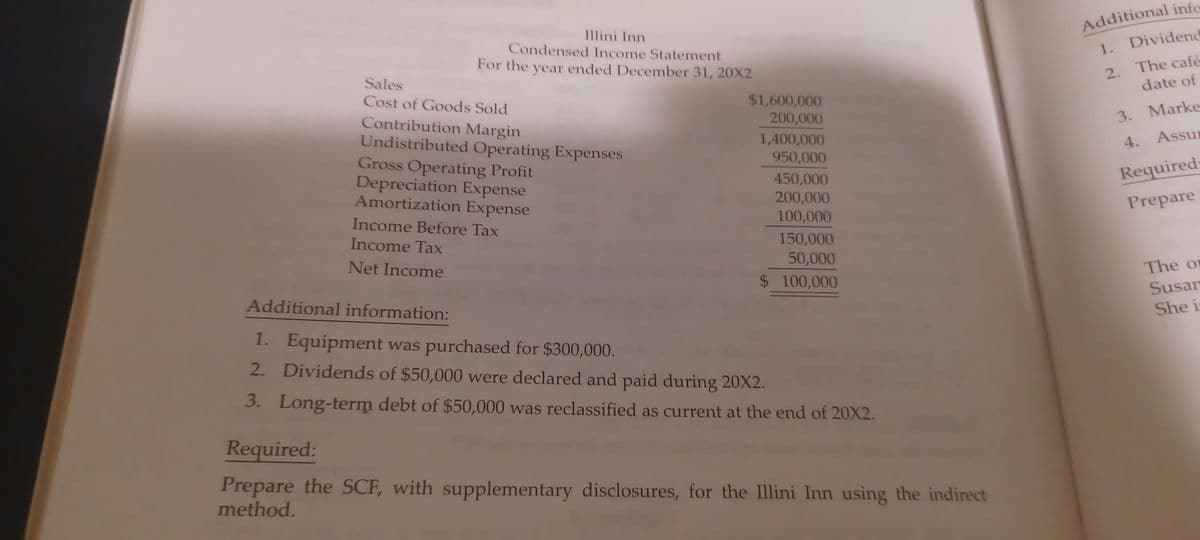

Illini Inn Condensed Income Statement For the year ended December 31, 20X2 Sales $1,600,000 200,000 Cost of Goods Sold Contribution Margin Undistributed Operating Expenses Gross Operating Profit Depreciation Expense Amortization Expense 1,400,000 950,000 450,000 200,000 100,000 Income Before Tax Income Tax 150,000 50,000 Net Income $ 100,000 Additional information: 1. Equipment was purchased for $300,000. 2. Dividends of $50,000 were declared and paid during 20X2. 3. Long-term debt of $50,000 was reclassified as current at the end of 20X2. Required: Prepare the SCF, with supplementary disclosures, for the Illini Inn using the indirect method.

Illini Inn Condensed Income Statement For the year ended December 31, 20X2 Sales $1,600,000 200,000 Cost of Goods Sold Contribution Margin Undistributed Operating Expenses Gross Operating Profit Depreciation Expense Amortization Expense 1,400,000 950,000 450,000 200,000 100,000 Income Before Tax Income Tax 150,000 50,000 Net Income $ 100,000 Additional information: 1. Equipment was purchased for $300,000. 2. Dividends of $50,000 were declared and paid during 20X2. 3. Long-term debt of $50,000 was reclassified as current at the end of 20X2. Required: Prepare the SCF, with supplementary disclosures, for the Illini Inn using the indirect method.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.10E: Components of the Statement of Cash Flows Identify each of the following items as operating (O),...

Related questions

Question

Help plz

Transcribed Image Text:Additional infe

Illini Inn

Condensed Income Statement

1. Dividend

2. The café

date of

For the year ended December 31, 20X2

Sales

Cost of Goods Sold

$1,600,000

200,000

3. Marke

Contribution Margin

Undistributed Operating Expenses

Gross Operating Profit

Depreciation Expense

Amortization Expense

Assur

1,400,000

950,000

4.

Required-

450,000

200,000

100,000

Prepare

Income Before Tax

150,000

50,000

Income Tax

Net Income

The or

$ 100,000

Susar

Additional information:

She i

1. Equipment was purchased for $300,000.

2. Dividends of $50,000 were declared and paid during 20X2.

3. Long-term debt of $50,000 was reclassified as current at the end of 20X2.

Required:

Prepare the SCF, with supplementary disclosures, for the Illini Inn using the indirect

method.

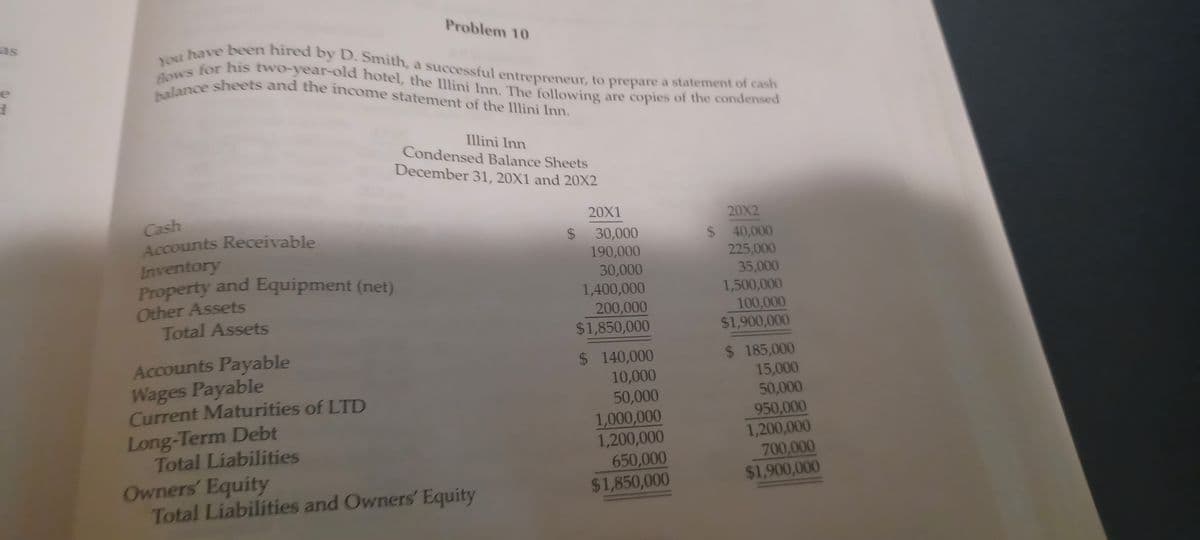

Transcribed Image Text:balance sheets and the income statement of the Illini Inn.

Property and Equipment (net)

You have been hired by D. Smith, a successful entrepreneur, to prepare a statement of cash

flows for his two-year-old hotel, the Illini Inn. The following are copies of the condensed

Problem 10

as

e

Illini Inn

Condensed Balance Sheets

December 31, 20X1 and 20X2

Cash

Accounts Receivable

Inventory

20X1

20X2

%24

30,000

190,000

30,000

1,400,000

200,000

$1,850,000

$ 40,000

225,000

35,000

1,500,000

100,000

$1,900,000

Other Assets

Total Assets

Accounts Payable

Wages Payable

Current Maturities of LTD

$ 185,000

15,000

50,000

950,000

1,200,000

700,000

$ 140,000

10,000

50,000

Long-Term Debt

Total Liabilities

1,000,000

1,200,000

650,000

$1,850,000

Owners' Equity

Total Liabilities and Owners' Equity

$1,900,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning