In 1993, Sunland Company completed the construction of a building at a cost of $2,260,000 and first occupied it in January 1994. It was estimated that the building will have a useful life of 40 years and a salvage value of $68,000 at the end of that time. Early in 2004, an addition to the building was constructed at a cost of $565,000. At that time, it was estimated that the remaining life of the building would be, as originally estimated, an additional 30 years, and that the addition would have a life of 30 years and a salvage value of $22,600. In 2022, it is determined that the probable life of the building and addition will extend to the end of 2053, or 20 years beyond the original estimate.

In 1993, Sunland Company completed the construction of a building at a cost of $2,260,000 and first occupied it in January 1994. It was estimated that the building will have a useful life of 40 years and a salvage value of $68,000 at the end of that time. Early in 2004, an addition to the building was constructed at a cost of $565,000. At that time, it was estimated that the remaining life of the building would be, as originally estimated, an additional 30 years, and that the addition would have a life of 30 years and a salvage value of $22,600. In 2022, it is determined that the probable life of the building and addition will extend to the end of 2053, or 20 years beyond the original estimate.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

Please do not give solution in image format thanku

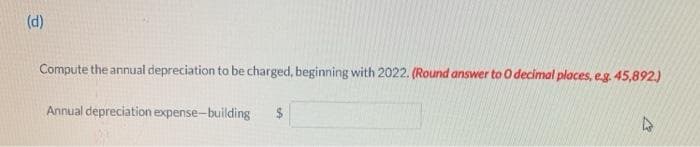

Transcribed Image Text:(d)

Compute the annual depreciation to be charged, beginning with 2022. (Round answer to 0 decimal places, e.g. 45,892.)

Annual depreciation expense-building $

Transcribed Image Text:In 1993, Sunland Company completed the construction of a building at a cost of $2,260,000 and first occupied it in January 1994. It

was estimated that the building will have a useful life of 40 years and a salvage value of $68,000 at the end of that time.

Early in 2004, an addition to the building was constructed at a cost of $565,000. At that time, it was estimated that the remaining

life of the building would be, as originally estimated, an additional 30 years, and that the addition would have a life of 30 years and a

salvage value of $22,600.

In 2022, it is determined that the probable life of the building and addition will extend to the end of 2053, or 20 years beyond the

original estimate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College