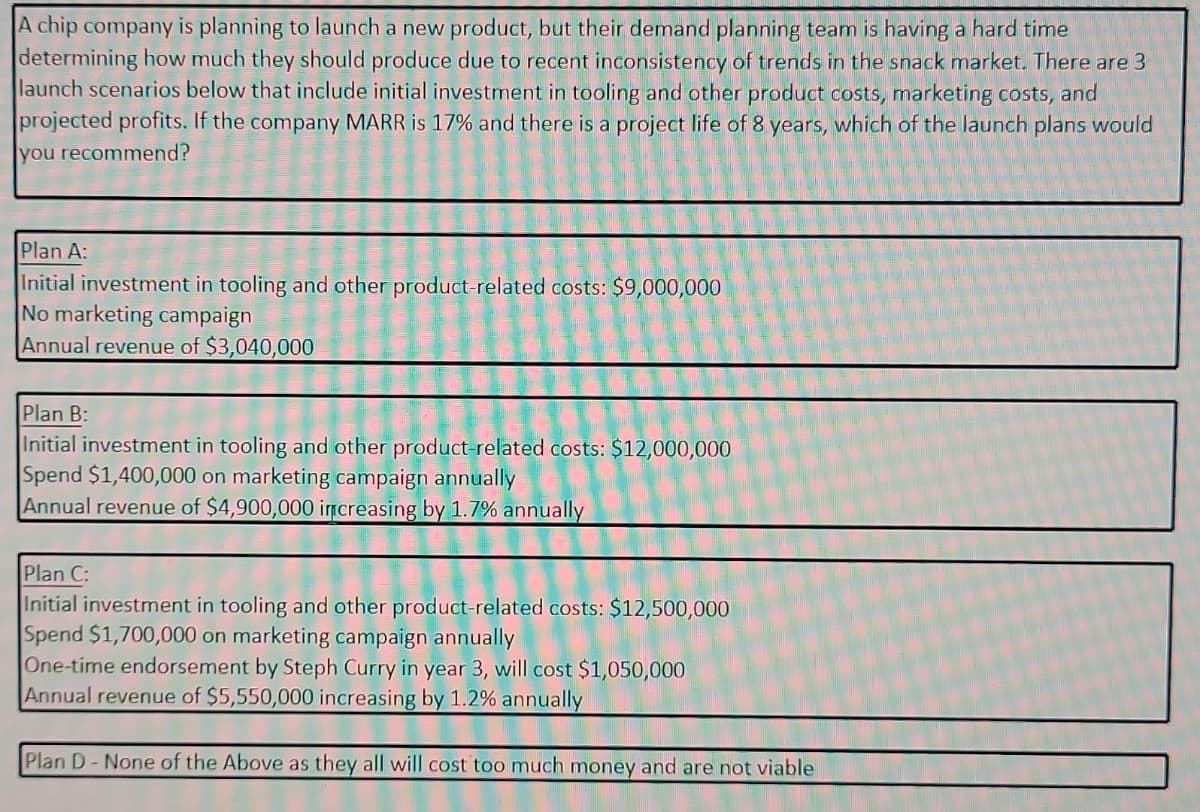

A chip company is planning to launch a new product, but their demand planning team is having a hard time determining how much they should produce due to recent inconsistency of trends in the snack market. There are 3 launch scenarios below that include initial investment in tooling and other product costs, marketing costs, and projected profits. If the company MARR is 17% and there is a project life of 8 years, which of the launch plans would you recommend? Plan A: Initial investment in tooling and other product-related costs: $9,000,000 No marketing campaign Annual revenue of $3,040,000 Plan B: Initial investment in tooling and other product-related costs: $12,000,000 Spend $1,400,000 on marketing campaign annually Annual revenue of $4,900,000 increasing by 1.7% annually Plan C: Initial investment in tooling and other product-related costs: $12,500,000 Spend $1,700,000 on marketing campaign annually One-time endorsement by Steph Curry in year 3, will cost $1,050,000 Annual revenue of $5,550,000 increasing by 1.2% annually Plan D-None of the Above as they all will cost too much money and are not viable

A chip company is planning to launch a new product, but their demand planning team is having a hard time determining how much they should produce due to recent inconsistency of trends in the snack market. There are 3 launch scenarios below that include initial investment in tooling and other product costs, marketing costs, and projected profits. If the company MARR is 17% and there is a project life of 8 years, which of the launch plans would you recommend? Plan A: Initial investment in tooling and other product-related costs: $9,000,000 No marketing campaign Annual revenue of $3,040,000 Plan B: Initial investment in tooling and other product-related costs: $12,000,000 Spend $1,400,000 on marketing campaign annually Annual revenue of $4,900,000 increasing by 1.7% annually Plan C: Initial investment in tooling and other product-related costs: $12,500,000 Spend $1,700,000 on marketing campaign annually One-time endorsement by Steph Curry in year 3, will cost $1,050,000 Annual revenue of $5,550,000 increasing by 1.2% annually Plan D-None of the Above as they all will cost too much money and are not viable

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1eM

Related questions

Question

Transcribed Image Text:A chip company is planning to launch a new product, but their demand planning team is having a hard time

determining how much they should produce due to recent inconsistency of trends in the snack market. There are 3

launch scenarios below that include initial investment in tooling and other product costs, marketing costs, and

projected profits. If the company MARR is 17% and there is a project life of 8 years, which of the launch plans would

you recommend?

Plan A:

Initial investment in tooling and other product-related costs: $9,000,000

No marketing campaign

Annual revenue of $3,040,000

Plan B:

Initial investment in tooling and other product-related costs: $12,000,000

Spend $1,400,000 on marketing campaign annually

Annual revenue of $4,900,000 increasing by 1.7% annually

Plan C:

Initial investment in tooling and other product-related costs: $12,500,000

Spend $1,700,000 on marketing campaign annually

One-time endorsement by Steph Curry in year 3, will cost $1,050,000

Annual revenue of $5,550,000 increasing by 1.2% annually

Plan D-None of the Above as they all will cost too much money and are not viable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,