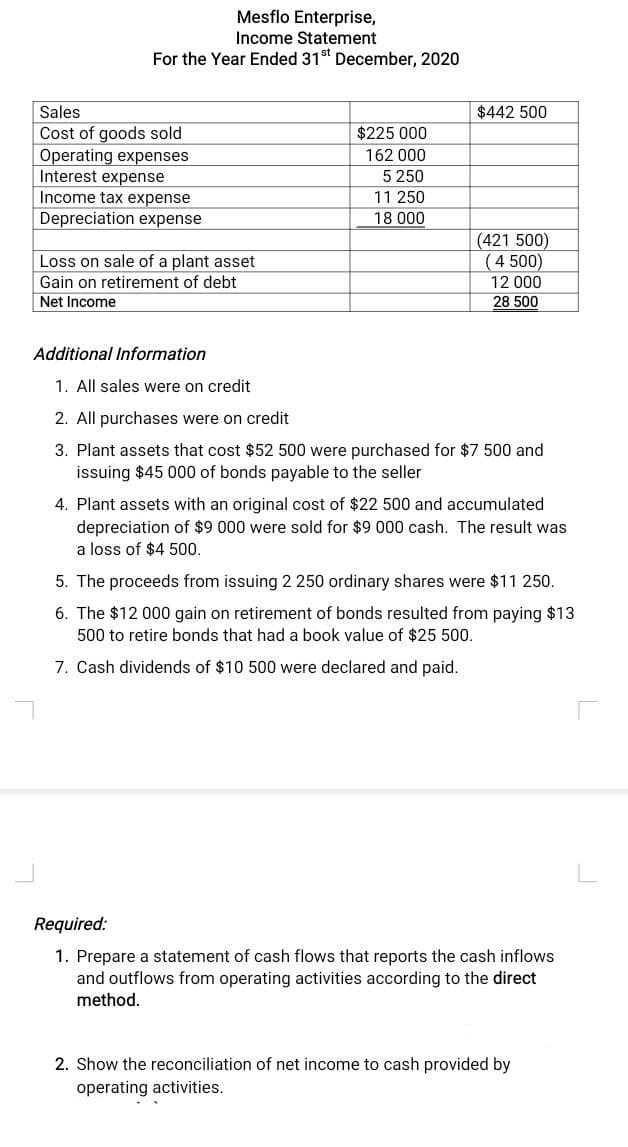

Mesflo Enterprise, Income Statement For the Year Ended 31t December, 2020 Sales $442 500 Cost of goods sold Operating expenses Interest expense Income tax expense Depreciation expense $225 000 162 000 5 250 11 250 18 000 (421 500) (4 500) Loss on sale of a plant asset Gain on retirement of debt Net Income 12 000 28 500 Additional Information 1. All sales were on credit 2. All purchases were on credit 3. Plant assets that cost $52 500 were purchased for $7 500 and issuing $45 000 of bonds payable to the seller 4. Plant assets with an original cost of $22 500 and accumulated depreciation of $9 000 were sold for $9 000 cash. The result was a loss of $4 500. 5. The proceeds from issuing 2 250 ordinary shares were $11 250. 6. The $12 000 gain on retirement of bonds resulted from paying $13 500 to retire bonds that had a book value of $25 500. 7. Cash dividends of $10 500 were declared and paid. Required: 1. Prepare a statement of cash flows that reports the cash inflows and outflows from operating activities according to the direct method. 2. Show the reconciliation of net income to cash provided by operating activities.

Mesflo Enterprise, Income Statement For the Year Ended 31t December, 2020 Sales $442 500 Cost of goods sold Operating expenses Interest expense Income tax expense Depreciation expense $225 000 162 000 5 250 11 250 18 000 (421 500) (4 500) Loss on sale of a plant asset Gain on retirement of debt Net Income 12 000 28 500 Additional Information 1. All sales were on credit 2. All purchases were on credit 3. Plant assets that cost $52 500 were purchased for $7 500 and issuing $45 000 of bonds payable to the seller 4. Plant assets with an original cost of $22 500 and accumulated depreciation of $9 000 were sold for $9 000 cash. The result was a loss of $4 500. 5. The proceeds from issuing 2 250 ordinary shares were $11 250. 6. The $12 000 gain on retirement of bonds resulted from paying $13 500 to retire bonds that had a book value of $25 500. 7. Cash dividends of $10 500 were declared and paid. Required: 1. Prepare a statement of cash flows that reports the cash inflows and outflows from operating activities according to the direct method. 2. Show the reconciliation of net income to cash provided by operating activities.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

Transcribed Image Text:Mesflo Enterprise,

Income Statement

For the Year Ended 31st December, 2020

Sales

$442 500

Cost of goods sold

Operating expenses

Interest expense

Income tax expense

Depreciation expense

$225 000

162 000

5 250

11 250

18 000

(421 500)

(4 500)

Loss on sale of a plant asset

Gain on retirement of debt

Net Income

12 000

28 500

Additional Information

1. All sales were on credit

2. All purchases were on credit

3. Plant assets that cost $52 500 were purchased for $7 500 and

issuing $45 000 of bonds payable to the seller

4. Plant assets with an original cost of $22 500 and accumulated

depreciation of $9 000 were sold for $9 000 cash. The result was

a loss of $4 500.

5. The proceeds from issuing 2 250 ordinary shares were $11 250.

6. The $12 000 gain on retirement of bonds resulted from paying $13

500 to retire bonds that had a book value of $25 500.

7. Cash dividends of $10 500 were declared and paid.

Required:

1. Prepare a statement of cash flows that reports the cash inflows

and outflows from operating activities according to the direct

method.

2. Show the reconciliation of net income to cash provided by

operating activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning