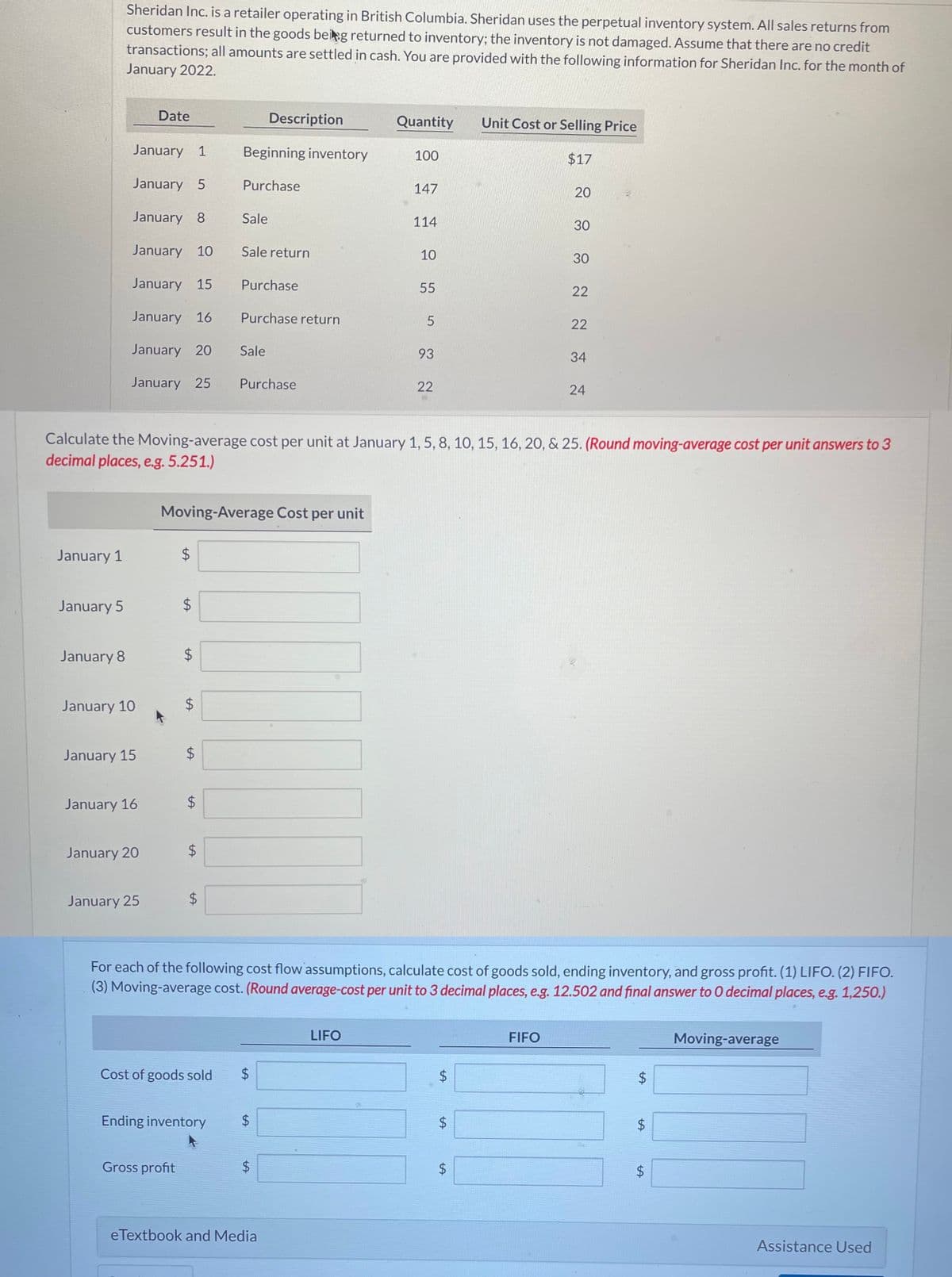

January 1 January 5 Sheridan Inc. is a retailer operating in British Columbia. Sheridan uses the perpetual inventory system. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Sheridan Inc. for the month of January 2022. January 8 January 1 January 5 January 8 January 10 January 15 January 16 January 20 January 25 January 10 January 15 January 16 Date January 20 January 25 4 $ $ $ Gross profit $ Moving-Average Cost per unit $ $ $ $ Beginning inventory Purchase Sale Ending inventory Sale return Purchase Purchase return Sale Description Purchase Calculate the Moving-average cost per unit at January 1, 5, 8, 10, 15, 16, 20, & 25. (Round moving-average cost per unit answers to 3 decimal places, e.g. 5.251.) Cost of goods sold $ $ $ Quantity 100 LIFO 147 114 10 55 5 93 22 $ Unit Cost or Selling Price $ For each of the following cost flow assumptions, calculate cost of goods sold, ending inventory, and gross profit. (1) LIFO. (2) FIFO. (3) Moving-average cost. (Round average-cost per unit to 3 decimal places, e.g. 12.502 and final answer to O decimal places, e.g. 1,250.) $ $17 20 FIFO 30 30 22 22 34 24 $ $ $ Moving-average

January 1 January 5 Sheridan Inc. is a retailer operating in British Columbia. Sheridan uses the perpetual inventory system. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Sheridan Inc. for the month of January 2022. January 8 January 1 January 5 January 8 January 10 January 15 January 16 January 20 January 25 January 10 January 15 January 16 Date January 20 January 25 4 $ $ $ Gross profit $ Moving-Average Cost per unit $ $ $ $ Beginning inventory Purchase Sale Ending inventory Sale return Purchase Purchase return Sale Description Purchase Calculate the Moving-average cost per unit at January 1, 5, 8, 10, 15, 16, 20, & 25. (Round moving-average cost per unit answers to 3 decimal places, e.g. 5.251.) Cost of goods sold $ $ $ Quantity 100 LIFO 147 114 10 55 5 93 22 $ Unit Cost or Selling Price $ For each of the following cost flow assumptions, calculate cost of goods sold, ending inventory, and gross profit. (1) LIFO. (2) FIFO. (3) Moving-average cost. (Round average-cost per unit to 3 decimal places, e.g. 12.502 and final answer to O decimal places, e.g. 1,250.) $ $17 20 FIFO 30 30 22 22 34 24 $ $ $ Moving-average

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter14: Adjustments And The Work Sheet For A Merchandising Business

Section: Chapter Questions

Problem 1SEB: ADJUSTMENT FOR MERCHANDISE INVENTORY USING T ACCOUNTS: PERIODIC INVENTORY SYSTEM Sandra Owens owns a...

Related questions

Question

Transcribed Image Text:January 1

January 5

Sheridan Inc. is a retailer operating in British Columbia. Sheridan uses the perpetual inventory system. All sales returns from

customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit

transactions; all amounts are settled in cash. You are provided with the following information for Sheridan Inc. for the month of

January 2022.

January 8

January 1

January 5

January 8

January 10

January 15

January 16

January 20

January 25

January 10

January 15

January 16

Date

January 20

January 25

LA

$

$

Gross profit

LA

$

LA

Moving-Average Cost per unit

$

LA

tA

$

tA

$

Cost of goods sold

Beginning inventory

Purchase

Sale

Ending inventory

Calculate the Moving-average cost per unit at January 1, 5, 8, 10, 15, 16, 20, & 25. (Round moving-average cost per unit answers to 3

decimal places, e.g. 5.251.)

Sale return

Purchase

Purchase return

Sale

Description

Purchase

LA

LA

LA

$

eTextbook and Media

Quantity

100

LIFO

147

114

10

55

5

93

22

For each of the following cost flow assumptions, calculate cost of goods sold, ending inventory, and gross profit. (1) LIFO. (2) FIFO.

(3) Moving-average cost. (Round average-cost per unit to 3 decimal places, e.g. 12.502 and final answer to O decimal places, e.g. 1,250.)

$

LA

LA

$

Unit Cost or Selling Price

$17

$

LA

20

30

FIFO

30

22

22

34

24

LA

$

$

LA

LA

Moving-average

Assistance Used

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub