Q: Clark borrows P 600,000 at 15% compounded annually agreeing to repay the loan in 15 equal payments. ...

A: Loan amount (PV) = P600,000 Interest rate (r) = 15% Number of payments (n) = 15

Q: Pedro borrows P300,000.00 from lender ABC today at 12% compounded monthly. To fulfill his obligation...

A: A type of loan in which the borrower has to make a schedule for the periodic payment regarding both ...

Q: How much will be received in 6 years if Php35,000 is deposited in an account earning 5.5% interest p...

A: Compound interest is an investment method where the interest earned is reinvested back which earns e...

Q: Avicorp has a $11.7 million debt issue outstanding, with a 5.8% coupon rate. The debt has semi-annua...

A: Debt refers to the amount borrowed by a firm to finance its operations. It forms part of the long-te...

Q: Find the principal and the interest amount. Future Value (Maturity Value) Present Value Interest Amo...

A: Future value (S) = $6134.48 Interest rate (r) = 4.4% Period (t) = 222 days = 222/365 = 0.60821917808...

Q: 2. HYZEL Merchandising borrowed Php 300,000 from Partner's Bank at 15% simple interest for one year....

A: Borrowed amount = Php 300,000 Interest rate = 15%

Q: gets are related to the following management fuctions, except Performance evaluation Pla...

A: Step 1 Budgeting to plan and manage your finances. If you write down on paper or a computer, you can...

Q: A geometric gradient that increases at ? = 6% per year for 15 years is shown in the accompanying di...

A: It is given that:P = $500 Growth g- 6% Interest r- 12% Time n – 15 yrs

Q: A mining property is offered for sale for P5.7 M. On the basis of estimated production, an annual re...

A: Cost of property = P5,700,000 Annual return = P800,000 Period = 10 Years

Q: Determine the present value of payments of $100 at the end of each month for 20 years. Use a discoun...

A: Monthly payment (P) = $100 Interest rate = 6% Monthly interest rate (r) = 6%/12 = 0.50% Period = 20 ...

Q: Bart is a college student who has never invested his funds. He has saved $540 and has decided to in...

A: An initial investment accumulates interest. The future value is the accumulated value of the initial...

Q: An investor with a required return of 12 percent for very risky investments in common stock has anal...

A: We will use the dividend growth model to find the prices of stock A, Stock B, and Stock C. We will t...

Q: To finance a vacation in 4 years, Elsie saves $450 at the beginning of every six months in an accoun...

A: Future Value The future value is the amount that will be received at the end of a certain period. Th...

Q: 10. Find the present worth of an annual installment of P5000 for 10 years, if the money is worth 15%...

A: Annual payment (P) = P5000 Number of payments (n) = 10 Interest rate = 15% Effective annual rate (r)...

Q: Briely discuss the advantage and disadvantage of franchise.

A: A franchise is a sort of license that allows a franchisee to sell a product or service under the fra...

Q: Lin Lowe plans to deposit $1,800 at the end of every 6 months for the next 15 years at 8% interest c...

A: Amount Deposit = $1,800 Time Period = 15 Years Interest Rate = 8%

Q: Tomas Fishing Products is analyzing the performance of its cash management. On the average, the firm...

A: The question is based on the concept of the operating cycle, which is defined as time required for a...

Q: What is the bad result if a cashless society increases more private currency?

A: A cashless society is an economic situation during which financial transactions are administered wit...

Q: uestion 5 Jack deposits $5000 in an account which pays 5 percent compounded quarterly. How much will...

A: The compound interest is the method in which interest earned is reinvested which gives us even more ...

Q: e importance of establishing an effective risk management policy at insurance companies to manage un...

A: Introduction : In simple words, risk management refers to the phenomenon under which a company decre...

Q: At 6% interest rate, find the capitalized cost of a bridge whose cost is P 300 million and life is 2...

A: iAnswer - Capitalised Cost - A capitalized cost is recognized as part of a fixed asset as it is an ...

Q: NASDAQ O is an example of an auction market O is the largest secondary market in the world O is an e...

A: Primary Market: The primary market is also known as the new issue market is where the shares are is...

Q: Gold is currently trading at $1,645.50 per ounce with a carrying cost of $1.25 per ounce per month f...

A: The question is based on the concept of the cost and carry approach of the forward price of a commod...

Q: 29. Nonconstant Growth. Tattletale News Corp. has been growing at a rate of 20% per year, and you ex...

A: Here we will use the dividend discount model to find the answers.

Q: A wholesale company prices its inventory at $143,483. If the original price of the items was $229,62...

A: Transaction price = $143,483 Original price = $229,622

Q: What is an estimate of Growth Company's cost of equity? Growth Company also has preferred stock outs...

A: As per the Bartleby Q&A guidelines, when multiple sub-parts of the question are asked then an ex...

Q: Financial Institutions are intermediaries that play a vital role in nation-building. They source fun...

A: Financial institutions are vital because they create a marketplace for money and assets, allowing ca...

Q: oney for her two years old child education in the amount of fifty thousand pesos at the rate of 10 ½...

A: Given information : Current age of kid 2 Initial investment made 50000 Interest rate 10.50% ...

Q: Alyssa Stuart is thinking of starting a store that specializes in handmade Viennese style bentwood c...

A: Contribution margin It is the amount excess of variable cost. Contribution margin is calculated as s...

Q: Lawn Care, Inc., has sales of $367,400, costs of $183,600, depreciation of $48,600, interest of $39,...

A: Return on equity measures the return generated by common or equity shareholders from their sharehold...

Q: You’re buying your first house for $180,000, giving $35,000 as down payment. The amount you will fin...

A: The amount of interest payable over the term of the loan and the loan amount due is equal to the tot...

Q: A company purchase an equipment at a price of RM368 000 and makes a down payment of 10% of the purch...

A: The interest payment is equal to the difference between the total amount paid through loan installme...

Q: Samuelson will produce 20,000 units in January using level production. If each unit costs $500 to ma...

A: Production = 20,000 Units Opening balance = 10000 Units Sales = 15000 Units Cost per unit = $500

Q: After moving to Boston, Massachusetts, USA, Larry Winters borrowed $1,000,000 for a thirty year mort...

A: Here the monthly mortgage payment will be same amount throughout the period of 30 years.

Q: Suppose you are the money manager of a $4 million investment fund. The fund consists of four stocks...

A: Value of investment fund = $4,000,000 Stock Investment Beta Weighted beta A B C=B*(A/4,000,000)...

Q: What nominal rate compounded quarterly can be charged to a payment at a nominal interest rate of 12%...

A: Effective Annual Rate The effective annual rate of interest is the actual or the real rate of intere...

Q: 5.7. Projects A through E are being considered by an investor. They all are ten-year projects and th...

A: Capital rationing is a concept that refers to analyzing the present value of inflows and outflows to...

Q: Given 2 alternatives: dneleviupe erf First Cost 4,000 1,000 2,000 6,000 500 Annual Cost Annual Benef...

A: Let the first cost = F Annual cost = A Annual benefit = B Salvage value = S r = 10% n = 5 years for ...

Q: You are testing the no-arbitrage principle of the APT, and you find a well-diversified portfolio wit...

A: APT or the Arbitrage Pricing Theory is an asset's pricing model which shows the expected returns of ...

Q: Compute the discount if PhP 2000 is discounted for 6 months at 8% simple interest.

A: Present Value The present value is the value of cash flow stream or the fixed lump sum amount at tim...

Q: Find a sentence of a semi-annual payment with a periodic value of 300.00 riyals, and it is paid for ...

A: Simple Interest is calculated directly on the principal for the respective period of time. Simple I...

Q: In five years, P18,000 will be needed to pay for a building renovation. In order to generate this su...

A: Annuity refers to equal payments made in a fund at regular intervals. The amount so deposited genera...

Q: The one-year spot rate is 8 percent and the two-year spot rate is 10 percent. What is the price of a...

A: Hi, since there are three separate questions, we will answer the first one, as per authoring guideli...

Q: a) You invest 155 000 TL for a year. At the end the year, you have 174 375 TL net in your account. I...

A: We will apply the formula to calculate the real interest rate using the nominal interest rate and in...

Q: very successful health and recreation club wants to construct mock mountain for Climbing and exercis...

A: Net present value of the project is the present value of all future cost associated with the project...

Q: A Bond par value sh. 100 coupon rate 7% investment period 10 years a) Determine the value of the ...

A: Par Value of Bond is sh 100 Coupon Rate is 7% Coupon Payment is 7%*100=7sh Time Period is 10 years I...

Q: The Tomac Swim Club arranged short-term financing of $13,100 .00 on July 5 with the Bank of Commerce...

A: Borrowed Amount is $13,100 Payment on 25 Sept is $5,900 Payment on 11 Nov is $3,400 Balance on 30th...

Q: What three real-world complications keep purchasing power parity from being a complete explanation o...

A: Purchasing power parity-It states that exchange rates between two currencies are in equilibrium,i.e....

Q: Assume you have an optimal risky portfolio with an expected return of 17% and a standard deviation o...

A: Expected return (Re) = 17% Risk free rate (Rf) = 5% Risk aversion measure (A) = 2 Standard deviation...

Q: Question: As data is attached to the image. You are required to comment/analyze on Artistic Denim Mi...

A: Leverage: The leverage of a company indicates how much of the asset is financed through debt. Debt i...

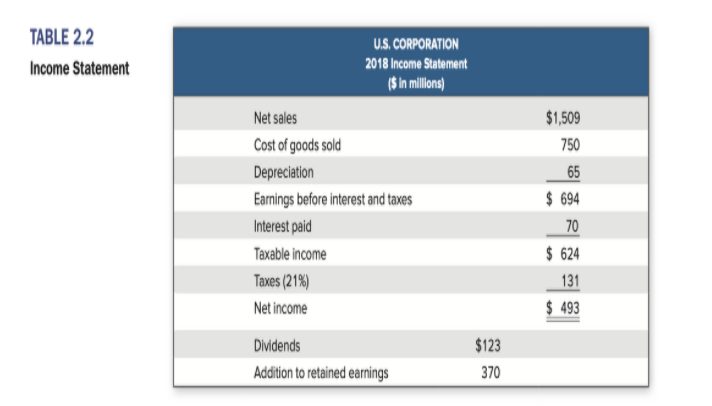

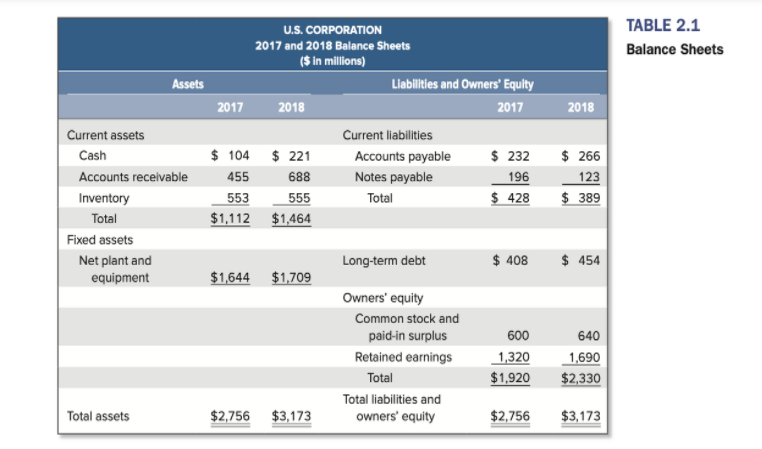

- What is the operating cash flow in 2018?

- What is the change of working capital in 2018?

- What is the capital spending in 2018?

- What is the

free cash flow in 2018?

5. What is the cash flow to creditors in 2018?

6. What is the cash flow to stockholders in 2018?

Step by step

Solved in 2 steps

- SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…

- SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…

- SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…Comparative statement of financial position of Alpha Sdn Bhd as at 31 December 2023 and 2022 are as following: 2023 2022 RM million RM million Cash at bank 108.5 50.4 Accounts receivable (less: provision for doubtful debts) 393.0 219.0 Inventories 84.0 134.4 585.5 403.8 Plant and equipment (NBV) 475.6 364.8 Investment in government securities 33.6 33.6 509.2 398.4 Total assets 1,094.7 802.2 Ordinary shares 530.0 290.0 180 million 10% Preference shares 180.0 180.0 Retained earnings 105.0 73.5 815.0 543.5 Accounts payable 205.9 197.8 Tax payable 15.0 10.0 Deferred taxation 37.8 50.9 10% Debentures 21.0…

- Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).Orbit Limited : Statement of Financial Position as at 31 December 2022 2021 Non-current Assets R11 810 000 R7 560 000 Property, Plant, Equipment R10 025 000 R6 250 000 Investments R1 785 000 R1 310 000 Current Assets R4 190 000 R4 690 000 Inventories R 1 875 000 R2 350 000 Account Receivable R1 925 000 R2 200 000 Cash R390 000 R140 000 Toatal Assets R16 000 000 R12 250 000 Equities & Liabilities Equity ? ? Oridanary share capital R5 480 000 R3 680 000 Retained earnings ? ? Non-current Liabilities R4 500 000 R3 800 000 Loan (20% p.a) R4 500 000 R3 800 000 Current Liabilities R2 300 000 R1 500 000 Accounts payable? R2 300 000 R1 500 000 Calculate the increase in the retained earnings over the two-year period.