Trinity Company Income Statement Year Ended December 31,2018 Sales 238,000 COGS (153,000) 85,000 Operating Expenses Insurance Expenses (14,400) Interest Expenses (3,500) Salaries Expenses (12,000) Other Operating Expenses (42,600) Miscellaneous Expenses (11,100) (83,600) Operating Income 1,400 Other Income Gain on sales of Land 4,800 Profit before Tax (PBIT) 6,200 Income Tax Expenses (1,860) Net Income 4,340 Additional Information: 1. Trinity Company sold land with an original cost of Rs. 10,000, for Rs. 14,800 cash. 2. A new parcel of land was purchased for Rs. 20,000, in exchange for a note payable. 3. Plant assets were purchased for Rs. 40,000 cash. 4. Trinity declared and paid a Rs. 440 cash dividend to shareholders. 5. Trinity issued common stock in exchange for Rs. 45,000 cash. Required Prepare the Cashflow statement by using indirect method.

Trinity Company Income Statement Year Ended December 31,2018 Sales 238,000 COGS (153,000) 85,000 Operating Expenses Insurance Expenses (14,400) Interest Expenses (3,500) Salaries Expenses (12,000) Other Operating Expenses (42,600) Miscellaneous Expenses (11,100) (83,600) Operating Income 1,400 Other Income Gain on sales of Land 4,800 Profit before Tax (PBIT) 6,200 Income Tax Expenses (1,860) Net Income 4,340 Additional Information: 1. Trinity Company sold land with an original cost of Rs. 10,000, for Rs. 14,800 cash. 2. A new parcel of land was purchased for Rs. 20,000, in exchange for a note payable. 3. Plant assets were purchased for Rs. 40,000 cash. 4. Trinity declared and paid a Rs. 440 cash dividend to shareholders. 5. Trinity issued common stock in exchange for Rs. 45,000 cash. Required Prepare the Cashflow statement by using indirect method.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 3MC: Prince Corporations accounts provided the following information at December 31, 2019: What should be...

Related questions

Question

ASAP!!

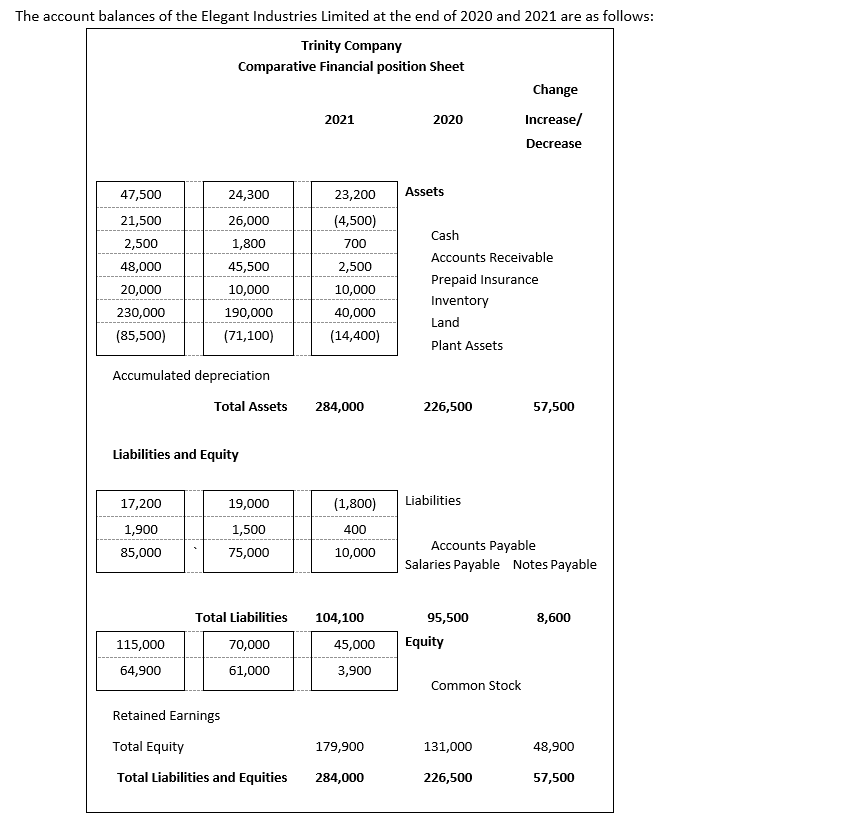

Transcribed Image Text:The account balances of the Elegant Industries Limited at the end of 2020 and 2021 are as follows:

Trinity Company

Comparative Financial position Sheet

Change

2021

2020

Increase/

Decrease

47,500

24,300

23,200

Assets

21,500

26,000

(4,500)

Cash

2,500

1,800

700

Accounts Receivable

48,000

45,500

2,500

Prepaid Insurance

20,000

10,000

10,000

Inventory

230,000

190,000

40,000

Land

(85,500)

(71,100)

(14,400)

Plant Assets

Accumulated depreciation

Total Assets

284,000

226,500

57,500

Liabilities and Equity

17,200

19,000

(1,800)

Liabilities

1,900

1,500

400

Accounts Payable

Salaries Payable Notes Payable

85,000

75,000

10,000

Total Liabilities

104,100

95,500

8,600

115,000

70,000

45,000

Equity

64,900

61,000

3,900

Common Stock

Retained Earnings

Total Equity

179,900

131,000

48,900

Total Liabilities and Equities

284,000

226,500

57,500

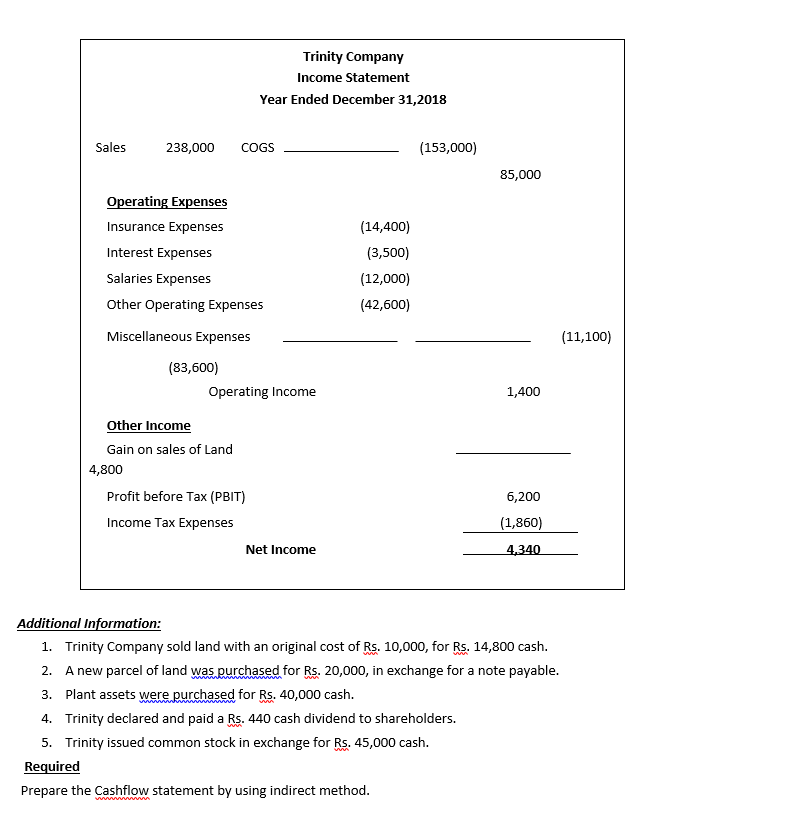

Transcribed Image Text:Trinity Company

Income Statement

Year Ended December 31,2018

Sales

238,000

COGS

(153,000)

85,000

Operating Expenses

Insurance Expenses

(14,400)

Interest Expenses

(3,500)

Salaries Expenses

(12,000)

Other Operating Expenses

(42,600)

Miscellaneous Expenses

(11,100)

(83,600)

Operating Income

1,400

Other Income

Gain on sales of Land

4,800

Profit before Tax (PBIT)

6,200

Income Tax Expenses

(1,860)

Net Income

4,340

Additional Information:

1. Trinity Company sold land with an original cost of Rs. 10,000, for Rs. 14,800 cash.

2. A new parcel of land was purchased for Rs. 20,000, in exchange for a note payable.

3. Plant assets were purchased for Rs. 40,000 cash.

4. Trinity declared and paid a Rs. 440 cash dividend to shareholders.

5. Trinity issued common stock in exchange for Rs. 45,000 cash.

Required

Prepare the Cashflow statement by using indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning